- Hong Kong

- /

- Entertainment

- /

- SEHK:2306

Asian Penny Stocks To Watch In November 2025

Reviewed by Simply Wall St

As the Asian markets navigate a complex landscape of economic challenges and opportunities, investors are keenly watching for signs of stability and growth. In this context, penny stocks—often representing smaller or newer companies—remain a niche yet intriguing investment area. Despite their somewhat outdated label, these stocks can offer unique value when backed by strong financial health, making them worth considering for those seeking under-the-radar opportunities with long-term potential.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.48 | HK$915.41M | ✅ 4 ⚠️ 1 View Analysis > |

| Asia Medical and Agricultural Laboratory and Research Center (SET:AMARC) | THB2.76 | THB1.16B | ✅ 3 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.50 | HK$2.07B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.06 | SGD429.61M | ✅ 4 ⚠️ 2 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.92 | THB2.95B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.099 | SGD51.83M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.35 | SGD13.18B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$0.96 | HK$2.57B | ✅ 3 ⚠️ 2 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.04 | NZ$148.04M | ✅ 2 ⚠️ 5 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.86 | NZ$237.89M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 938 stocks from our Asian Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

YH Entertainment Group (SEHK:2306)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: YH Entertainment Group is an investment holding company that operates as an artist management firm in Mainland China and Korea, with a market cap of HK$1.68 billion.

Operations: The company generates revenue through three primary segments: Artist Management (CN¥748.30 million), Pan-Entertainment Business (CN¥39.32 million), and Music IP Production and Operation (CN¥43.87 million).

Market Cap: HK$1.68B

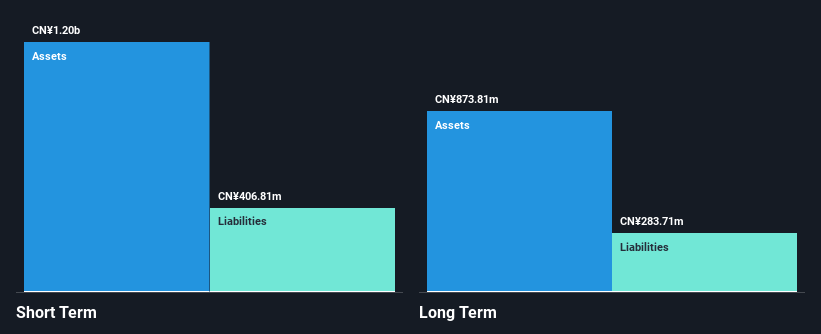

YH Entertainment Group, with a market cap of HK$1.68 billion, shows mixed signals for investors interested in penny stocks. The company has demonstrated profit growth over the past year, reporting net income of CN¥58.1 million for the first half of 2025 compared to CN¥30.8 million a year ago. However, earnings have declined by 43.4% annually over five years. Recent share buybacks totaling HK$35.91 million indicate management's confidence in its prospects despite high volatility and low return on equity at 5.3%. YH maintains strong liquidity with short-term assets exceeding liabilities and reduced debt levels significantly over five years.

- Navigate through the intricacies of YH Entertainment Group with our comprehensive balance sheet health report here.

- Explore historical data to track YH Entertainment Group's performance over time in our past results report.

China Oriental Group (SEHK:581)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China Oriental Group Company Limited manufactures and sells iron and steel products for downstream steel manufacturers in the People’s Republic of China, with a market cap of HK$5.17 billion.

Operations: The company generates revenue primarily from its Iron and Steel segment, which accounts for CN¥40.14 billion, while its Real Estate segment contributes CN¥120.26 million.

Market Cap: HK$5.17B

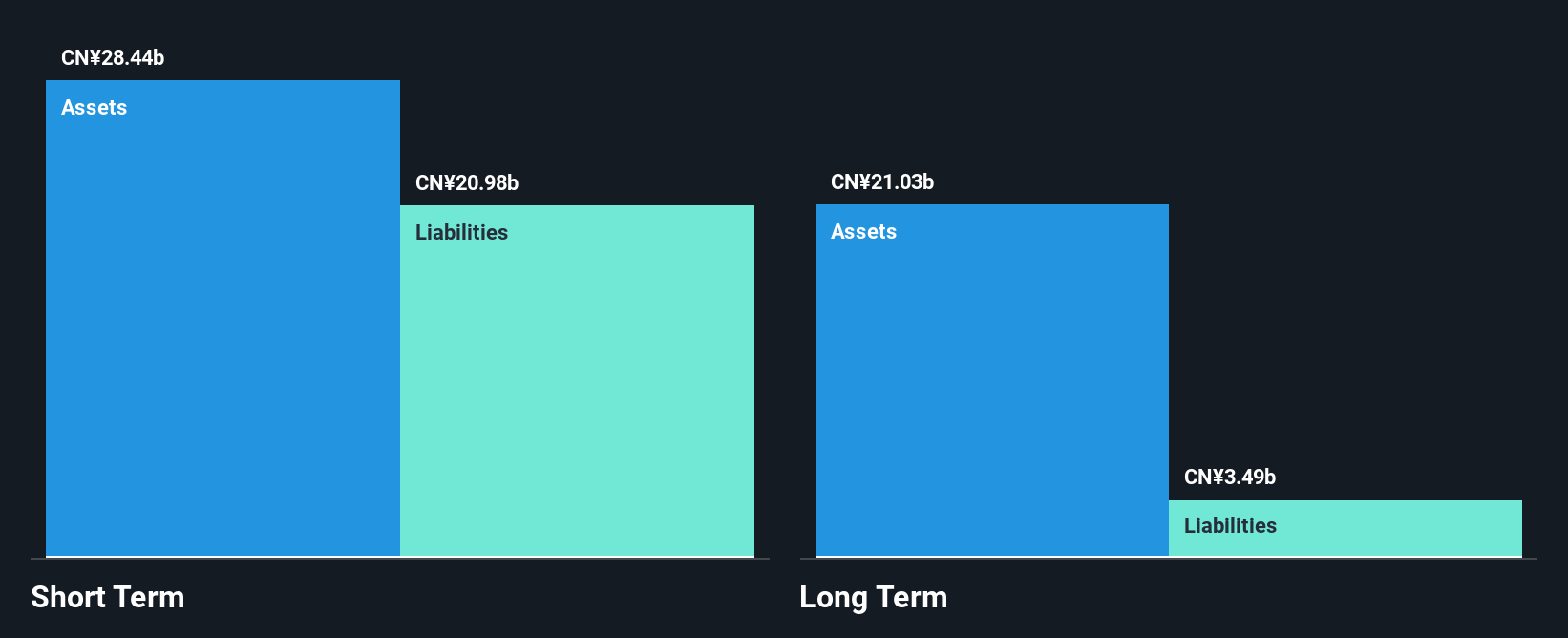

China Oriental Group, with a market cap of HK$5.17 billion, presents a complex picture for penny stock investors. The company has recently turned profitable, reporting net income of CN¥203.15 million for the first half of 2025, up from CN¥94.06 million the previous year. Despite this positive trend, its earnings have declined by an average of 52.8% annually over five years and it trades at 97% below estimated fair value. Short-term assets comfortably cover liabilities and debt is well-managed with operating cash flow covering 20.7% of debt obligations, although return on equity remains low at 1.4%.

- Take a closer look at China Oriental Group's potential here in our financial health report.

- Review our historical performance report to gain insights into China Oriental Group's track record.

Rojukiss International (SET:KISS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Rojukiss International Public Company Limited develops, manufactures, and distributes skincare, cosmetics, and food supplements across Thailand and several other Southeast Asian countries with a market cap of THB1.83 billion.

Operations: The company's revenue primarily comes from its Personal Products segment, generating THB1.19 billion.

Market Cap: THB1.83B

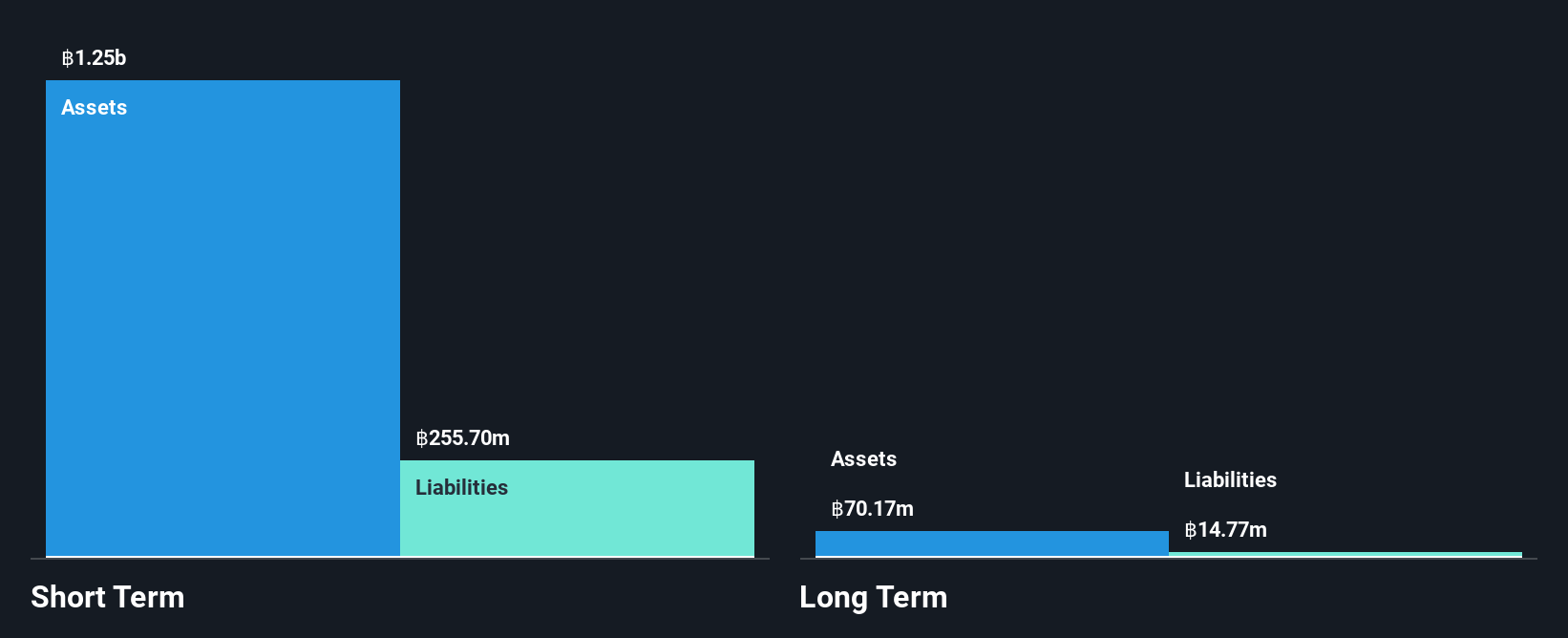

Rojukiss International, with a market cap of THB1.83 billion, shows mixed signals for penny stock investors. The company reported third-quarter sales of THB329.73 million and net income of THB61.87 million, reflecting a modest year-over-year increase in earnings per share to THB0.1. Despite no debt and strong asset coverage for liabilities, its earnings growth is negative compared to the industry average, and profit margins have declined from 15.6% to 13.1%. Additionally, its dividend yield is not well supported by free cash flows, while management's short tenure suggests potential instability in leadership experience.

- Dive into the specifics of Rojukiss International here with our thorough balance sheet health report.

- Learn about Rojukiss International's historical performance here.

Make It Happen

- Explore the 938 names from our Asian Penny Stocks screener here.

- Interested In Other Possibilities? This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2306

YH Entertainment Group

An investment holding company, operates as an artist management company in Mainland China and Korea.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives