- Hong Kong

- /

- Metals and Mining

- /

- SEHK:358

Jiangxi Copper (SEHK:358): Assessing Valuation Following Earnings Growth and Governance Changes

Reviewed by Simply Wall St

Jiangxi Copper (SEHK:358) has just released its nine-month earnings, revealing growth in both revenue and net income from a year earlier. The company also introduced governance changes, including key amendments and a new board appointment. These may shape future strategy.

See our latest analysis for Jiangxi Copper.

Jiangxi Copper’s refreshed leadership and stronger earnings seem to be resonating with investors, as shown by its recent 90-day share price return of 88.1% and a standout 156.4% share price gain year to date. Long-term momentum remains impressive, with a five-year total shareholder return near 285% signaling sustained value creation.

If you’re interested in finding what other companies are poised for growth, now is a perfect moment to broaden your perspective and explore fast growing stocks with high insider ownership

But with such robust returns and recent earnings momentum, is Jiangxi Copper’s current share price still offering investors good value? Or has the market already priced in its next wave of growth potential?

Price-to-Earnings of 12.5x: Is it justified?

Jiangxi Copper’s shares recently closed at HK$31.74, trading at 12.5 times earnings. This valuation stands out as notably more attractive than both its industry and peer group averages.

The price-to-earnings (P/E) ratio compares a company’s current share price to its per-share earnings, highlighting how much investors are willing to pay for future profit. For metals and mining firms like Jiangxi Copper, P/E helps capture the balance between earnings growth, commodity cycles, and the sector’s inherent volatility.

At 12.5x earnings, Jiangxi Copper’s shares are valued much lower than the industry average of 15.4x and the peer average of 38.7x. The market appears to be underpricing its recent profit acceleration and margin improvement, even while the fair P/E ratio stands at 14.3x. This is a level that the market could move toward should its performance continue.

Explore the SWS fair ratio for Jiangxi Copper

Result: Price-to-Earnings of 12.5x (UNDERVALUED)

However, potential risks remain, such as reduced analyst price targets and slowing revenue growth. These factors could limit further upside despite recent strong returns.

Find out about the key risks to this Jiangxi Copper narrative.

Another View: Discounted Cash Flow Signals Even Deeper Value

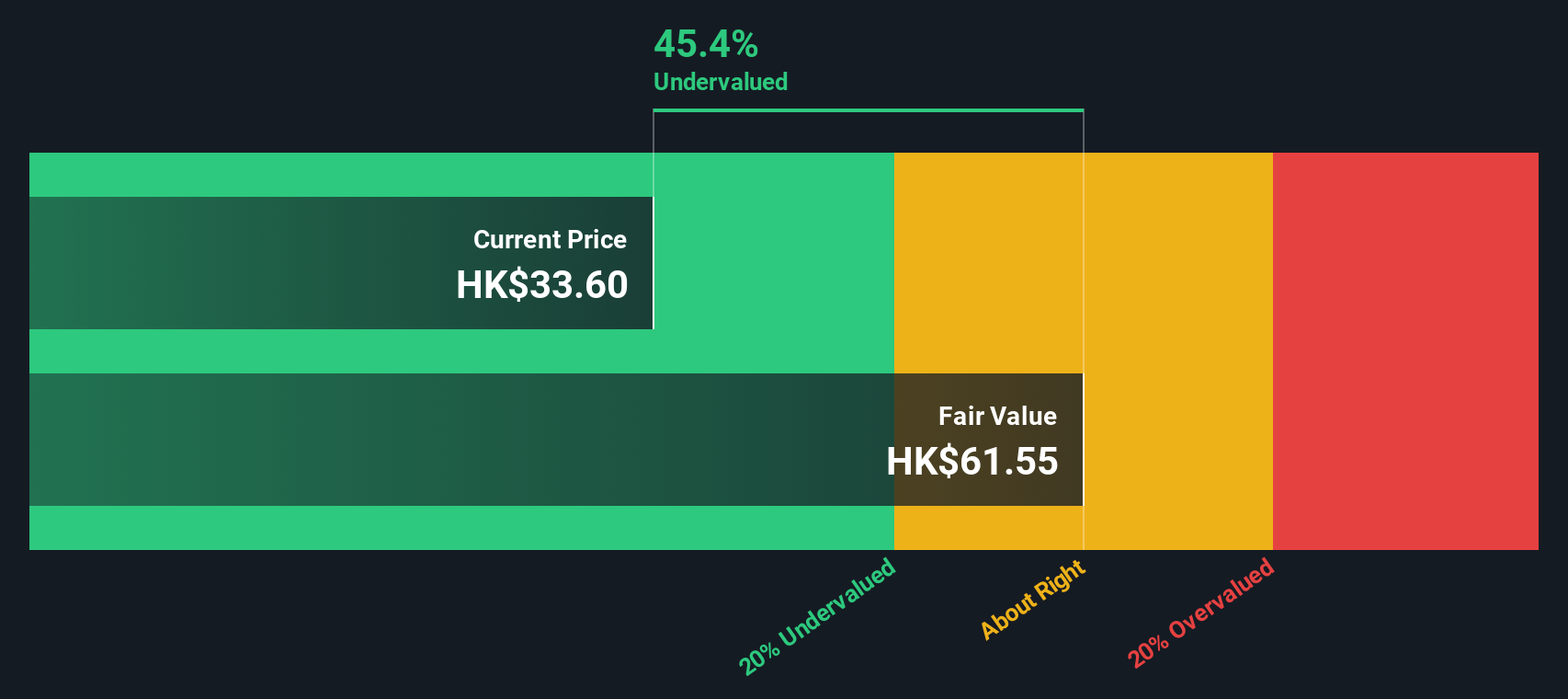

Looking at our SWS DCF model, Jiangxi Copper appears even more undervalued. The current share price is 48.6% below our estimate of fair value, which suggests a sizable disconnect between price and future cash flow potential. Could the market be underestimating its long-term growth story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Jiangxi Copper for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 849 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Jiangxi Copper Narrative

If you see Jiangxi Copper’s outlook differently or want to dig deeper into the numbers, you can craft your own analysis and interpretation in under three minutes. This makes it easy to compare with our findings. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Jiangxi Copper.

Looking for more investment ideas?

Don’t let market-changing opportunities pass you by. Take the lead and tap into the next wave of innovation, income, and future growth right now.

- Capture tomorrow’s income advantage with high-yield picks by joining these 20 dividend stocks with yields > 3%, which features standout stocks offering attractive yields above 3%.

- Get ahead in the tech race and ride the surge of transformative companies by checking out these 26 AI penny stocks, which highlights businesses pushing boundaries in artificial intelligence.

- Seize undervalued opportunities as you scan these 849 undervalued stocks based on cash flows for strong businesses trading below their cash flow potential before the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:358

Jiangxi Copper

Engages in mining, smelting, and processing of copper and gold in Chinese Mainland, China, Hong Kong, and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives