- Taiwan

- /

- Semiconductors

- /

- TPEX:5493

Asian Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets continue to navigate the impacts of new U.S. tariffs, Asian indices are showing resilience with some markets like China experiencing gains amid hopes for further economic stimulus. In this environment, dividend stocks in Asia can offer investors a potential source of steady income and stability, especially when market volatility is a concern.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.38% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.07% | ★★★★★★ |

| NCD (TSE:4783) | 4.34% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.28% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.34% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.39% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.49% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.98% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.08% | ★★★★★★ |

| Daicel (TSE:4202) | 4.78% | ★★★★★★ |

Click here to see the full list of 1201 stocks from our Top Asian Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

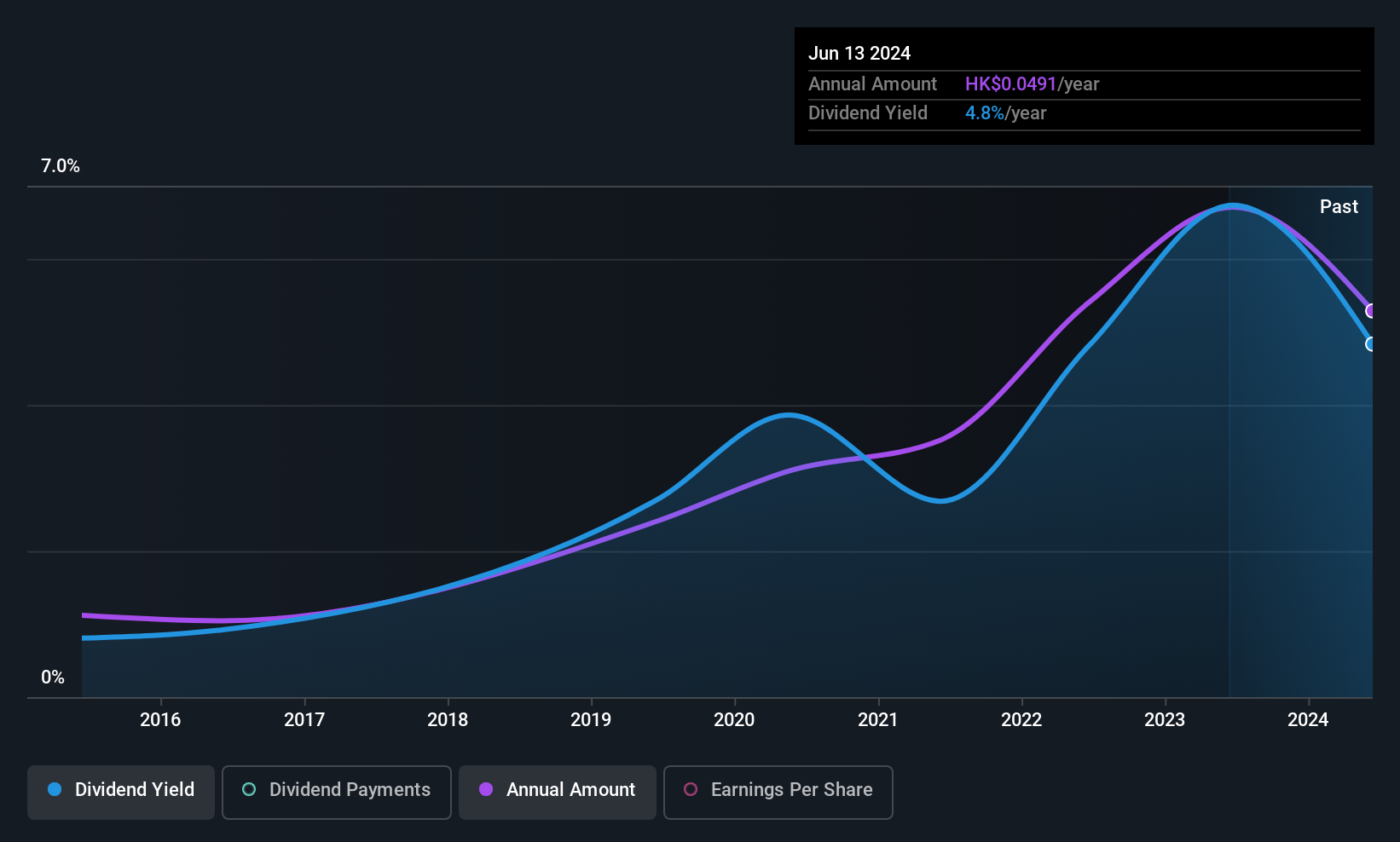

Sinofert Holdings (SEHK:297)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sinofert Holdings Limited is an investment holding company involved in the production, import and export, distribution, and retail of fertilizer raw materials and crop nutrition products in Mainland China and internationally, with a market cap of HK$10.04 billion.

Operations: Sinofert Holdings Limited generates revenue through its Production segment (CN¥5.29 billion), Basic Business segment (CN¥14.05 billion), and Growth Business segment (CN¥10.85 billion).

Dividend Yield: 4%

Sinofert Holdings recently announced a special dividend of HK$0.0246 per share, reflecting its commitment to shareholder returns despite a historically volatile dividend record. While the company's dividends are well-covered by earnings and cash flows, its yield remains below the top tier in Hong Kong. The recent appointment of Ms. Wang Ling to the nomination committee may enhance governance and strategic oversight, potentially influencing future dividend stability and growth initiatives such as the formamide project contract with Luxi Industrial.

- Click here and access our complete dividend analysis report to understand the dynamics of Sinofert Holdings.

- The valuation report we've compiled suggests that Sinofert Holdings' current price could be quite moderate.

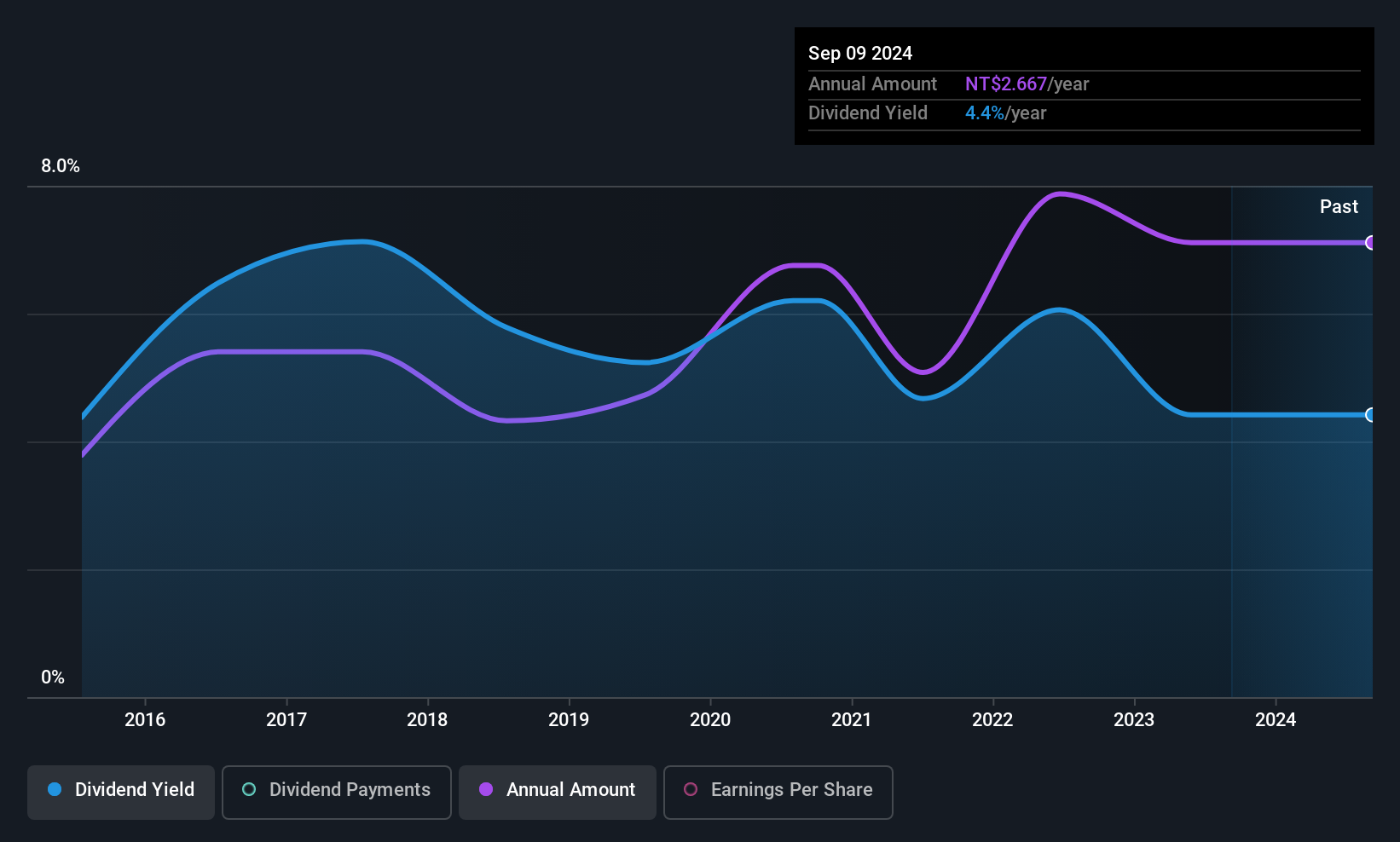

Sanlien Technology (TPEX:5493)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sanlien Technology Corp. manufactures and sells specialty chemicals for the semiconductor industry in Taiwan, Asia, and internationally, with a market cap of NT$3.39 billion.

Operations: Sanlien Technology Corp.'s revenue is primarily derived from its Electronic Materials Division, which contributes NT$4.16 billion, followed by the Automation Monitoring Division at NT$465.56 million, and the Foreign Sensors and Equipment Department at NT$56.84 million.

Dividend Yield: 3.4%

Sanlien Technology's dividend payments are well-supported by earnings and cash flows, with a payout ratio of 53.9% and a cash payout ratio of 25.2%. Despite this coverage, its dividend yield of 3.35% is below the top tier in Taiwan, and the dividend has been volatile over the past decade. Recently, Sanlien announced a TWD 113.59 million cash dividend distribution set for October 15, 2025, following strong Q1 earnings growth compared to last year.

- Delve into the full analysis dividend report here for a deeper understanding of Sanlien Technology.

- Our valuation report unveils the possibility Sanlien Technology's shares may be trading at a discount.

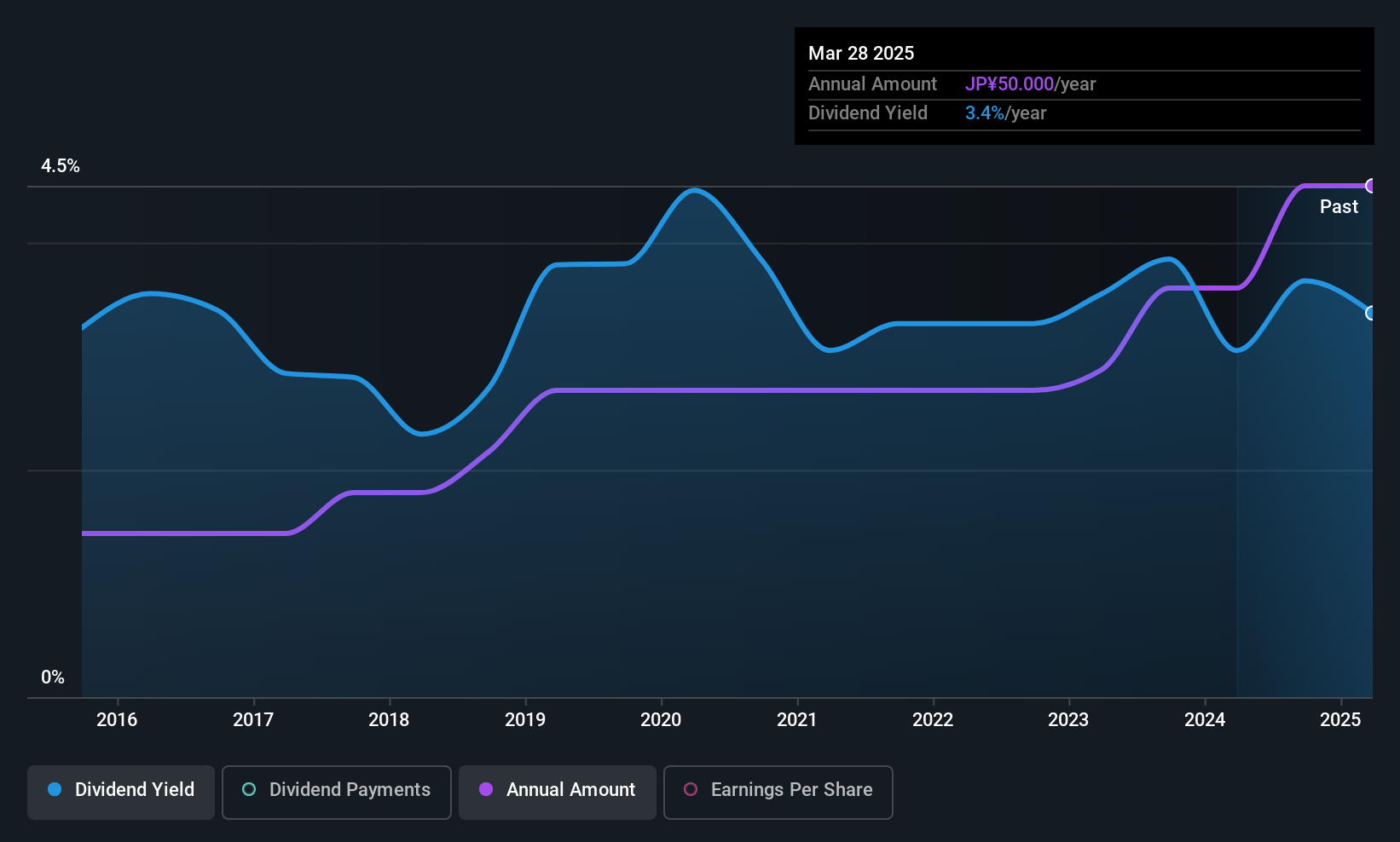

Fujita Engineering (TSE:1770)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fujita Engineering Co., Ltd. operates in the facilities construction sector both in Japan and internationally, with a market cap of ¥15.12 billion.

Operations: Fujita Engineering Co., Ltd. generates revenue primarily from its facilities construction operations in both domestic and international markets.

Dividend Yield: 3.6%

Fujita Engineering's dividends are well-covered by earnings, with a payout ratio of 30.8%, and cash flows, despite a higher cash payout ratio of 79.2%. The dividend yield stands at 3.64%, which is lower than Japan's top quartile but remains reliable and stable over the past decade with consistent growth. The company’s price-to-earnings ratio of 8.5x suggests it may be undervalued compared to the broader Japanese market average of 13.5x.

- Unlock comprehensive insights into our analysis of Fujita Engineering stock in this dividend report.

- According our valuation report, there's an indication that Fujita Engineering's share price might be on the expensive side.

Summing It All Up

- Unlock more gems! Our Top Asian Dividend Stocks screener has unearthed 1198 more companies for you to explore.Click here to unveil our expertly curated list of 1201 Top Asian Dividend Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:5493

Sanlien Technology

Manufactures and sells specialty chemical for the semiconductor industry in Taiwan, Asia, and internationally.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives