- Hong Kong

- /

- Metals and Mining

- /

- SEHK:2600

Aluminum Corporation of China (SEHK:2600) Is Up 10.1% After Strong Earnings and New Germanium Venture – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

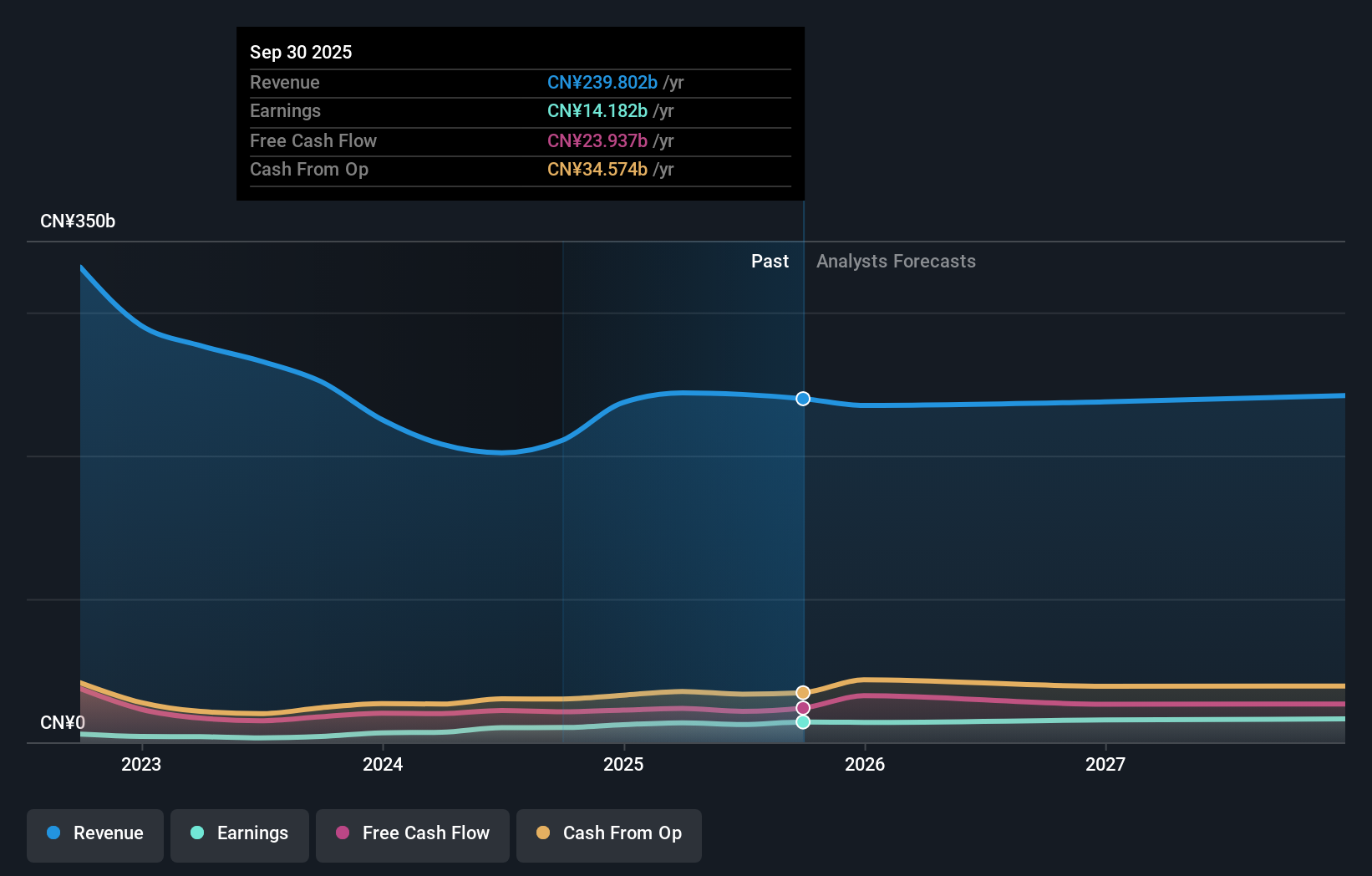

- Aluminum Corporation of China reported strong earnings for the nine months ended September 30, 2025, with revenue rising to CNY176.52 billion and net income climbing to CNY10.87 billion year-over-year.

- Just days earlier, Chinalco announced a joint venture with Aluminum Corporation of China and several partners to expand into the germanium materials market, highlighting a shift towards specialty materials and enhanced industry collaboration.

- We’ll explore how the company’s entry into germanium materials through a new joint venture is influencing its investment story.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Aluminum Corporation of China's Investment Narrative?

When looking at Aluminum Corporation of China, the investment story centers around belief in gradual value creation through earnings quality, improved profit margins, and possibly diversification into higher-value markets. The recent joint venture announcement marks a meaningful shift by aiming to expand into germanium materials, aligning with the company's focus on specialty products. Short-term, this adds a new catalyst that could shape sentiment and future growth options, although it won’t immediately feed into reported earnings since the venture's results aren’t consolidated for now. That said, this move might help the company address historically slow revenue growth and add resilience against volatile aluminum prices or commodity cycles. Potential risks remain, like a relatively inexperienced management team and board turnover, as well as the slower projected revenue and earnings growth against the Hong Kong market. If the market starts to view this specialty push as impactful, key risks and catalysts could change quickly. Unlike its steady profit growth, board turnover could still pose fresh uncertainty for investors.

Aluminum Corporation of China's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 3 other fair value estimates on Aluminum Corporation of China - why the stock might be worth less than half the current price!

Build Your Own Aluminum Corporation of China Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aluminum Corporation of China research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Aluminum Corporation of China research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aluminum Corporation of China's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2600

Aluminum Corporation of China

Primarily engages in the exploration and mining of bauxite, coal, and other resources in the People's Republic of China and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives