- Hong Kong

- /

- Basic Materials

- /

- SEHK:1847

Should YCIH Green High-Performance Concrete (HKG:1847) Be Disappointed With Their 22% Profit?

On average, over time, stock markets tend to rise higher. This makes investing attractive. But if when you choose to buy stocks, some of them will be below average performers. For example, the YCIH Green High-Performance Concrete Company Limited (HKG:1847), share price is up over the last year, but its gain of 22% trails the market return. YCIH Green High-Performance Concrete hasn't been listed for long, so it's still not clear if it is a long term winner.

Check out our latest analysis for YCIH Green High-Performance Concrete

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year, YCIH Green High-Performance Concrete actually saw its earnings per share drop 2.2%.

Sometimes companies will sacrifice EPS in the short term for longer term gains; and in that case we may be able to find other positives. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

Absent any improvement, we don't think a thirst for dividends is pushing up the YCIH Green High-Performance Concrete's share price. It seems far more likely that the 8.9% boost to the revenue over the last year, is making the difference. Revenue growth often does precede earnings growth, so some investors might be willing to forgo profits today because they have their eyes fixed firmly on the future.

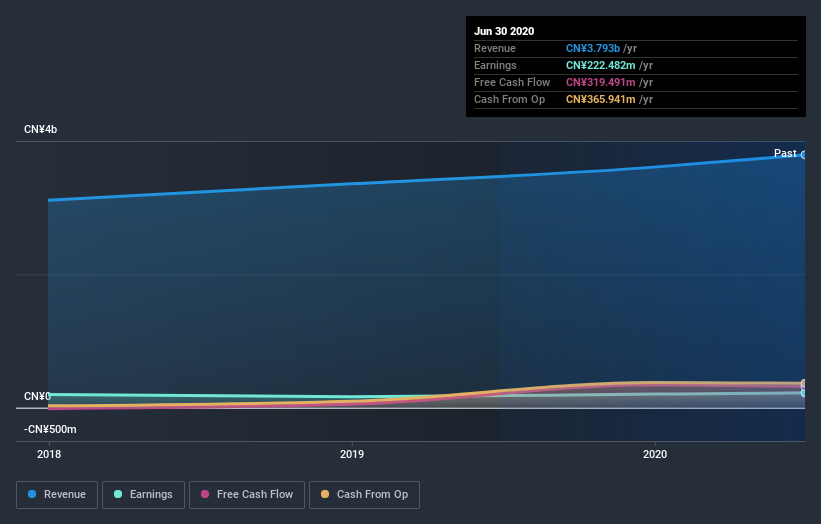

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for YCIH Green High-Performance Concrete the TSR over the last year was 33%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

YCIH Green High-Performance Concrete shareholders have gained 33% for the year (even including dividends). The bad news is that's no better than the average market return, which was roughly 50%. The stock trailed the market by 5.0% in that time, testament to the power of passive investing. It might be that investors are more concerned about the business lately due to some fundamental change (or else the share price simply got ahead of itself, previously). I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for YCIH Green High-Performance Concrete you should know about.

We will like YCIH Green High-Performance Concrete better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

When trading YCIH Green High-Performance Concrete or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1847

YCIH Green High-Performance Concrete

Operates as a ready-mixed concrete producer in the People's Republic of China.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives