Touyun Biotech Group (HKG:1332) adds HK$45m to market cap in the past 7 days, though investors from three years ago are still down 89%

It's nice to see the Touyun Biotech Group Limited (HKG:1332) share price up 10% in a week. But only the myopic could ignore the astounding decline over three years. To wit, the share price sky-dived 89% in that time. So it sure is nice to see a bit of an improvement. Only time will tell if the company can sustain the turnaround. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

The recent uptick of 10% could be a positive sign of things to come, so let's take a look at historical fundamentals.

View our latest analysis for Touyun Biotech Group

Because Touyun Biotech Group made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last three years, Touyun Biotech Group's revenue dropped 14% per year. That's not what investors generally want to see. The share price fall of 24% (per year, over three years) is a stern reminder that money-losing companies are expected to grow revenue. This business clearly needs to grow revenues if it is to perform as investors hope. Don't let a share price decline ruin your calm. You make better decisions when you're calm.

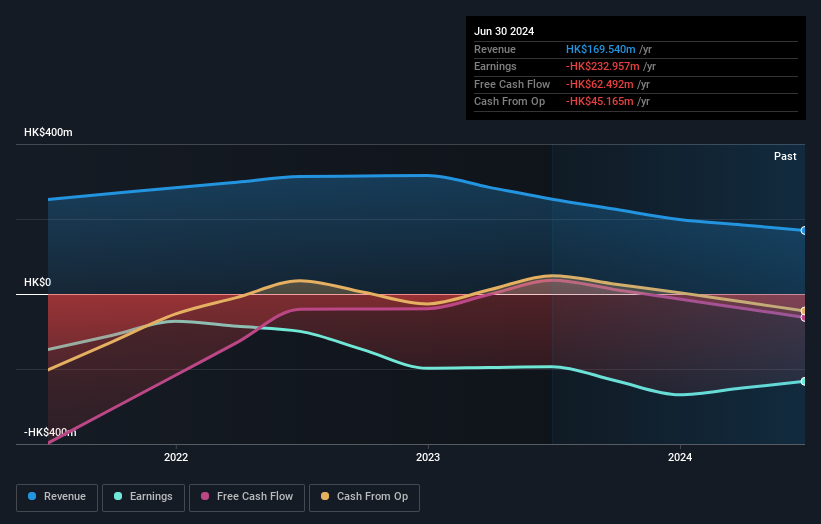

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Touyun Biotech Group shareholders are down 64% for the year, but the market itself is up 15%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 5% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Touyun Biotech Group better, we need to consider many other factors. Case in point: We've spotted 4 warning signs for Touyun Biotech Group you should be aware of, and 3 of them are concerning.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Touyun Biotech Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1332

Touyun Biotech Group

An investment holding company, designs, develops, manufactures, and sells packaging products in Hong Kong, the People’s Republic of China, Europe, North and South America, and internationally.

Slight with weak fundamentals.