Stock Analysis

- Hong Kong

- /

- Metals and Mining

- /

- SEHK:1303

While shareholders of Huili Resources (Group) (HKG:1303) are in the black over 3 years, those who bought a week ago aren't so fortunate

It might be of some concern to shareholders to see the Huili Resources (Group) Limited (HKG:1303) share price down 15% in the last month. But that doesn't change the fact that the returns over the last three years have been very strong. In fact, the share price is up a full 190% compared to three years ago. So the recent fall in the share price should be viewed in that context. Only time will tell if there is still too much optimism currently reflected in the share price.

Since the long term performance has been good but there's been a recent pullback of 12%, let's check if the fundamentals match the share price.

See our latest analysis for Huili Resources (Group)

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

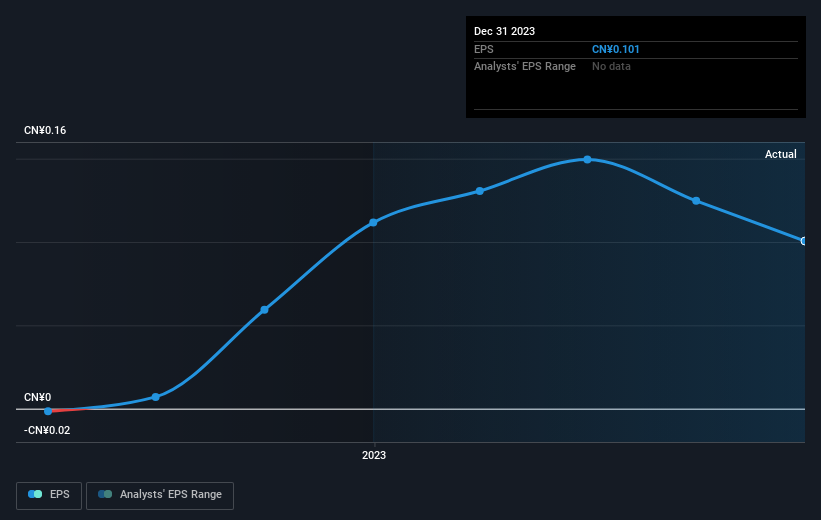

Huili Resources (Group) became profitable within the last three years. Given the importance of this milestone, it's not overly surprising that the share price has increased strongly.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Dive deeper into the earnings by checking this interactive graph of Huili Resources (Group)'s earnings, revenue and cash flow.

A Different Perspective

It's good to see that Huili Resources (Group) has rewarded shareholders with a total shareholder return of 45% in the last twelve months. That's better than the annualised return of 3% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Huili Resources (Group) better, we need to consider many other factors. Case in point: We've spotted 4 warning signs for Huili Resources (Group) you should be aware of, and 2 of them can't be ignored.

Huili Resources (Group) is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Huili Resources (Group) is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Huili Resources (Group) is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1303

Huili Resources (Group)

An investment holding company, engages in mining, processing, and selling mineral ores in the People’s Republic of China.

Flawless balance sheet low.