- Hong Kong

- /

- Metals and Mining

- /

- SEHK:1303

Do Huili Resources (Group)'s (HKG:1303) Earnings Warrant Your Attention?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Huili Resources (Group) (HKG:1303), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Huili Resources (Group)

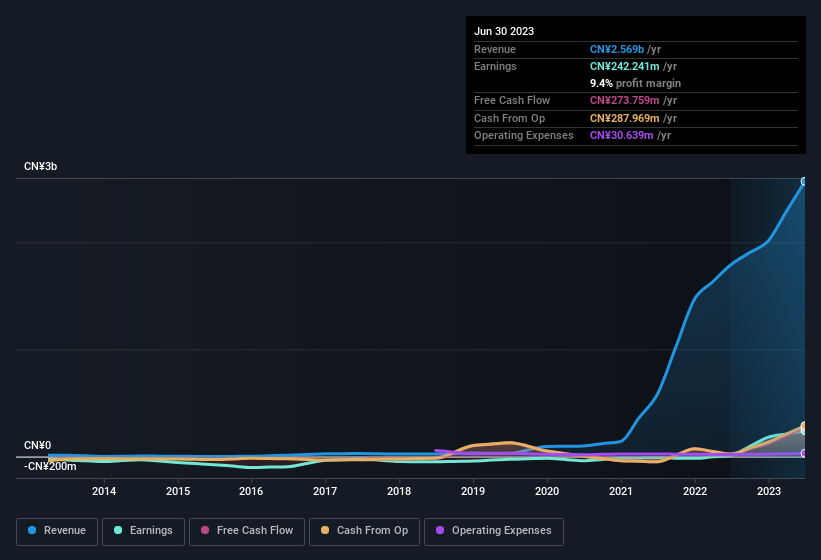

Huili Resources (Group)'s Improving Profits

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. Which is why EPS growth is looked upon so favourably. Commendations have to be given in seeing that Huili Resources (Group) grew its EPS from CN¥0.007 to CN¥0.12, in one short year. Even though that growth rate may not be repeated, that looks like a breakout improvement. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Huili Resources (Group) shareholders can take confidence from the fact that EBIT margins are up from 0.5% to 11%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Huili Resources (Group) isn't a huge company, given its market capitalisation of HK$778m. That makes it extra important to check on its balance sheet strength.

Are Huili Resources (Group) Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The real kicker here is that Huili Resources (Group) insiders spent a staggering CN¥190m on acquiring shares in just one year, without single share being sold in the meantime. Knowing this, Huili Resources (Group) will have have all eyes on them in anticipation for the what could happen in the near future. It is also worth noting that it was company insider Chin Chung Bong who made the biggest single purchase, worth HK$63m, paying HK$0.40 per share.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Huili Resources (Group) will reveal that insiders own a significant piece of the pie. In fact, they own 40% of the shares, making insiders a very influential shareholder group. Shareholders and speculators should be reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. To give you an idea, the value of insiders' holdings in the business are valued at CN¥308m at the current share price. That's nothing to sneeze at!

Does Huili Resources (Group) Deserve A Spot On Your Watchlist?

Huili Resources (Group)'s earnings per share have been soaring, with growth rates sky high. Just as heartening; insiders both own and are buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Huili Resources (Group) belongs near the top of your watchlist. We don't want to rain on the parade too much, but we did also find 2 warning signs for Huili Resources (Group) that you need to be mindful of.

Keen growth investors love to see insider buying. Thankfully, Huili Resources (Group) isn't the only one. You can see a a curated list of Hong Kong companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Huili Resources (Group) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1303

Huili Resources (Group)

An investment holding, engages in mining, processing, and selling mineral ores in the People’s Republic of China.

Excellent balance sheet and good value.

Market Insights

Community Narratives