- Hong Kong

- /

- Metals and Mining

- /

- SEHK:1090

Most Shareholders Will Probably Agree With Da Ming International Holdings Limited's (HKG:1090) CEO Compensation

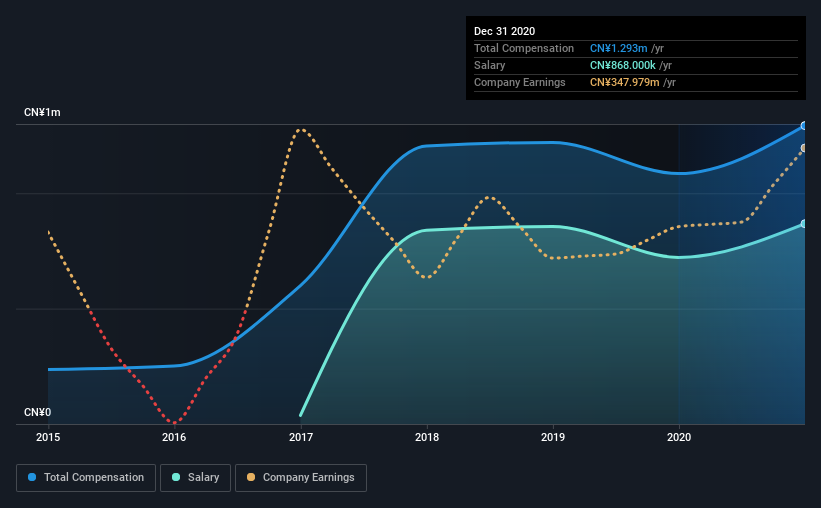

Under the guidance of CEO Changhong Jiang, Da Ming International Holdings Limited (HKG:1090) has performed reasonably well recently. As shareholders go into the upcoming AGM on 10 June 2021, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. Based on our analysis of the data below, we think CEO compensation seems reasonable for now.

Check out our latest analysis for Da Ming International Holdings

Comparing Da Ming International Holdings Limited's CEO Compensation With the industry

At the time of writing, our data shows that Da Ming International Holdings Limited has a market capitalization of HK$3.7b, and reported total annual CEO compensation of CN¥1.3m for the year to December 2020. That's a notable increase of 19% on last year. In particular, the salary of CN¥868.0k, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations ranging from HK$1.6b to HK$6.2b, the reported median CEO total compensation was CN¥1.2m. This suggests that Da Ming International Holdings remunerates its CEO largely in line with the industry average. Moreover, Changhong Jiang also holds HK$1.1m worth of Da Ming International Holdings stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CN¥868k | CN¥722k | 67% |

| Other | CN¥425k | CN¥363k | 33% |

| Total Compensation | CN¥1.3m | CN¥1.1m | 100% |

On an industry level, around 84% of total compensation represents salary and 16% is other remuneration. Da Ming International Holdings pays a modest slice of remuneration through salary, as compared to the broader industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Da Ming International Holdings Limited's Growth Numbers

Over the past three years, Da Ming International Holdings Limited has seen its earnings per share (EPS) grow by 71% per year. It saw its revenue drop 1.0% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's always a tough situation when revenues are not growing, but ultimately profits are more important. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Da Ming International Holdings Limited Been A Good Investment?

With a total shareholder return of 30% over three years, Da Ming International Holdings Limited shareholders would, in general, be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. Despite the pleasing results, we still think that any proposed increases to CEO compensation will be examined based on a case by case basis and linked to performance outcomes.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We identified 3 warning signs for Da Ming International Holdings (1 can't be ignored!) that you should be aware of before investing here.

Switching gears from Da Ming International Holdings, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1090

Da Ming International Holdings

Processes, distributes, and sells stainless steel and carbon steel products and components, and equipment in the Mainland China.

Good value with very low risk.

Market Insights

Community Narratives