Green Future Food Hydrocolloid Marine Science (HKG:1084) Has Announced That It Will Be Increasing Its Dividend To HK$0.02

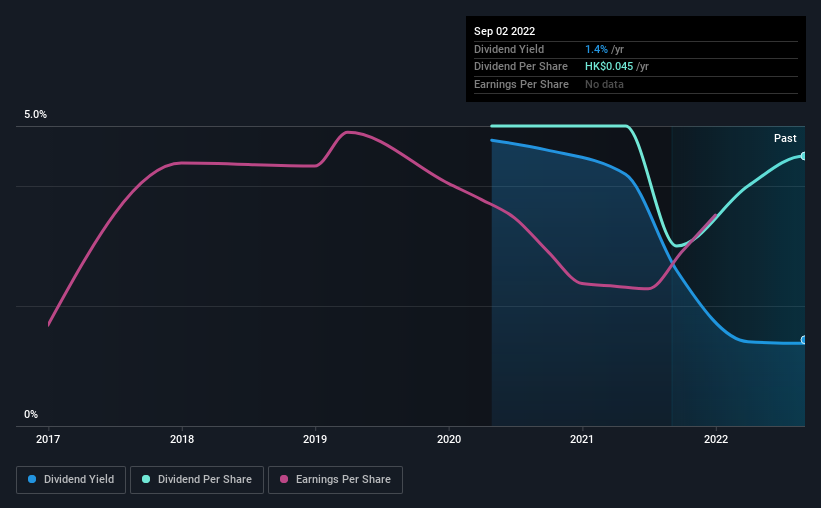

Green Future Food Hydrocolloid Marine Science Company Limited's (HKG:1084) dividend will be increasing from last year's payment of the same period to HK$0.02 on 20th of October. Even though the dividend went up, the yield is still quite low at only 1.4%.

View our latest analysis for Green Future Food Hydrocolloid Marine Science

Green Future Food Hydrocolloid Marine Science's Earnings Easily Cover The Distributions

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. However, prior to this announcement, Green Future Food Hydrocolloid Marine Science's dividend was comfortably covered by both cash flow and earnings. As a result, a large proportion of what it earned was being reinvested back into the business.

If the trend of the last few years continues, EPS will grow by 15.7% over the next 12 months. Assuming the dividend continues along recent trends, we think the payout ratio could be 31% by next year, which is in a pretty sustainable range.

Green Future Food Hydrocolloid Marine Science's Dividend Has Lacked Consistency

Even in its short history, we have seen the dividend cut. The dividend has gone from an annual total of HK$0.05 in 2020 to the most recent total annual payment of HK$0.045. The dividend has shrunk at around 5.1% a year during that period. A company that decreases its dividend over time generally isn't what we are looking for.

The Dividend Looks Likely To Grow

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. Green Future Food Hydrocolloid Marine Science has seen EPS rising for the last five years, at 16% per annum. With a decent amount of growth and a low payout ratio, we think this bodes well for Green Future Food Hydrocolloid Marine Science's prospects of growing its dividend payments in the future.

We Really Like Green Future Food Hydrocolloid Marine Science's Dividend

In summary, it is always positive to see the dividend being increased, and we are particularly pleased with its overall sustainability. Distributions are quite easily covered by earnings, which are also being converted to cash flows. Taking this all into consideration, this looks like it could be a good dividend opportunity.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Case in point: We've spotted 3 warning signs for Green Future Food Hydrocolloid Marine Science (of which 2 are potentially serious!) you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1084

Green Fresh Biotechnology

An investment holding company, produces and sells seaweed-based and plant-based hydrocolloid products in China, Europe, rest of Asia, South America, North America, Africa, and Oceania.

Low risk with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success