Assessing China Taiping After Shares Drop 22% Despite Strong Yearly Gains

Reviewed by Simply Wall St

If you have been watching China Taiping Insurance Holdings and wondering whether now is the right time to act, you are far from alone. Its recent share price journey has been nothing short of eventful. Over the past month, the stock pulled back by 22.5%, giving some investors pause. If we zoom out, the bigger picture looks much brighter: China Taiping’s shares are up 33.7% year-to-date and have surged a remarkable 144.0% over the past three years. Even after a softer week, the stock is still up 37.8% over the last year, which is hard to ignore.

These numbers hint at shifting investor sentiment and changing risk perceptions, possibly linked to wider industry trends and improving market optimism around China’s insurance sector. Still, the most pressing question remains: Is the stock actually undervalued, or is it simply riding a wave of broader market enthusiasm?

To give you a sense of how undervalued China Taiping might be right now, the company scores a solid 5 out of 6 on our valuation check. This means it passes nearly all of the major tests we apply to spot investments that could be trading below their real worth.

Let us break down what these different valuation approaches reveal about the stock, and, even more importantly, discuss a smarter way to understand what China Taiping might be worth to you as an investor.

Why China Taiping Insurance Holdings is lagging behind its peersApproach 1: China Taiping Insurance Holdings Excess Returns Analysis

The Excess Returns model helps assess whether China Taiping Insurance Holdings is generating more returns on its capital than what shareholders would normally require. This approach is particularly important in the insurance industry, where consistent profits and disciplined use of shareholder funds are key to long-term value creation.

Here is what the latest data shows for China Taiping:

- Book Value: HK$20.66 per share

- Stable Earnings Per Share (EPS): HK$3.12 per share (Source: Weighted future Return on Equity estimates from 9 analysts.)

- Cost of Equity: HK$1.78 per share

- Excess Return: HK$1.34 per share

- Average Return on Equity: 11.86%

- Stable Book Value: HK$26.28 per share (Source: Weighted future Book Value estimates from 8 analysts.)

This model estimates an intrinsic value for the stock that is substantially higher than the current share price. This suggests the stock is trading at a significant discount. According to the Excess Returns methodology, the intrinsic discount implies the stock is 74.7% undervalued compared to its fair value. For investors seeking a stock with a margin of safety, China Taiping’s returns on invested capital and robust book value growth may be worth noting.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for China Taiping Insurance Holdings.

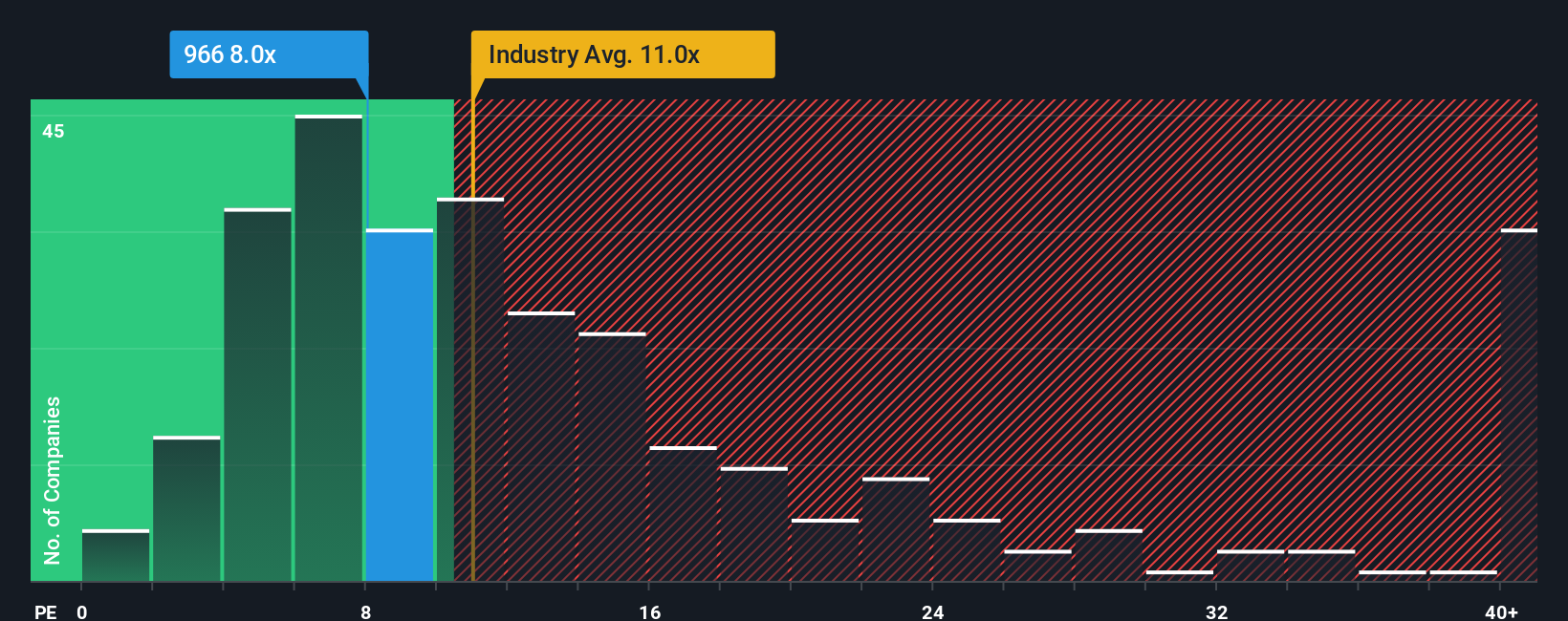

Approach 2: China Taiping Insurance Holdings Price vs Earnings

For profitable companies like China Taiping Insurance Holdings, the Price-to-Earnings (PE) ratio is often the go-to metric for valuing shares. The PE ratio offers a quick snapshot of how much investors are willing to pay today for each dollar of a company’s earnings. This makes it especially useful for comparing companies that are generating consistent profits.

Growth expectations and perceived risk play important roles in determining what counts as a “normal” or “fair” PE ratio. Companies expected to grow faster or seen as relatively low risk tend to command higher PE ratios, while slower growth or increased risks typically lead to lower ratios.

China Taiping currently trades at a PE ratio of 6.57x, which is notably lower than the industry average of 12.05x and the peer average of 33.88x. On paper, this gap alone suggests the stock might be trading at a discount to its sector. However, just comparing raw PE numbers can be misleading, because companies in the same sector may have very different prospects and risk profiles.

This is where Simply Wall St's proprietary “Fair Ratio” metric comes in. The Fair Ratio for China Taiping sits at 10.26x, reflecting not only industry context and market cap but also company-specific factors like earnings growth, profit margins, and risk. Unlike a basic industry or peer comparison, the Fair Ratio is designed to be more granular and tailored to each company's situation. This gives investors a sharper benchmark for what the market should really pay.

With China Taiping’s actual PE multiple well below the Fair Ratio, the numbers indicate the stock is undervalued by this approach. Investors looking for value could see this as a potential opportunity.

Result: UNDERVALUED

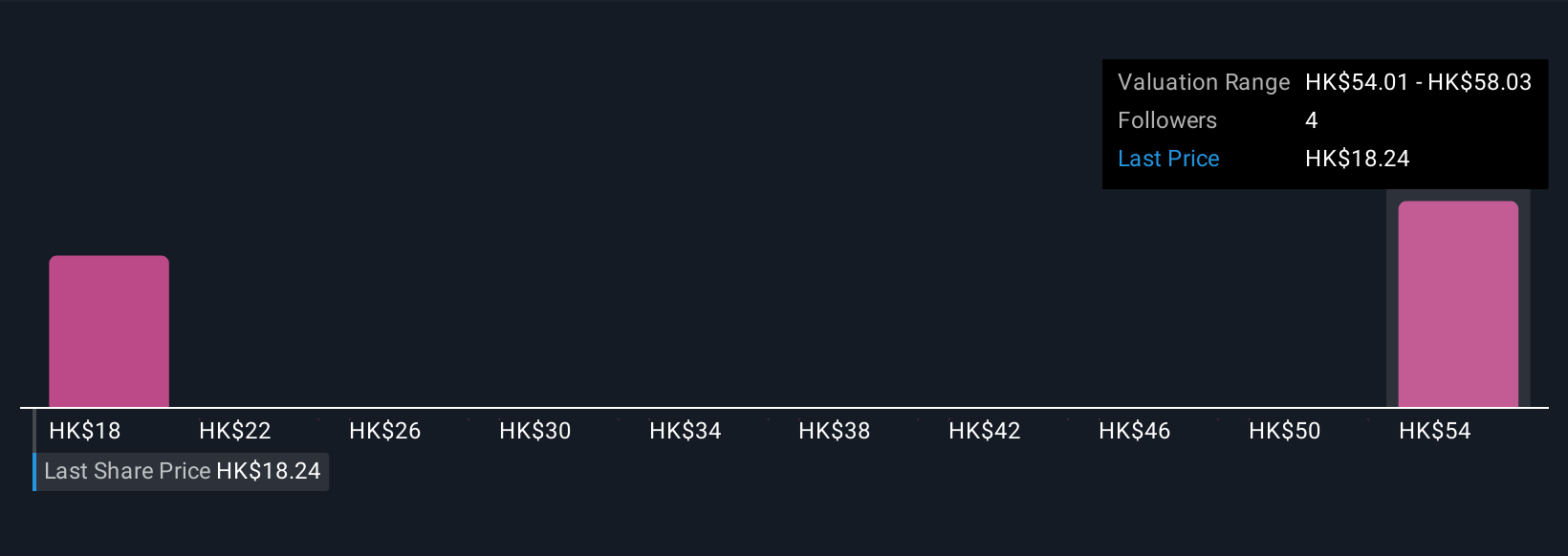

Upgrade Your Decision Making: Choose your China Taiping Insurance Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is simply the story you believe about a company, based not just on numbers but on your own assumptions about its future growth, risks, and potential. Narratives connect the dots between a company’s story, the financial forecasts you expect, and the fair value you see as reasonable.

Available right now on Simply Wall St’s Community page, Narratives give you a straightforward, accessible way to test out your own view of China Taiping against those of millions of other investors. You can easily compare your estimated fair value to the current market price, helping you decide if now is the right time to buy or sell. As the news or earnings reports roll in, Narratives update automatically to keep your analysis relevant and up to date.

For China Taiping Insurance Holdings, you might find some investors forecasting rapid recovery and a fair value much higher than today’s price. Others may take a more cautious approach and value the shares more conservatively. Whether you are optimistic or hesitant, Narratives empower you to invest with confidence, using real stories linked to real numbers.

Do you think there's more to the story for China Taiping Insurance Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:966

China Taiping Insurance Holdings

An investment holding company, underwrites various insurance and reinsurance products in the People’s Republic of China, Hong Kong, Macau, Singapore, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives