China Life (SEHK:2628): Valuation Perspectives Following Strong Earnings Growth for First Nine Months of 2025

Reviewed by Simply Wall St

China Life Insurance (SEHK:2628) just released its earnings for the first nine months of 2025, posting a notable jump in both net income and earnings per share compared to the same period last year. Investors are watching how these numbers might influence the stock’s outlook going forward.

See our latest analysis for China Life Insurance.

Momentum has clearly been building for China Life Insurance, with the stock posting an 83.7% year-to-date share price return and a three-year total shareholder return of 189.4%. The latest surge in profits appears to have reinforced confidence and has helped drive this sustained rally.

If you’re interested in what else is capturing investor attention lately, now is a great time to broaden your view and check out fast growing stocks with high insider ownership

But with shares now trading near analyst price targets after such a rapid climb, investors may wonder if China Life Insurance is still undervalued. Has the market already factored in its future growth potential, leaving little room for a bargain?

Most Popular Narrative: Fairly Valued

China Life Insurance’s current share price is virtually level with its widely followed fair value estimate, setting up a debate on what truly drives its market price.

The company's shift towards a diversified product portfolio, including increased focus on whole life and participating products, indicates potential challenges in adapting to changing customer preferences and interest rate environments. This could impact revenue growth. The need for substantial training and transformation of the large sales force may lead to increased operational costs and inefficiencies in the short term, potentially affecting net margins and earnings.

Think China Life’s future is all about momentum? The real story in this narrative is about the surprising pressure points: tense cost dynamics, evolving products and ambitious profit assumptions. Which of these is crucial for the fair value? Get the full details inside and see what numbers underpin the market’s consensus.

Result: Fair Value of $25.94 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a sharp decline in investment income or a failure to control operational costs could quickly challenge the current fair value outlook.

Find out about the key risks to this China Life Insurance narrative.

Another View: What Do Market Ratios Say?

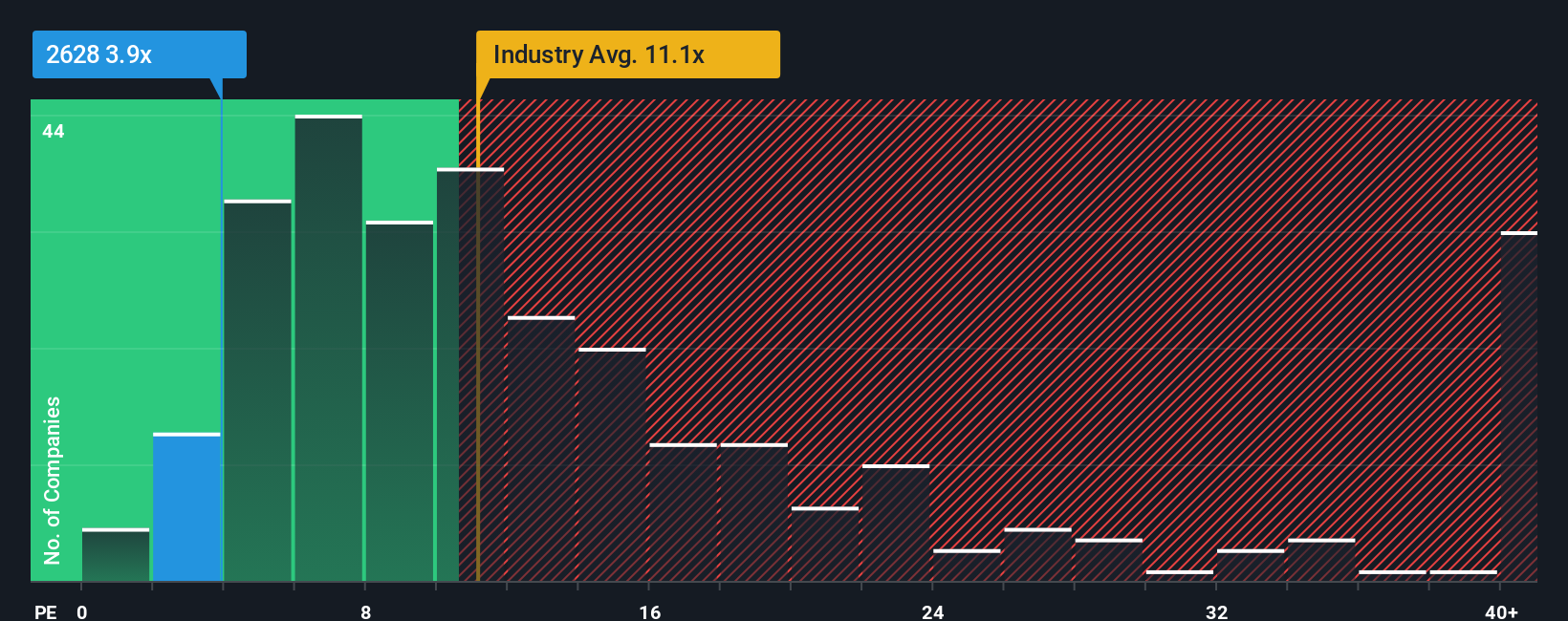

Looking at market ratios, China Life Insurance trades at a price-to-earnings ratio of 3.9x. This is more attractive than the Asian insurance industry average of 11.1x and the peer average of 25.8x. However, it is approximately even with its own fair ratio of 3.9x. This suggests potential for stability but also less obvious upside. Is the market playing it safe, or is an opportunity waiting beneath the surface?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own China Life Insurance Narrative

If you want a different perspective or would rather dive into the details yourself, you can craft your own view of the numbers in just a few minutes. Do it your way

A great starting point for your China Life Insurance research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for Your Next Big Opportunity?

Smart decisions set you apart. Don’t miss out on hidden gems and unique sectors ready for a breakthrough. Your next winning idea could be one click away.

- Boost your passive income by targeting high yields with these 17 dividend stocks with yields > 3% that consistently outperform traditional savings.

- Step ahead in emerging tech by tapping into these 28 quantum computing stocks, where real game-changers in computing are making their mark.

- Catch undervalued stocks before the rest of the market reacts by scanning these 862 undervalued stocks based on cash flows for ideas aligned with long-term value growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2628

China Life Insurance

Operates as a life insurance company in the People’s Republic of China.

Outstanding track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives