- Hong Kong

- /

- Electrical

- /

- SEHK:1979

Top 3 Dividend Stocks On SEHK For Steady Income

Reviewed by Simply Wall St

As global markets react to anticipated interest rate cuts and economic shifts, the Hong Kong market has shown resilience, with the Hang Seng Index advancing despite broader uncertainties. In this dynamic environment, dividend stocks on the SEHK offer a reliable source of steady income for investors seeking stability. A good dividend stock typically combines consistent earnings with a strong payout history, making it an attractive option in today's fluctuating market conditions.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| Luk Fook Holdings (International) (SEHK:590) | 9.55% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 5.28% | ★★★★★☆ |

| China Construction Bank (SEHK:939) | 7.63% | ★★★★★☆ |

| China Electronics Huada Technology (SEHK:85) | 9.81% | ★★★★★☆ |

| S.A.S. Dragon Holdings (SEHK:1184) | 8.75% | ★★★★★☆ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.25% | ★★★★★☆ |

| Zhongsheng Group Holdings (SEHK:881) | 9.20% | ★★★★★☆ |

| PC Partner Group (SEHK:1263) | 9.01% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 7.21% | ★★★★★☆ |

| Beijing Tong Ren Tang Chinese Medicine (SEHK:3613) | 3.86% | ★★★★★☆ |

Click here to see the full list of 80 stocks from our Top SEHK Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Ten Pao Group Holdings (SEHK:1979)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ten Pao Group Holdings Limited is an investment holding company that develops, manufactures, and sells electric charging products globally, with a market cap of HK$1.36 billion.

Operations: Ten Pao Group Holdings Limited generates revenue from the development, manufacturing, and sales of electric charging products across various regions including China, Asia, the United States, Europe, and Africa.

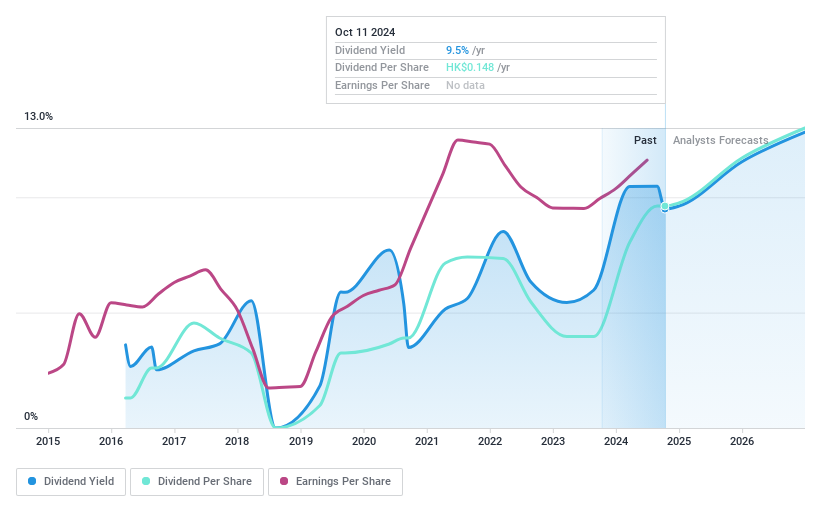

Dividend Yield: 9.4%

Ten Pao Group Holdings has a reasonably low payout ratio of 34.4%, indicating dividends are well-covered by earnings, and a cash payout ratio of 72.2%, suggesting sustainability from cash flows. Despite an attractive dividend yield in the top 25% of Hong Kong stocks, its dividend history is volatile with less than ten years of payments. Recent earnings growth (22.4%) and an interim dividend increase to HKD 0.052 per share reflect positive financial momentum.

- Get an in-depth perspective on Ten Pao Group Holdings' performance by reading our dividend report here.

- The analysis detailed in our Ten Pao Group Holdings valuation report hints at an deflated share price compared to its estimated value.

PICC Property and Casualty (SEHK:2328)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PICC Property and Casualty Company Limited, along with its subsidiaries, operates as a property and casualty insurance provider in the People’s Republic of China, with a market cap of HK$227.77 billion.

Operations: PICC Property and Casualty Company Limited generates revenue from various insurance segments, including Motor Vehicle (CN¥282.11 billion), Agriculture (CN¥52.79 billion), Accidental Injury and Health (CN¥43.75 billion), Liability (CN¥32.74 billion), Others (CN¥26.59 billion), and Commercial Property (CN¥16.10 billion).

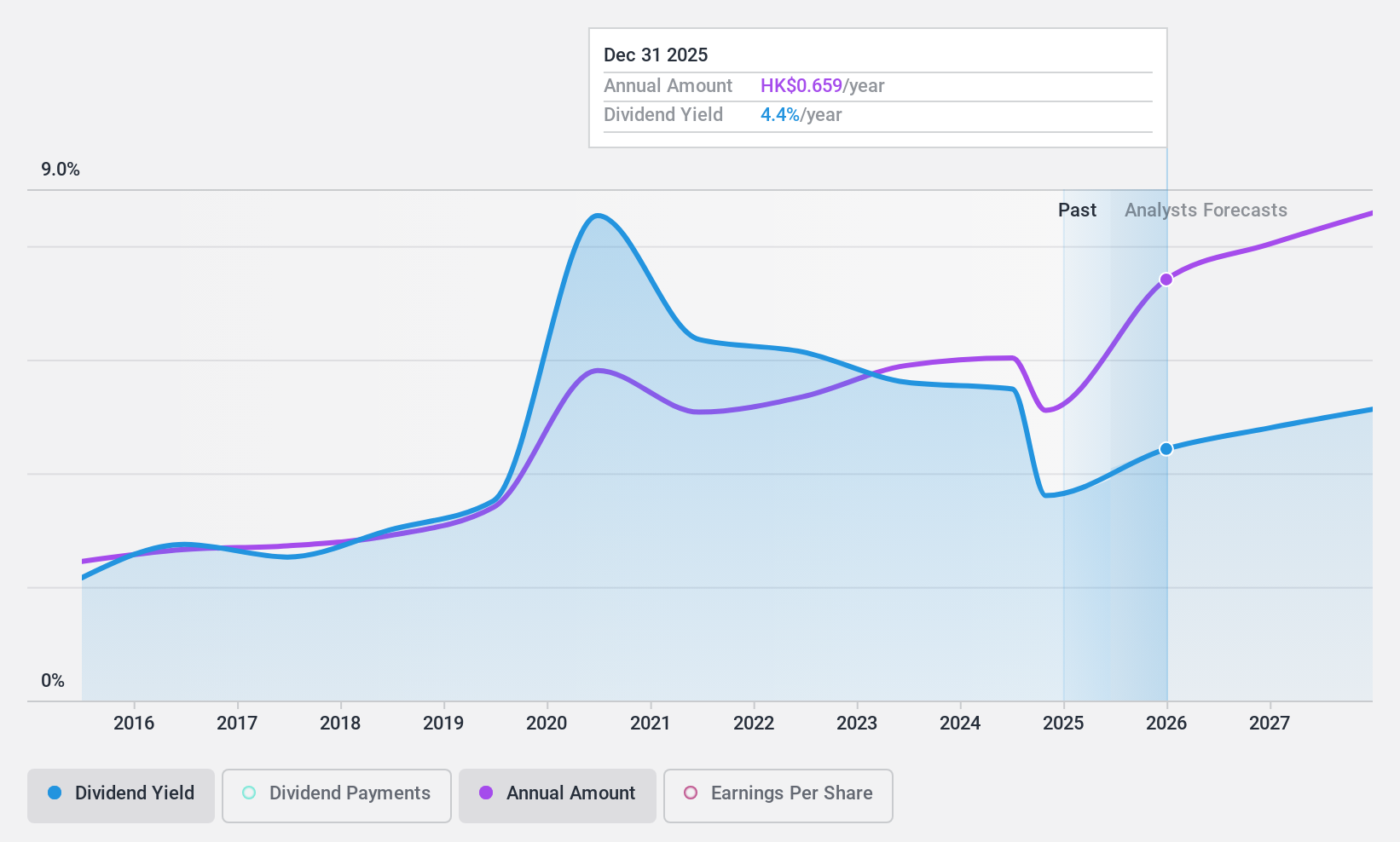

Dividend Yield: 5.2%

PICC Property and Casualty's dividend payments are well-covered by earnings (payout ratio: 44.2%) and cash flows (cash payout ratio: 61.1%), though the yield is low compared to top Hong Kong dividend payers. The company has a history of volatile dividends despite recent increases, such as the RMB 0.49 per share final dividend for 2024. Recent unaudited premiums income reached RMB 311.99 billion, indicating strong operational performance amidst executive changes and product launches.

- Click here and access our complete dividend analysis report to understand the dynamics of PICC Property and Casualty.

- The valuation report we've compiled suggests that PICC Property and Casualty's current price could be quite moderate.

Dawnrays Pharmaceutical (Holdings) (SEHK:2348)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dawnrays Pharmaceutical (Holdings) Limited is an investment holding company that develops, manufactures, and sells non-patented pharmaceutical medicines in Mainland China and internationally, with a market cap of HK$1.73 billion.

Operations: Dawnrays Pharmaceutical (Holdings) Limited generates revenue primarily from two segments: Finished Drugs (CN¥1.04 billion) and Intermediates and Bulk Medicines (CN¥130.31 million).

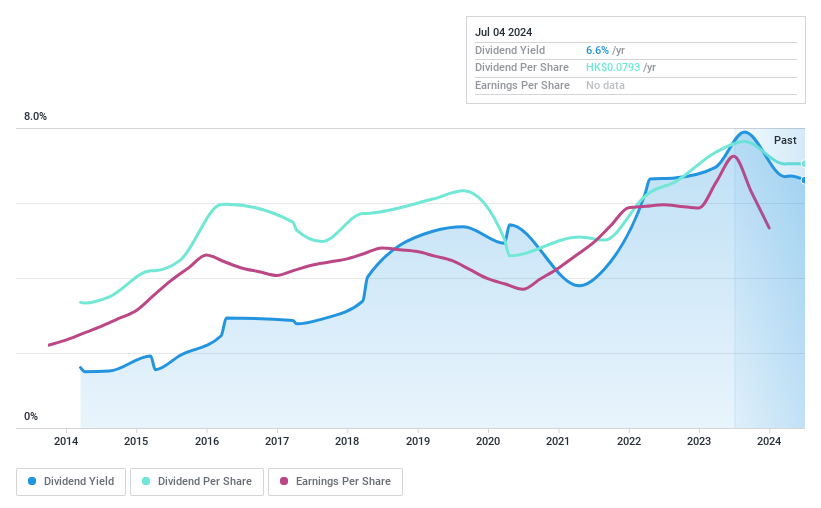

Dividend Yield: 7.0%

Dawnrays Pharmaceutical (Holdings) Limited declared an interim dividend of HK$0.015 per share for the first half of 2024, with payment due on October 3, 2024. Despite a history of volatile dividends, the company's low payout ratio (19.4%) suggests dividends are well-covered by earnings. Recent earnings showed significant growth in net income to CNY493.05 million from CNY255.94 million a year ago, despite a decline in sales to CNY577.45 million from CNY649.92 million.

- Take a closer look at Dawnrays Pharmaceutical (Holdings)'s potential here in our dividend report.

- Our valuation report here indicates Dawnrays Pharmaceutical (Holdings) may be undervalued.

Key Takeaways

- Unlock more gems! Our Top SEHK Dividend Stocks screener has unearthed 77 more companies for you to explore.Click here to unveil our expertly curated list of 80 Top SEHK Dividend Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ten Pao Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1979

Ten Pao Group Holdings

An investment holding company, engages in the development, manufacture, and sale of electric charging products in the People’s Republic of China, the rest of Asia, the United States, Europe, Africa, and internationally.

Outstanding track record with flawless balance sheet.