Why People's Insurance (SEHK:1339) Is Up 5.8% After Earnings Jump and Higher Interim Dividend

Reviewed by Sasha Jovanovic

- People's Insurance Company (Group) of China recently reported earnings results for the nine months ended September 30, 2025, with net income rising to CNY 46.82 billion from CNY 36.33 billion the prior year and basic earnings per share increasing from CNY 0.82 to CNY 1.06; shareholders also approved an interim dividend of RMB 0.75 per 10 Shares to be paid in December 2025.

- This combination of improved profitability and a higher interim dividend highlights management's confidence in the company's financial health and delivery of shareholder returns.

- Now, we'll explore how the robust earnings growth and dividend increase could influence People's Insurance Company of China's investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

People's Insurance Company (Group) of China Investment Narrative Recap

Investors in People's Insurance Company (Group) of China typically believe in the company’s ability to capture growth from digital transformation and efficiency gains, while managing rising competition in non-auto insurance. The recent earnings and dividend announcements reinforce near-term confidence, but do not materially alter the key catalyst of further digital transformation, or lessen the risk of profitability challenges from intense market competition and regulatory changes.

Of the recent announcements, the approved interim dividend of RMB 0.75 per 10 shares stands out, underlining the company’s aim to reward shareholders amid climbing earnings. This payout ties closely to the broader investment narrative that emphasizes balancing growing profits with shareholder returns, especially as PICC continues to push for efficiency and digital reform as primary growth drivers.

Yet, in contrast to the good news, persistent competitive pressure in non-auto insurance is a risk investors should be aware of as...

Read the full narrative on People's Insurance Company (Group) of China (it's free!)

People's Insurance Company (Group) of China's outlook anticipates CN¥698.0 billion in revenue and CN¥39.5 billion in earnings by 2028. This is based on a forecasted annual revenue growth rate of 8.3%, but represents a decrease in earnings of CN¥3.4 billion from the current level of CN¥42.9 billion.

Uncover how People's Insurance Company (Group) of China's forecasts yield a HK$7.17 fair value, a 4% downside to its current price.

Exploring Other Perspectives

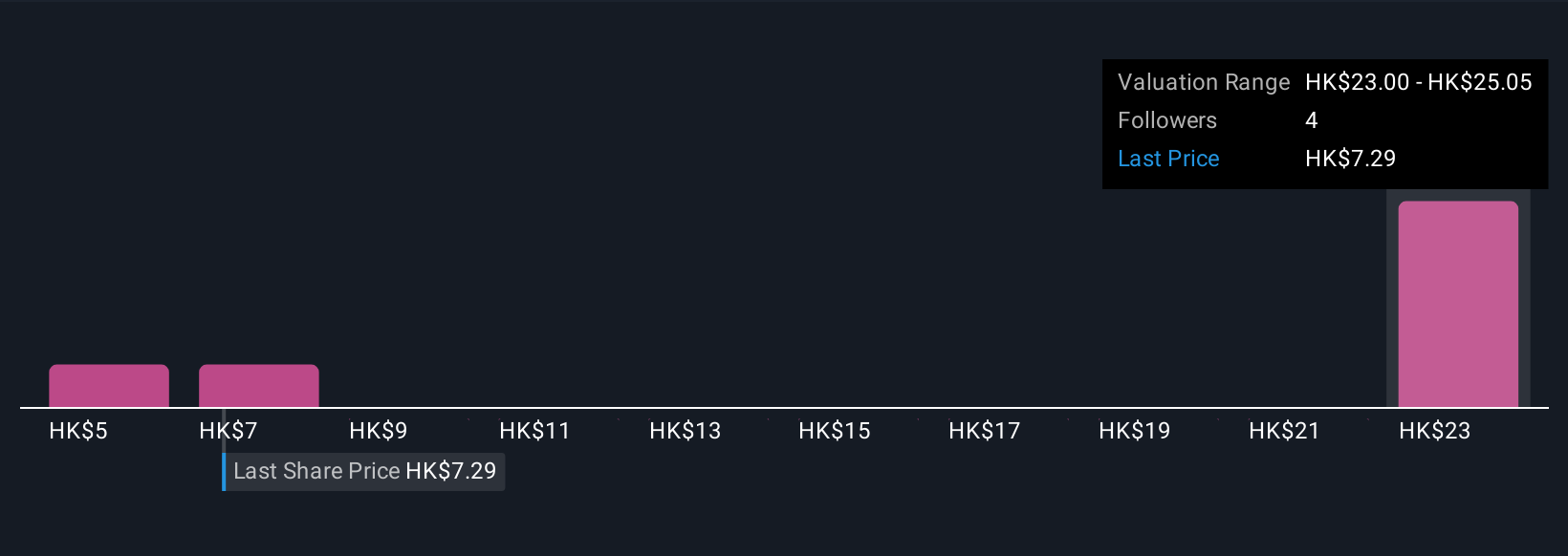

The Simply Wall St Community’s fair value estimates for People's Insurance Company (Group) of China range widely from HK$4.56 to HK$25.15 based on three independent views. Despite this spread, recent dividend increases highlight the company’s focus on efficient capital use, making it essential for you to consider how business model shifts could impact future returns.

Explore 3 other fair value estimates on People's Insurance Company (Group) of China - why the stock might be worth over 3x more than the current price!

Build Your Own People's Insurance Company (Group) of China Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your People's Insurance Company (Group) of China research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free People's Insurance Company (Group) of China research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate People's Insurance Company (Group) of China's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1339

People's Insurance Company (Group) of China

An investment holding company, provides insurance products and services in the People’s Republic of China and Hong Kong.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives