PI C Group (SEHK:1339) Valuation After Interim Dividend Approval and Strong Nine-Month Earnings

Reviewed by Simply Wall St

People's Insurance Company (Group) of China (SEHK:1339) just gave investors a double dose of good news, as shareholders approved a 2025 interim dividend and the company posted higher earnings for the first three quarters of the year.

See our latest analysis for People's Insurance Company (Group) of China.

The recent surge in People's Insurance Company (Group) of China’s share price, now at HK$7.29, has been fueled by solid earnings momentum and the freshly approved interim dividend. This confidence boost is clear in its impressive 1-month share price return of 9.3% and a remarkable 98.1% price gain year-to-date. The three-year total shareholder return stands out at 282%. Momentum appears to be on the rise following a series of positive developments and investor-friendly moves.

If this kind of turnaround has you interested in what else the market has to offer, now is a great time to broaden your horizons and discover fast growing stocks with high insider ownership

With shares rallying on the back of robust earnings and a generous dividend, investors may be wondering whether People's Insurance Company (Group) of China is still trading at an attractive value, or if its future growth is already reflected in the price.

Most Popular Narrative: Fairly Valued

Analyst consensus puts People's Insurance Company (Group) of China's fair value at HK$7.17, right in line with the last close at HK$7.29. This places the stock near equilibrium, as expectations for future earnings are offset by market pricing.

PICC's strategic emphasis on digital reform and AI as part of its future growth plans is expected to enhance operational efficiency and customer experience, likely impacting revenue positively by driving business innovation and broader adoption of insurance products. The planned expansion into international markets, with a focus on countries along the Belt and Road initiative, suggests potential for revenue growth and increased international competitiveness, which could enhance overall earnings.

Curious about the financial leap that underpins this fair value call? The complete narrative reveals which future business pillars and scaling strategies are set to power the next earnings cycle. Uncover the bold assumptions hidden just beneath the surface to see what the market consensus projects beyond the headlines.

Result: Fair Value of $7.17 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges such as increased competition and the threat of natural catastrophes could put pressure on margins and undermine the current fair value outlook.

Find out about the key risks to this People's Insurance Company (Group) of China narrative.

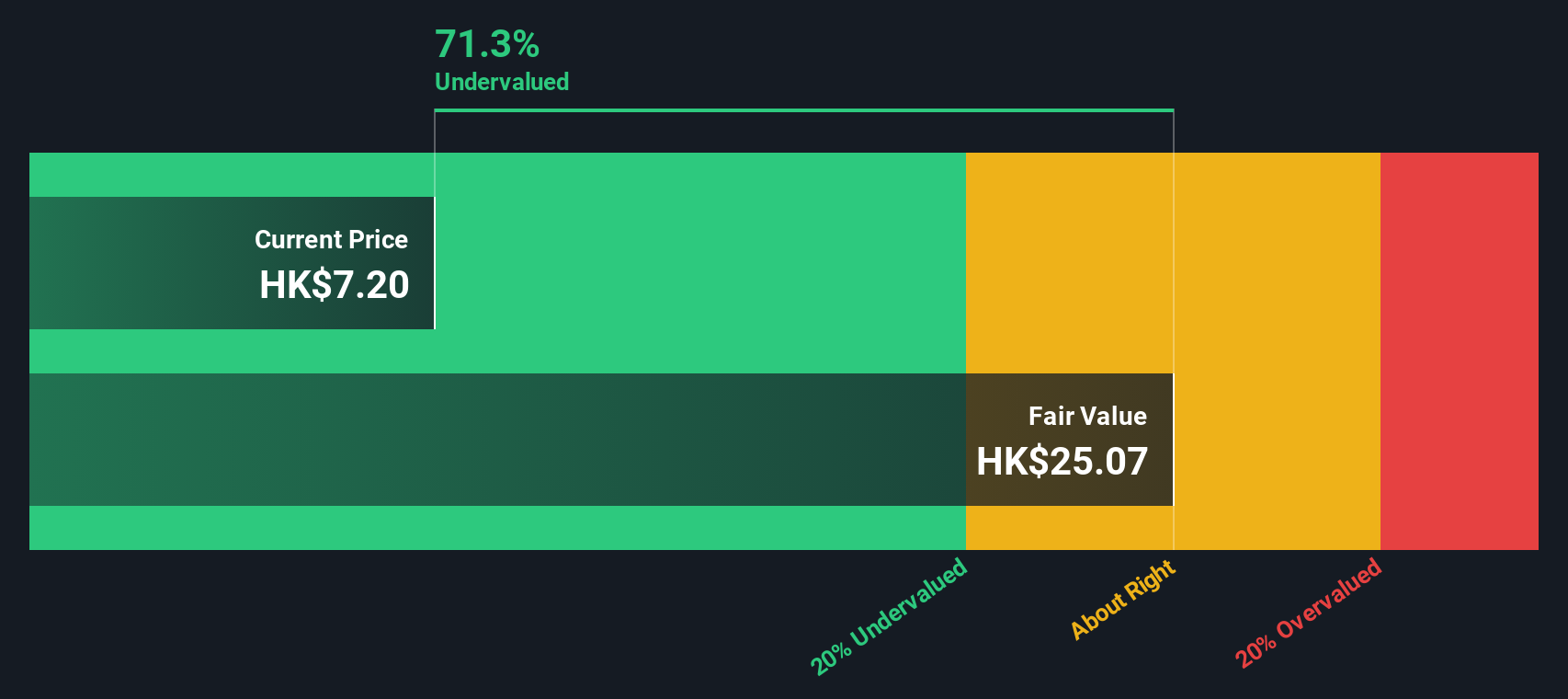

Another View: What Does the SWS DCF Model Say?

While analyst consensus suggests People's Insurance Company (Group) of China is fairly valued, our SWS DCF model offers a strikingly different perspective. According to this approach, the shares are trading well below intrinsic value and this indicates significant undervaluation by the market. Could this be the overlooked opportunity that challenges consensus thinking?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own People's Insurance Company (Group) of China Narrative

If you think the story runs deeper or want to test your own perspective, you can build your own narrative in just a few minutes: Do it your way

A great starting point for your People's Insurance Company (Group) of China research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors keep their edge by spotting the market’s next standouts. Don’t let fresh opportunities pass you by. These tailored stock ideas can fuel your portfolio’s growth:

- Seize steady income potential from companies yielding over 3% by checking out these 17 dividend stocks with yields > 3%.

- Ride the momentum of the artificial intelligence boom with these 25 AI penny stocks targeting fast-growing names in this transformative sector.

- Capitalize on the next big undervalued opportunity with these 849 undervalued stocks based on cash flows and position yourself ahead of the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1339

People's Insurance Company (Group) of China

An investment holding company, provides insurance products and services in the People’s Republic of China and Hong Kong.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives