- Hong Kong

- /

- Consumer Durables

- /

- SEHK:2148

Undervalued Small Caps With Insider Activity In Hong Kong October 2024

Reviewed by Simply Wall St

In October 2024, the Hong Kong market has been navigating a challenging environment as global economic uncertainties and waning optimism about Beijing's stimulus measures have led to a significant decline in the Hang Seng Index. Despite these headwinds, small-cap stocks in Hong Kong present intriguing opportunities for investors looking to capitalize on potential value plays amidst broader market volatility. In this context, identifying small-cap companies with strong fundamentals and notable insider activity can be crucial for discerning investors seeking to leverage current market conditions effectively.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Edianyun | NA | 0.6x | 41.25% | ★★★★★☆ |

| Vesync | 7.2x | 1.1x | -3.46% | ★★★★☆☆ |

| Lion Rock Group | 5.5x | 0.4x | 49.36% | ★★★★☆☆ |

| Cheerwin Group | 10.8x | 1.4x | 48.85% | ★★★★☆☆ |

| Ferretti | 10.7x | 0.7x | 48.04% | ★★★★☆☆ |

| Gemdale Properties and Investment | NA | 0.2x | 41.99% | ★★★★☆☆ |

| China Lesso Group Holdings | 5.7x | 0.4x | -500.45% | ★★★☆☆☆ |

| Skyworth Group | 5.5x | 0.1x | -288.94% | ★★★☆☆☆ |

| Lee & Man Paper Manufacturing | 6.9x | 0.4x | -41.05% | ★★★☆☆☆ |

| Emperor International Holdings | NA | 0.9x | 25.53% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Vesync (SEHK:2148)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Vesync is a company that specializes in the design, development, and sale of small home appliances and tools, with a market capitalization of approximately HK$2.95 billion.

Operations: The company generates revenue primarily from the Appliance & Tool segment, with the latest reported revenue at $604.75 million. The cost of goods sold (COGS) is $311.70 million, resulting in a gross profit of $293.04 million and a gross profit margin of 48.46%. Operating expenses amount to $180.14 million, including significant allocations towards sales and marketing as well as general and administrative expenses.

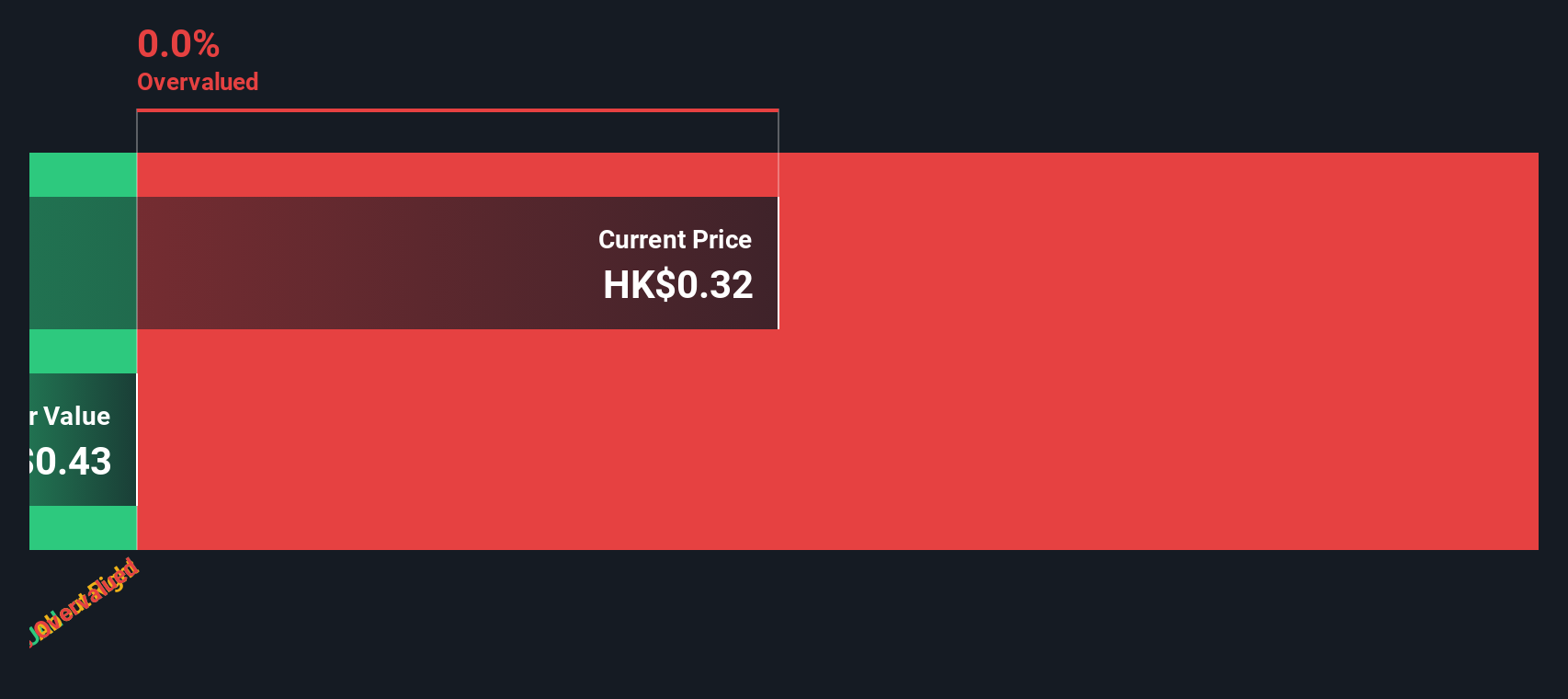

PE: 7.2x

Vesync, a smaller player in Hong Kong's market, has shown potential for growth with its recent addition to the S&P Global BMI Index on September 23, 2024. The company reported a notable increase in net income to US$44.86 million for the first half of 2024, up from US$32.62 million the previous year. Insider confidence is evident as Zhaojun Chen acquired 200,000 shares valued at approximately HK$829K recently. Despite relying on external borrowing for funding, Vesync forecasts earnings growth of 6% annually and has proposed an interim dividend increase payable on October 22, reflecting operational improvements and cost reductions achieved over the past year.

- Delve into the full analysis valuation report here for a deeper understanding of Vesync.

Assess Vesync's past performance with our detailed historical performance reports.

Gemdale Properties and Investment (SEHK:535)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Gemdale Properties and Investment engages in property development, investment, and management, with a focus on real estate projects, and has a market capitalization of approximately CN¥5.44 billion.

Operations: The company's primary revenue streams are derived from property development and property investment and management, with recent figures showing a gross profit margin of 8.82%. Operating expenses, including general and administrative costs, have been increasing over time, impacting profitability.

PE: -1.9x

Gemdale Properties and Investment, a smaller player in Hong Kong's market, recently reported significant insider confidence with Lian Huat Loh purchasing 10 million shares for approximately RMB 2.6 million. Despite volatile share prices and a notable net loss of RMB 2.18 billion for the first half of 2024, the company achieved aggregate contracted sales of RMB 14.18 billion by September, reflecting strong sales performance amid challenges. Funding relies entirely on external borrowing, adding financial risk but also potential upside if managed effectively.

- Unlock comprehensive insights into our analysis of Gemdale Properties and Investment stock in this valuation report.

Learn about Gemdale Properties and Investment's historical performance.

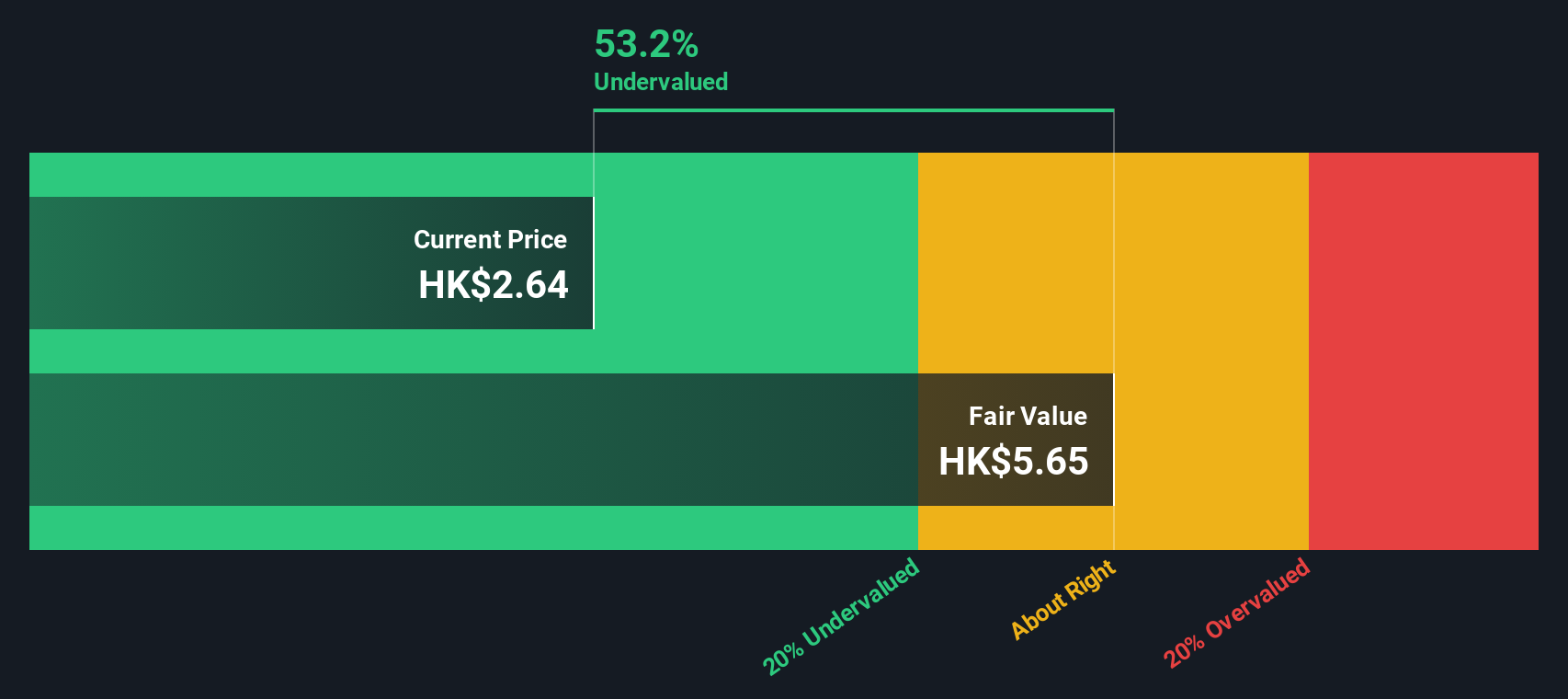

Cheerwin Group (SEHK:6601)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Cheerwin Group focuses on manufacturing and distributing household care, personal care, and pet products, with a market cap of CN¥2.93 billion.

Operations: Cheerwin Group's revenue primarily stems from Household Care, generating CN¥1.59 billion, with additional contributions from Personal Care and Pets and Pet Products. The company has experienced fluctuations in its net income margin, which was 12.59% as of October 2024. Operating expenses are significantly influenced by sales and marketing efforts, which consistently represent a substantial portion of total costs.

PE: 10.8x

Cheerwin Group, a consumer goods company in Hong Kong's small cap sector, has shown promising financial growth. For the first half of 2024, sales increased to CNY 1.25 billion from CNY 1.13 billion a year earlier, while net income rose to CNY 179 million from CNY 137 million. The company's decision to increase its interim dividend to RMB 0.0538 per share reflects insider confidence in its future performance. Recent board changes and strategic appointments aim to strengthen management and enhance operational effectiveness within this dynamic industry context.

- Get an in-depth perspective on Cheerwin Group's performance by reading our valuation report here.

Evaluate Cheerwin Group's historical performance by accessing our past performance report.

Summing It All Up

- Navigate through the entire inventory of 11 Undervalued SEHK Small Caps With Insider Buying here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2148

Vesync

Engages in the research and development, manufacture, and sale of smart household appliances and smart home devices in North America, Europe, and Asia.

Outstanding track record with flawless balance sheet.