- Hong Kong

- /

- Household Products

- /

- SEHK:6601

Undervalued Small Caps With Insider Activity In Hong Kong October 2024

Reviewed by Simply Wall St

In October 2024, the Hong Kong market has been navigating a challenging environment, with the Hang Seng Index experiencing a significant decline amid waning optimism about Beijing's stimulus measures. Despite this backdrop, small-cap stocks in Hong Kong continue to attract attention as investors seek opportunities in companies that may be undervalued by broader market standards. In such conditions, identifying stocks with strong fundamentals and potential insider activity can provide valuable insights into their intrinsic value and future prospects.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Edianyun | NA | 0.6x | 42.03% | ★★★★★☆ |

| Vesync | 7.0x | 1.0x | -0.59% | ★★★★☆☆ |

| Lion Rock Group | 5.4x | 0.4x | 49.95% | ★★★★☆☆ |

| Cheerwin Group | 10.8x | 1.4x | 49.08% | ★★★★☆☆ |

| Ferretti | 11.1x | 0.7x | 45.69% | ★★★★☆☆ |

| Gemdale Properties and Investment | NA | 0.2x | 47.75% | ★★★★☆☆ |

| China Lesso Group Holdings | 5.5x | 0.4x | -474.59% | ★★★☆☆☆ |

| Skyworth Group | 5.5x | 0.1x | -286.44% | ★★★☆☆☆ |

| Lee & Man Paper Manufacturing | 6.9x | 0.4x | -41.64% | ★★★☆☆☆ |

| Emperor International Holdings | NA | 0.9x | 25.53% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Vesync (SEHK:2148)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Vesync is a company that specializes in the design, development, and sale of smart home appliances and tools.

Operations: The company generates revenue primarily from its Appliance & Tool segment, with a recent figure of $604.75 million. Over the periods reviewed, the gross profit margin showed an upward trend, reaching 48.46% in the latest period. Operating expenses are significant, driven mainly by sales and marketing expenses and general administrative costs.

PE: 7.0x

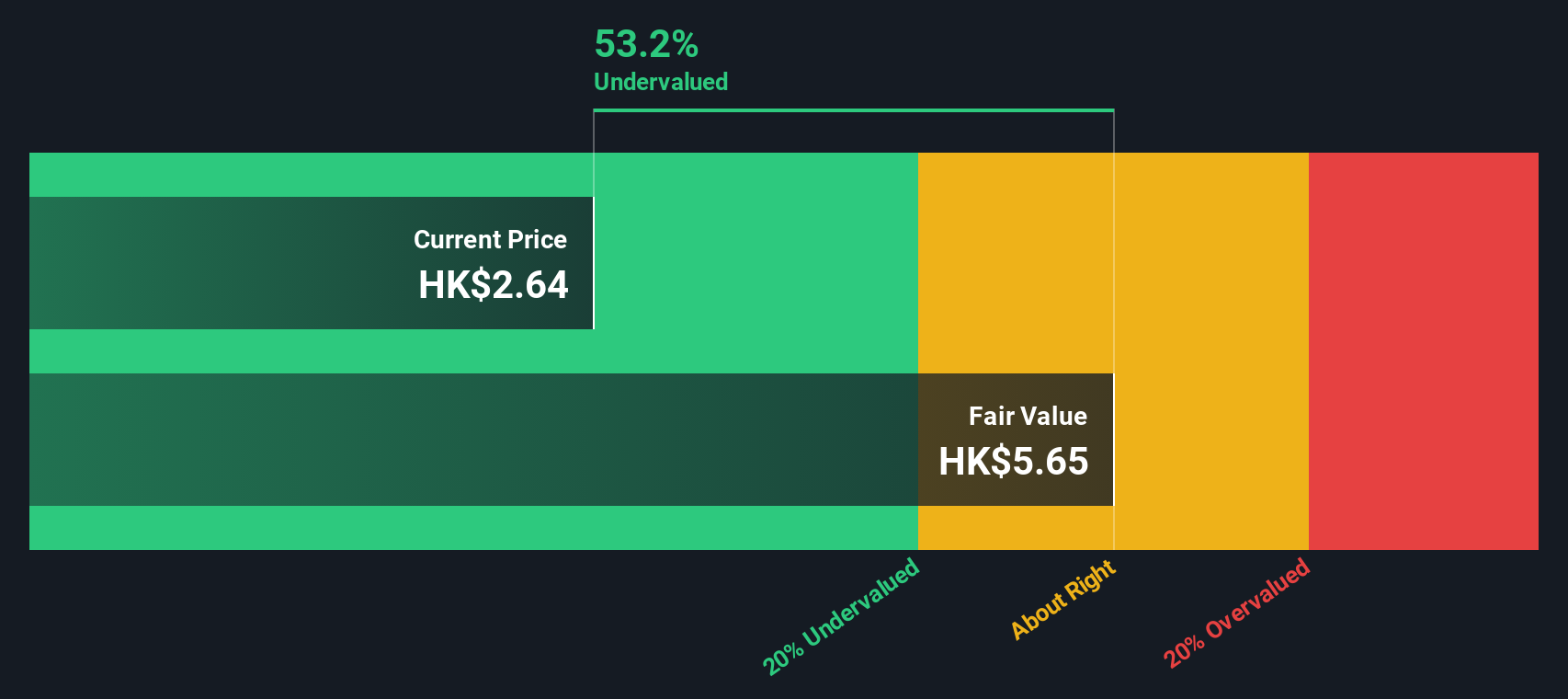

Vesync, a smaller company in Hong Kong's market landscape, has demonstrated growth potential with earnings forecasted to rise by 6.61% annually. Recently added to the S&P Global BMI Index, Vesync reported a half-year sales increase to US$296 million from US$277 million last year and net income of US$45 million compared to US$33 million previously. Insider confidence is evident as Zhaojun Chen acquired 200,000 shares for approximately HK$829K in September 2024. Despite relying solely on external borrowing for funding, the company shows promise with increased sales outside Amazon and improved operational efficiency.

- Click here and access our complete valuation analysis report to understand the dynamics of Vesync.

Gain insights into Vesync's historical performance by reviewing our past performance report.

Cheerwin Group (SEHK:6601)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Cheerwin Group is a company engaged in the production and sale of household care, personal care, and pet products, with a market capitalization of CN¥3.22 billion.

Operations: The primary revenue streams for the company are Household Care, contributing significantly with CN¥1.59 billion, followed by Pets and Pet Products at CN¥79.69 million, and Personal Care at CN¥53.51 million. The gross profit margin has shown an upward trend, reaching 47.89% as of October 2024 from earlier periods like December 2017 when it was 35.94%. Operating expenses have been substantial, particularly in sales and marketing efforts which were CN¥477.98 million by October 2024.

PE: 10.8x

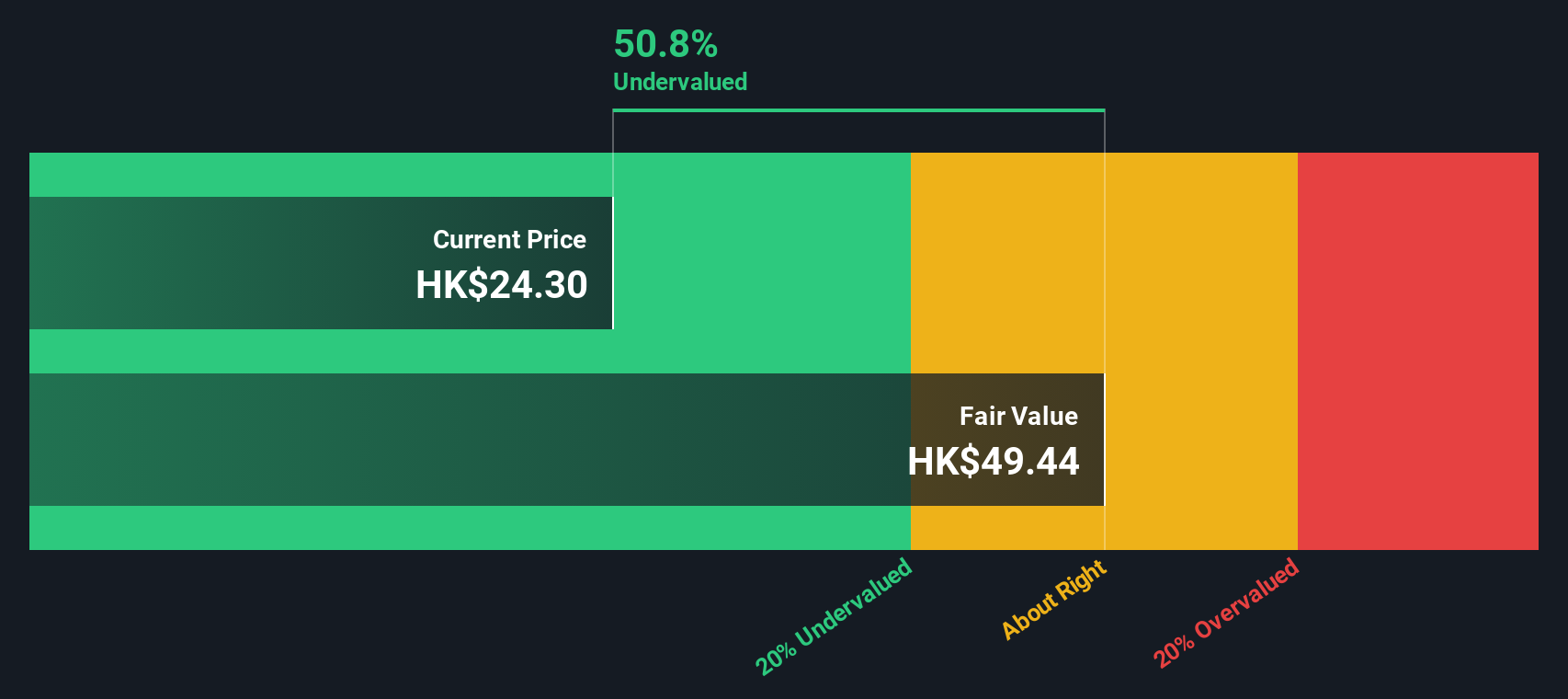

Cheerwin Group, a smaller player in Hong Kong's market, shows potential with its recent financial performance. For the first half of 2024, sales grew to ¥1.25 billion from ¥1.13 billion the previous year, while net income increased to ¥179 million from ¥136 million. Insider confidence is evident as insiders purchased shares between July and August 2024. The company's dividend increase further signals financial health despite relying on higher-risk external funding sources for liabilities.

- Unlock comprehensive insights into our analysis of Cheerwin Group stock in this valuation report.

Explore historical data to track Cheerwin Group's performance over time in our Past section.

Ferretti (SEHK:9638)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ferretti is a company involved in the design, construction, and marketing of yachts and recreational boats with a market capitalization of approximately HK$7.61 billion.

Operations: The primary revenue stream comes from the design, construction, and marketing of yachts and recreational boats, generating €1.30 billion as of the latest period. The gross profit margin has shown variability over time, with a recent figure of 36.04%. Operating expenses are primarily driven by general and administrative costs, which amounted to €263.40 million in the most recent data available.

PE: 11.1x

Ferretti, a smaller company in Hong Kong's market, shows potential for growth despite recent challenges. Their earnings report for the first half of 2024 revealed sales of €695.1 million and net income of €43.86 million, indicating steady performance. The company's inclusion in the S&P Global BMI Index on September 23, 2024, underscores its market relevance. Leadership changes have been smoothly managed to ensure continuity. Insider confidence is reflected through share purchases over recent months, suggesting belief in future prospects despite reliance on external borrowing for funding.

- Dive into the specifics of Ferretti here with our thorough valuation report.

Assess Ferretti's past performance with our detailed historical performance reports.

Summing It All Up

- Get an in-depth perspective on all 10 Undervalued SEHK Small Caps With Insider Buying by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6601

Cheerwin Group

An investment holding company, manufactures and trades household insecticides and repellents, household cleaning, air care, personal care, pets and pet products, and other products in the People’s Republic of China.

Flawless balance sheet and good value.