- Hong Kong

- /

- Medical Equipment

- /

- SEHK:1501

3 SEHK Stocks Estimated To Be Undervalued By Up To 49.8%

Reviewed by Simply Wall St

As global markets experience mixed signals, with the Hong Kong Hang Seng Index recently giving up 0.43%, investors are increasingly on the lookout for undervalued opportunities. In this environment, identifying stocks that are trading below their intrinsic value can offer significant potential for growth and stability amidst market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Bosideng International Holdings (SEHK:3998) | HK$3.62 | HK$6.75 | 46.4% |

| WuXi XDC Cayman (SEHK:2268) | HK$20.10 | HK$39.32 | 48.9% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$28.20 | HK$56.20 | 49.8% |

| BYD (SEHK:1211) | HK$239.80 | HK$461.26 | 48% |

| Vobile Group (SEHK:3738) | HK$1.47 | HK$2.61 | 43.7% |

| Digital China Holdings (SEHK:861) | HK$3.24 | HK$6.11 | 47% |

| United Company RUSAL International (SEHK:486) | HK$2.27 | HK$4.25 | 46.6% |

| Innovent Biologics (SEHK:1801) | HK$44.05 | HK$80.41 | 45.2% |

| AK Medical Holdings (SEHK:1789) | HK$4.22 | HK$8.33 | 49.4% |

| Jinke Smart Services Group (SEHK:9666) | HK$7.59 | HK$13.78 | 44.9% |

Here's a peek at a few of the choices from the screener.

BYD (SEHK:1211)

Overview: BYD Company Limited, along with its subsidiaries, operates in the automobiles and batteries sectors across China, Hong Kong, Macau, Taiwan, and internationally with a market cap of HK$769.84 billion.

Operations: Revenue Segments (in millions of CN¥): Automobiles and Related Products and Other Products: ¥507.52 billion, Mobile Handset Components, Assembly Service and Other Products: ¥154.49 billion

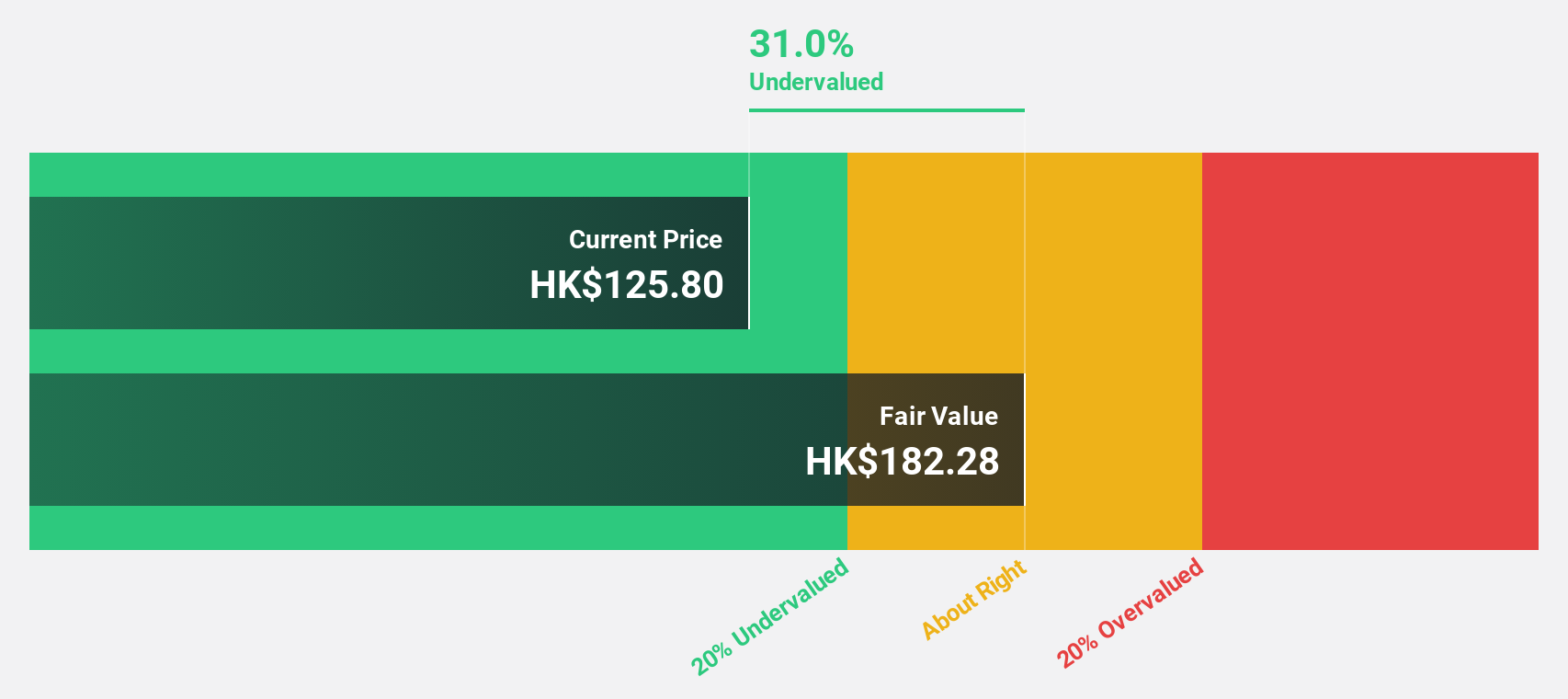

Estimated Discount To Fair Value: 48%

BYD Company Limited appears undervalued based on discounted cash flow analysis, trading at HK$239.8, significantly below its estimated fair value of HK$461.26. Recent half-year results show strong financial performance with net income rising to CNY 13.63 billion from CNY 10.95 billion a year ago, supported by substantial production and sales volume increases. The strategic partnership with Uber and expansion in Thailand further bolster BYD’s long-term growth prospects, enhancing its cash flow potential.

- Our expertly prepared growth report on BYD implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of BYD.

Shanghai INT Medical Instruments (SEHK:1501)

Overview: Shanghai INT Medical Instruments Co., Ltd. (SEHK:1501) is involved in the development, manufacturing, and distribution of medical instruments and has a market cap of HK$4.94 billion.

Operations: Shanghai INT Medical Instruments Co., Ltd. (SEHK:1501) is involved in the development, manufacturing, and distribution of medical instruments and has a market cap of HK$4.94 billion. The company's revenue from its Cardiovascular Interventional Business segment amounts to CN¥718.71 million.

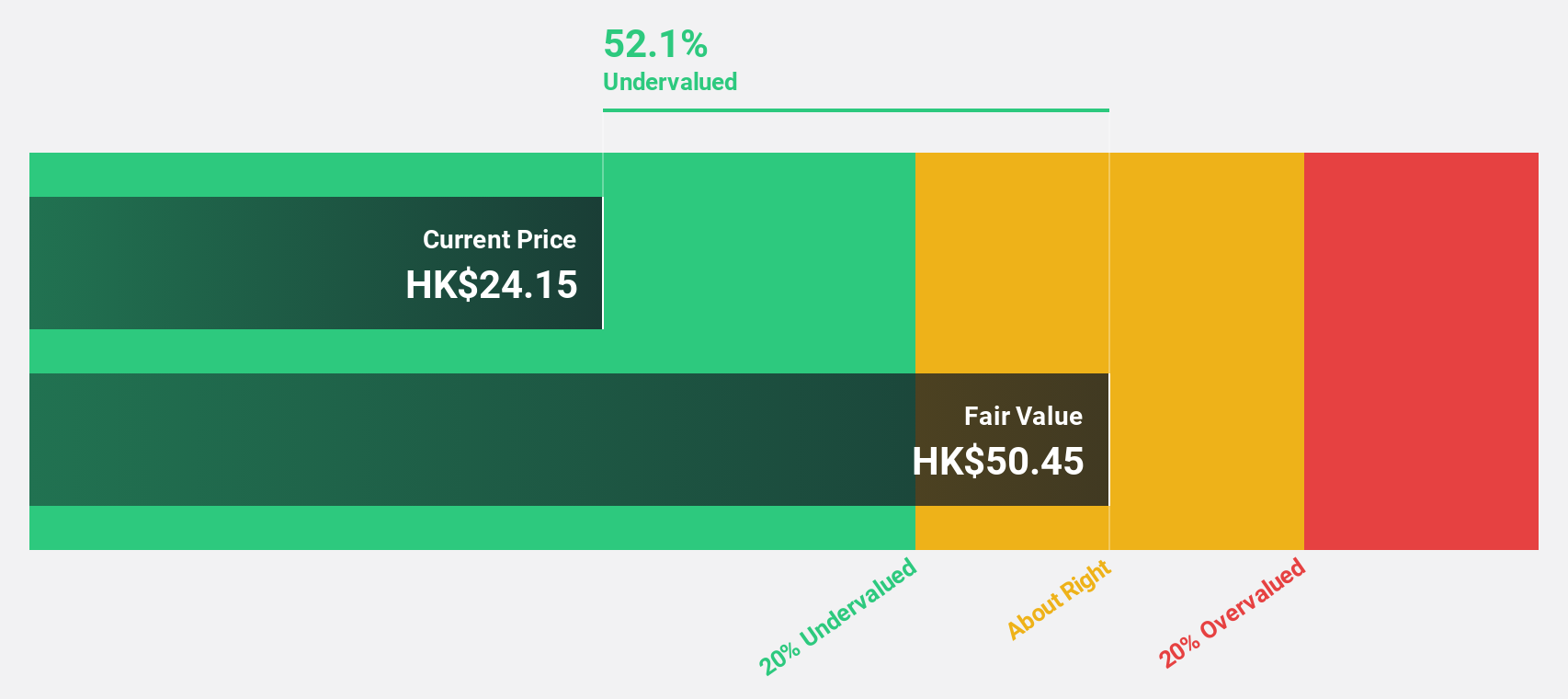

Estimated Discount To Fair Value: 49.8%

Shanghai INT Medical Instruments Co., Ltd. is trading at HK$28.2, significantly below its estimated fair value of HK$56.2, indicating strong undervaluation based on discounted cash flow analysis. Recent earnings for the half year ended June 30, 2024, showed a rise in net income to CNY 100.54 million from CNY 80.5 million a year ago, with revenue also increasing to CNY 392.32 million from CNY 339.76 million previously, highlighting robust financial performance and growth potential in cash flows despite past shareholder dilution concerns.

- The analysis detailed in our Shanghai INT Medical Instruments growth report hints at robust future financial performance.

- Take a closer look at Shanghai INT Medical Instruments' balance sheet health here in our report.

Angelalign Technology (SEHK:6699)

Overview: Angelalign Technology Inc. researches, develops, designs, manufactures, and markets clear aligner treatment solutions in the People’s Republic of China with a market cap of HK$9.45 billion.

Operations: The company's revenue is primarily derived from its Dental Equipment & Supplies segment, which generated CN¥1.72 billion.

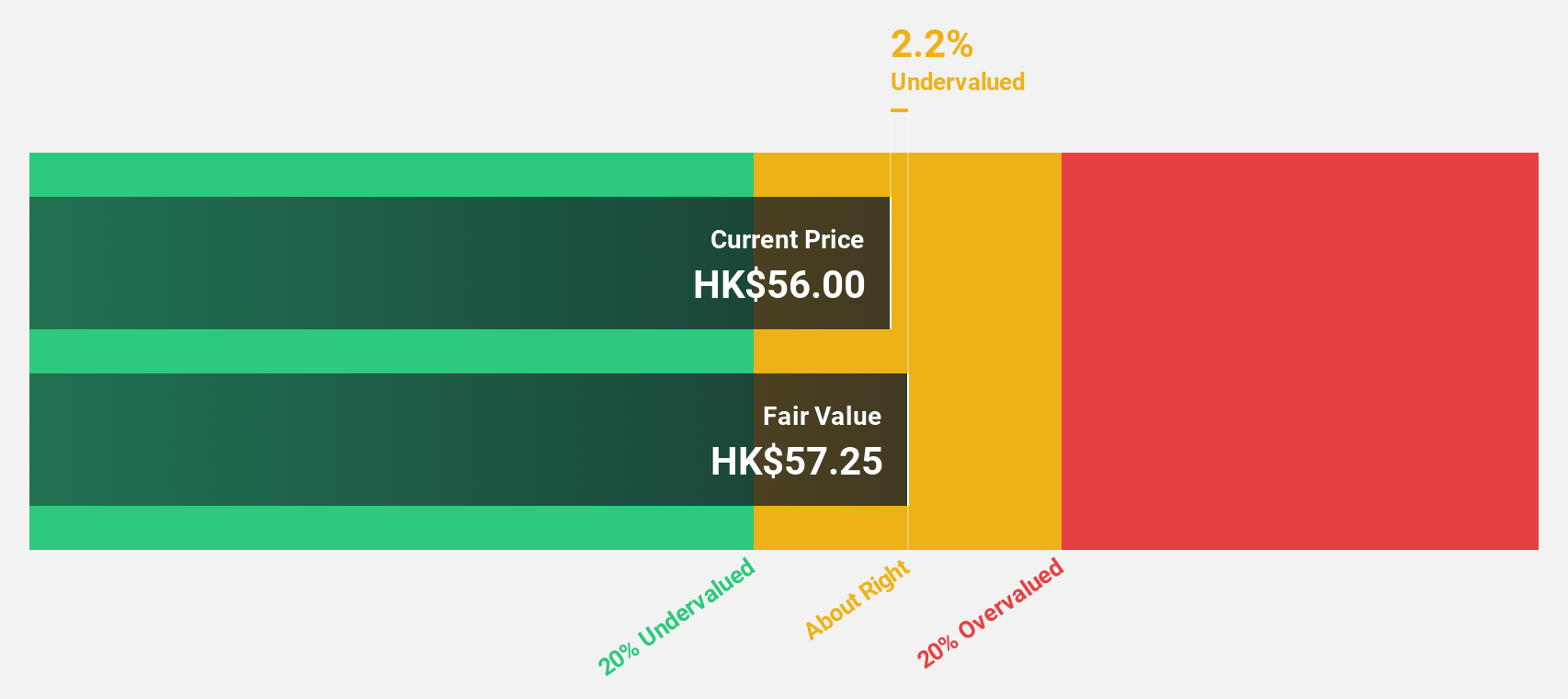

Estimated Discount To Fair Value: 12.8%

Angelalign Technology Inc. reported half-year sales of CNY 861.5 million, up from CNY 616.33 million a year ago, but net income fell to CNY 22.48 million from CNY 32.31 million, reflecting lower profit margins. The stock trades at HK$55.6, slightly below its estimated fair value of HK$63.75 based on discounted cash flow analysis, suggesting some undervaluation despite recent earnings challenges and a forecasted annual profit growth rate significantly higher than the market average.

- Our earnings growth report unveils the potential for significant increases in Angelalign Technology's future results.

- Click to explore a detailed breakdown of our findings in Angelalign Technology's balance sheet health report.

Where To Now?

- Investigate our full lineup of 27 Undervalued SEHK Stocks Based On Cash Flows right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1501

Shanghai INT Medical Instruments

Shanghai INT Medical Instruments Co., Ltd.

High growth potential with excellent balance sheet.