- Hong Kong

- /

- Medical Equipment

- /

- SEHK:2160

MicroPort CardioFlow Medtech Corporation (HKG:2160) Stocks Shoot Up 34% But Its P/S Still Looks Reasonable

MicroPort CardioFlow Medtech Corporation (HKG:2160) shares have had a really impressive month, gaining 34% after a shaky period beforehand. But the last month did very little to improve the 50% share price decline over the last year.

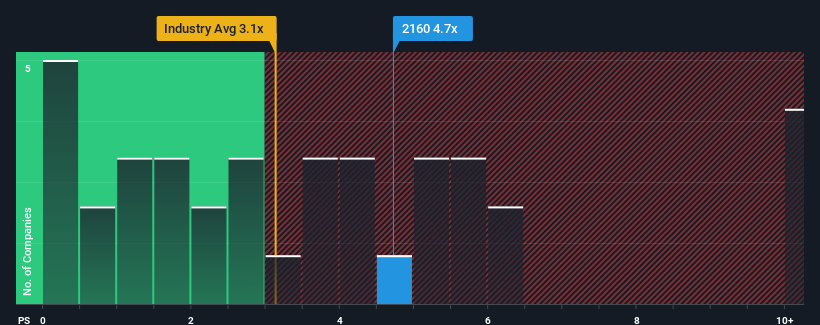

After such a large jump in price, given close to half the companies operating in Hong Kong's Medical Equipment industry have price-to-sales ratios (or "P/S") below 3.1x, you may consider MicroPort CardioFlow Medtech as a stock to potentially avoid with its 4.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for MicroPort CardioFlow Medtech

What Does MicroPort CardioFlow Medtech's P/S Mean For Shareholders?

Recent times have been advantageous for MicroPort CardioFlow Medtech as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think MicroPort CardioFlow Medtech's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, MicroPort CardioFlow Medtech would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered an exceptional 27% gain to the company's top line. Pleasingly, revenue has also lifted 153% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 30% per year as estimated by the three analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 23% per year, which is noticeably less attractive.

With this in mind, it's not hard to understand why MicroPort CardioFlow Medtech's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

MicroPort CardioFlow Medtech shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that MicroPort CardioFlow Medtech maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Medical Equipment industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for MicroPort CardioFlow Medtech with six simple checks on some of these key factors.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2160

MicroPort CardioFlow Medtech

A medical device company, engages in the research, development, and commercialization of transcatheter and surgical solutions for structural heart diseases in the People’s Republic of China and internationally.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives