- Hong Kong

- /

- Medical Equipment

- /

- SEHK:2160

MicroPort CardioFlow Medtech Corporation (HKG:2160) Shares May Have Slumped 29% But Getting In Cheap Is Still Unlikely

To the annoyance of some shareholders, MicroPort CardioFlow Medtech Corporation (HKG:2160) shares are down a considerable 29% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 62% share price decline.

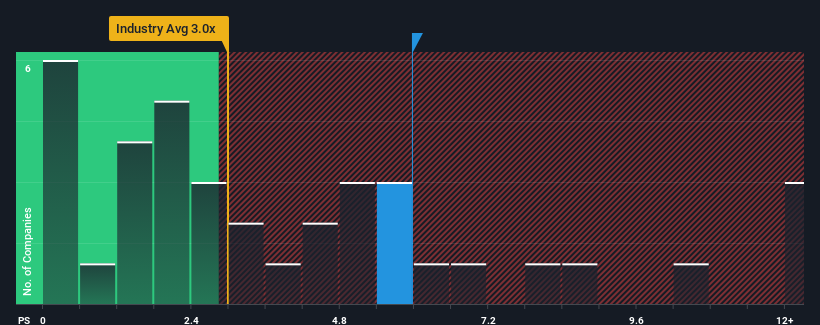

Even after such a large drop in price, you could still be forgiven for thinking MicroPort CardioFlow Medtech is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 6x, considering almost half the companies in Hong Kong's Medical Equipment industry have P/S ratios below 3x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for MicroPort CardioFlow Medtech

How MicroPort CardioFlow Medtech Has Been Performing

Recent times haven't been great for MicroPort CardioFlow Medtech as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on MicroPort CardioFlow Medtech will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like MicroPort CardioFlow Medtech's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 34%. The strong recent performance means it was also able to grow revenue by 223% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 28% each year as estimated by the three analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 51% per annum, which is noticeably more attractive.

In light of this, it's alarming that MicroPort CardioFlow Medtech's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

A significant share price dive has done very little to deflate MicroPort CardioFlow Medtech's very lofty P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It comes as a surprise to see MicroPort CardioFlow Medtech trade at such a high P/S given the revenue forecasts look less than stellar. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It is also worth noting that we have found 1 warning sign for MicroPort CardioFlow Medtech that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2160

MicroPort CardioFlow Medtech

A medical device company, engages in the research, development, and commercialization of transcatheter and surgical solutions for structural heart diseases in the People’s Republic of China and internationally.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives