- Hong Kong

- /

- Medical Equipment

- /

- SEHK:1066

Shandong Weigao (SEHK:1066): Evaluating Valuation Following Q3 Revenue Growth and Ongoing Pricing Headwinds

Reviewed by Simply Wall St

See our latest analysis for Shandong Weigao Group Medical Polymer.

Shandong Weigao Group Medical Polymer’s share price has cooled off lately after a challenging month, but its year-to-date gain of 24.4% puts recent dips in perspective. While current momentum is mixed, long-term total shareholder returns show that performance has been volatile, with a 1-year total return of 11.6% and deeper losses over the last three and five years.

Interested in other healthcare stocks showing strong fundamentals and growth potential? Check out the full list with our top picks here: See the full list for free.

With shares trading nearly 29% below analyst price targets even after recent gains, is Shandong Weigao Group Medical Polymer an undervalued opportunity for investors, or has the market already factored in its future prospects?

Price-to-Earnings of 11.5x: Is it justified?

Shandong Weigao Group Medical Polymer trades at a price-to-earnings (P/E) ratio of 11.5x, which puts it well below most direct peers and sector averages at the last close price of HK$5.45.

The P/E ratio measures how much investors are willing to pay for each dollar of company earnings. A low figure can mean the stock is undervalued or the market expects limited growth. For a medical equipment company, P/E is a critical metric because it reflects both profitability and market sentiment about future performance.

This multiple stands out sharply against both the Hong Kong Medical Equipment industry average (20.4x) and the wider peer group (25.9x). Notably, it is also below the estimated "fair" P/E of 18.8x, suggesting the broader market may be underestimating Weigao's earnings power or future growth. The current discount to both peers and the fair ratio sets the stage for potential rerating if sentiment shifts or performance accelerates.

Explore the SWS fair ratio for Shandong Weigao Group Medical Polymer

Result: Price-to-Earnings of 11.5x (UNDERVALUED)

However, ongoing government pricing pressure and volatile long-term returns could continue to weigh on sentiment, even as fundamentals improve.

Find out about the key risks to this Shandong Weigao Group Medical Polymer narrative.

Another View: What Does the DCF Model Say?

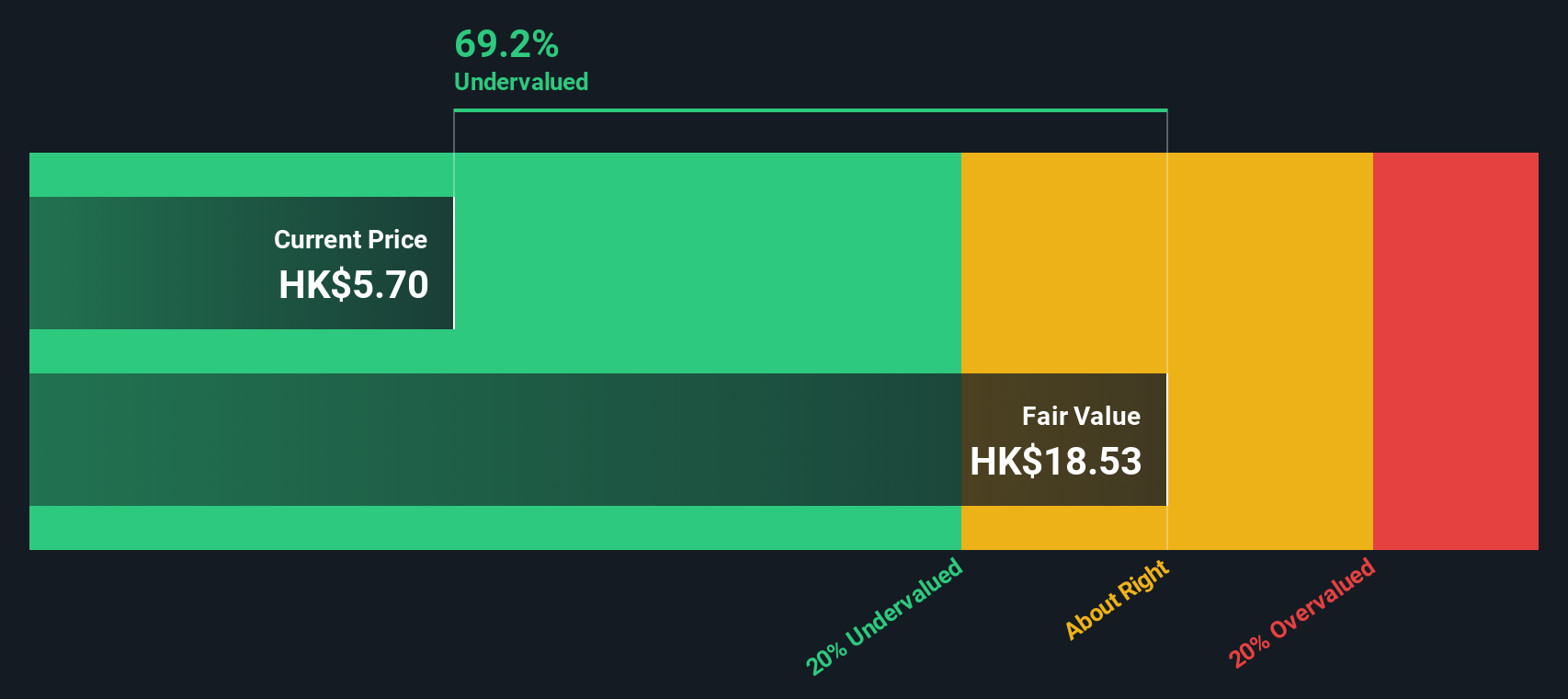

While the price-to-earnings ratio suggests Shandong Weigao Group Medical Polymer is trading at a discount to peers and the fair ratio, our DCF model paints an even starker picture. On this basis, shares are trading over 70% below the estimated fair value. This highlights significantly more upside than the market or peer-based metrics alone suggest. Could this deeper undervaluation signal a real opportunity, or is there something the models are missing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Shandong Weigao Group Medical Polymer for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 848 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Shandong Weigao Group Medical Polymer Narrative

Keep in mind, the tools are there for you to analyze the numbers firsthand and shape your own view of the story in minutes. Do it your way.

A great starting point for your Shandong Weigao Group Medical Polymer research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Winning Ideas?

Smart investors stay ahead by tracking more than one opportunity. Set yourself up for long-term success with these standout stock ideas chosen for their growth, potential, and innovation.

- Uncover income reliability by checking out these 20 dividend stocks with yields > 3%, where high-yield stocks offer stability in a changing market.

- Spot tomorrow’s technology leaders and cutting-edge trends when you scan these 26 AI penny stocks for AI-driven companies making an impact now.

- Capitalize on value and growth together with these 848 undervalued stocks based on cash flows, featuring companies currently trading below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1066

Shandong Weigao Group Medical Polymer

Engages in the research and development, production, wholesale, and sale of medical devices in the People’s Republic of China and internationally.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives