China Feihe (SEHK:6186) Valuation in Focus After Growth Moves and New Investment Strategy

Reviewed by Simply Wall St

China Feihe (SEHK:6186) has caught the market’s attention after announcing new steps to scale up procurement for its growing e-commerce platform. The company is also committing idle funds to major financial products, aiming for better returns and efficient liquidity management.

See our latest analysis for China Feihe.

Shares of China Feihe have seen renewed energy lately, with a 1-day share price return of 1.16% and a notable 12.37% gain over the past month. This hints at rising momentum as the company invests for future growth. However, with a 1-year total shareholder return still at -22.55%, there is ground to recover even as strategic initiatives spark some optimism for a rebound.

If Feihe’s surge has you watching for what’s next, now is an ideal time to broaden your search and discover fast growing stocks with high insider ownership

Given these fresh company moves and the stock’s recent pop, is China Feihe trading at a true discount, or have markets already factored in all the expected growth, leaving limited room for buyers to benefit?

Price-to-Earnings of 13.3x: Is it justified?

China Feihe’s current Price-to-Earnings ratio stands at 13.3x, positioned above the peer average of 10x but below the Hong Kong Food industry average of 14.3x. With shares last closing at HK$4.36, this places Feihe in a unique middle ground among its competitors.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for each dollar of earnings and is commonly used to benchmark profitability and future growth expectations for food industry companies. In Feihe’s case, the P/E signals a slightly higher valuation than its direct peers, but not so lofty as to outpace the sector average.

Given the company is trading at a noticeable discount to its calculated fair P/E ratio (18.4x), the market may be underestimating near-term earnings growth or overlooking potential recovery amid recent strategic initiatives. This divergence presents an interesting opportunity, especially as the fair ratio suggests room for upward movement if growth materializes.

Against the industry, Feihe’s P/E sits just below sector norms but noticeably higher than peers, underscoring both restrained optimism and lingering caution. Should growth pick up or margins expand, there is a real possibility the market re-rates the stock toward its fair multiple of 18.4x.

Explore the SWS fair ratio for China Feihe

Result: Price-to-Earnings of 13.3x (UNDERVALUED)

However, persistent sector competition and unpredictable shifts in consumer demand could limit the upside. These factors may challenge sustained earnings growth for China Feihe.Find out about the key risks to this China Feihe narrative.

Another View: SWS DCF Model Points to Deep Value

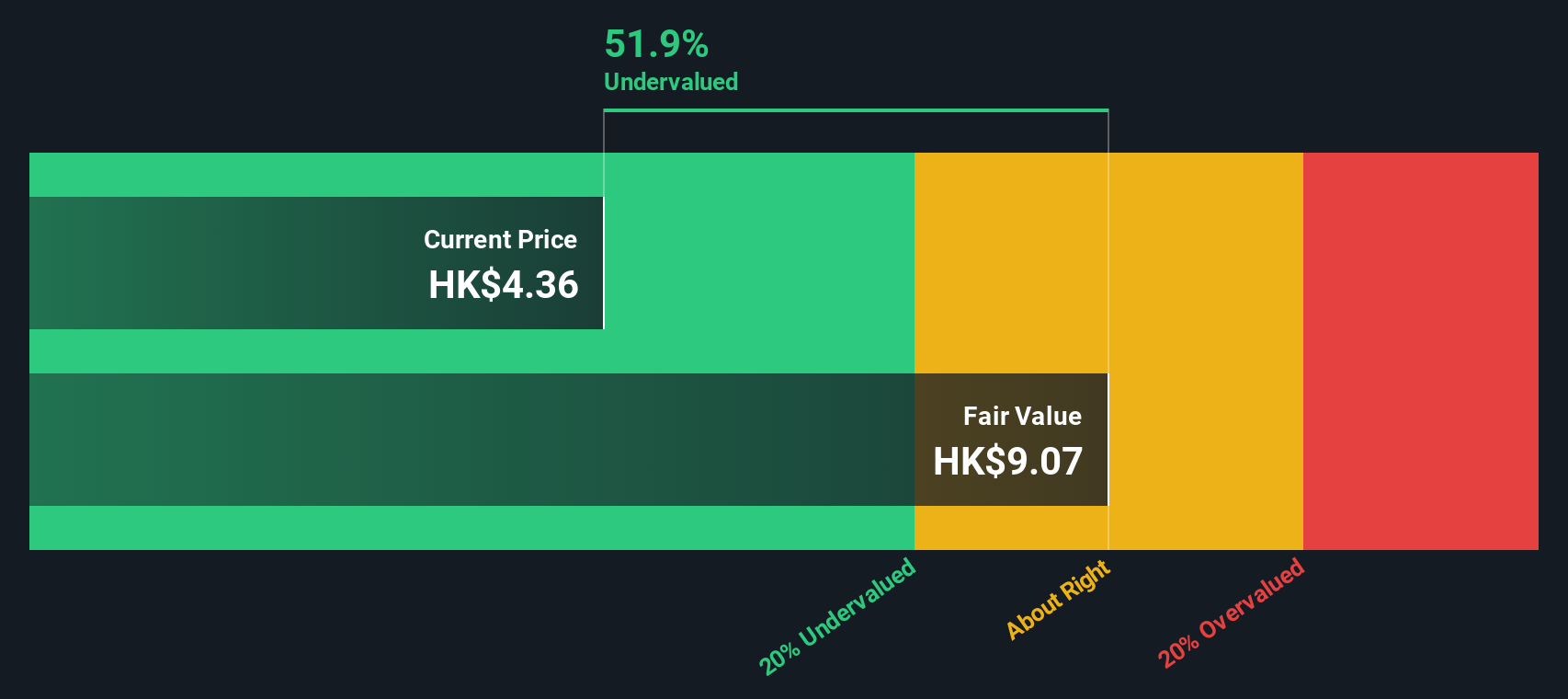

Looking through a different lens, our SWS DCF model estimates China Feihe's fair value at HK$9.06, which is 51.9% higher than the current share price. This means the stock is trading well below its calculated intrinsic value and may be significantly undervalued. However, it is worth considering whether the market sees risks not captured by the model, or if there is a genuine opportunity that has been overlooked.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out China Feihe for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own China Feihe Narrative

If you believe there is more to the story or want to examine the numbers your way, you can quickly build your own perspective in just a few minutes, Do it your way

A great starting point for your China Feihe research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Smart Opportunities?

Step up your investing game with handpicked market ideas designed to give you an edge. Miss these chances, and you could leave smart money on the table.

- Grow your portfolio’s potential by targeting high-yield payouts from these 16 dividend stocks with yields > 3%. These options offer strong rewards above 3%.

- Jump on the innovation wave by tapping into these 24 AI penny stocks, where artificial intelligence is reshaping entire industries and market leaders are emerging quickly.

- Capture opportunities at compelling prices by selecting from these 870 undervalued stocks based on cash flows that show strong cash flow-based value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6186

China Feihe

An investment holding company, produces and sells dairy products and raw milk in Mainland China, Canada, and the United States.

Flawless balance sheet and good value.

Market Insights

Community Narratives