- Hong Kong

- /

- Real Estate

- /

- SEHK:472

Market Might Still Lack Some Conviction On New Silkroad Culturaltainment Limited (HKG:472) Even After 28% Share Price Boost

New Silkroad Culturaltainment Limited (HKG:472) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

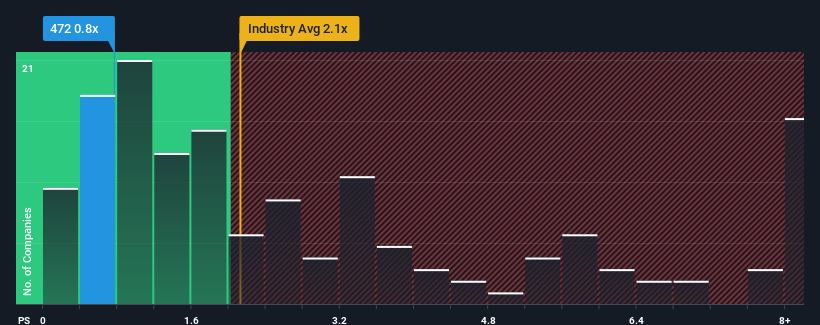

Although its price has surged higher, when close to half the companies operating in Hong Kong's Beverage industry have price-to-sales ratios (or "P/S") above 2x, you may still consider New Silkroad Culturaltainment as an enticing stock to check out with its 0.8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for New Silkroad Culturaltainment

What Does New Silkroad Culturaltainment's P/S Mean For Shareholders?

Recent times have been quite advantageous for New Silkroad Culturaltainment as its revenue has been rising very briskly. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Although there are no analyst estimates available for New Silkroad Culturaltainment, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, New Silkroad Culturaltainment would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 142% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to grow by 8.9% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that New Silkroad Culturaltainment is trading at a P/S lower than the industry. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Bottom Line On New Silkroad Culturaltainment's P/S

New Silkroad Culturaltainment's stock price has surged recently, but its but its P/S still remains modest. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of New Silkroad Culturaltainment revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with New Silkroad Culturaltainment (at least 1 which is a bit concerning), and understanding these should be part of your investment process.

If you're unsure about the strength of New Silkroad Culturaltainment's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if New Silkroad Culturaltainment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:472

New Silkroad Culturaltainment

An investment holding company, provides property management services in the People’s Republic of China.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives