Dekon Food and Agriculture Group (SEHK:2419): Evaluating Valuation in Light of New Sales Revenue Figures

Reviewed by Simply Wall St

Dekon Food and Agriculture Group (SEHK:2419) has just released its unaudited sales revenue figures for October and the year to date. This offers investors a closer look at the company’s recent operational momentum.

See our latest analysis for Dekon Food and Agriculture Group.

Dekon Food and Agriculture Group’s latest unaudited sales update appears to have re-energized investor interest, with a strong 1-day share price return of 2.33% and a robust year-to-date gain of 145.89%. While some recent volatility has emerged, momentum for the stock remains impressive when viewed over the longer term, as reflected by a 1-year total shareholder return of 108.30%.

If Dekon's rapid gains have you looking for fresh opportunities beyond food and agriculture, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

Yet with this impressive growth streak, the key question emerges: is Dekon’s current valuation leaving meaningful upside on the table, or have markets already factored future gains into its soaring share price?

Price-to-Earnings of 7.3x: Is it justified?

Compared to its recent close at HK$74.75, Dekon Food and Agriculture Group’s price-to-earnings (P/E) ratio of 7.3x signals the market is pricing shares below peers in its sector.

The price-to-earnings ratio compares a company's share price to its annual earnings per share, giving investors a sense of how much they are willing to pay for every dollar of profit. For fast-growing food producers, this multiple can offer important context on whether future growth is fully recognized by the market.

With Dekon's P/E considerably lower than the Hong Kong Food industry average of 13.2x and also well below the estimated Fair Price-to-Earnings Ratio of 23.5x, the market is placing a steep discount on current and future earnings. This undervaluation may reflect skepticism over sustainability of recent profit acceleration, or could suggest a market opportunity if current growth rates persist. The Fair P/E indicates a level the market could move toward if the company continues to outperform expectations.

Explore the SWS fair ratio for Dekon Food and Agriculture Group

Result: Price-to-Earnings of 7.3x (UNDERVALUED)

However, risks remain, such as profit growth sustainability and sector volatility. Both factors could challenge Dekon's current momentum if conditions shift unexpectedly.

Find out about the key risks to this Dekon Food and Agriculture Group narrative.

Another View: What Does the SWS DCF Model Suggest?

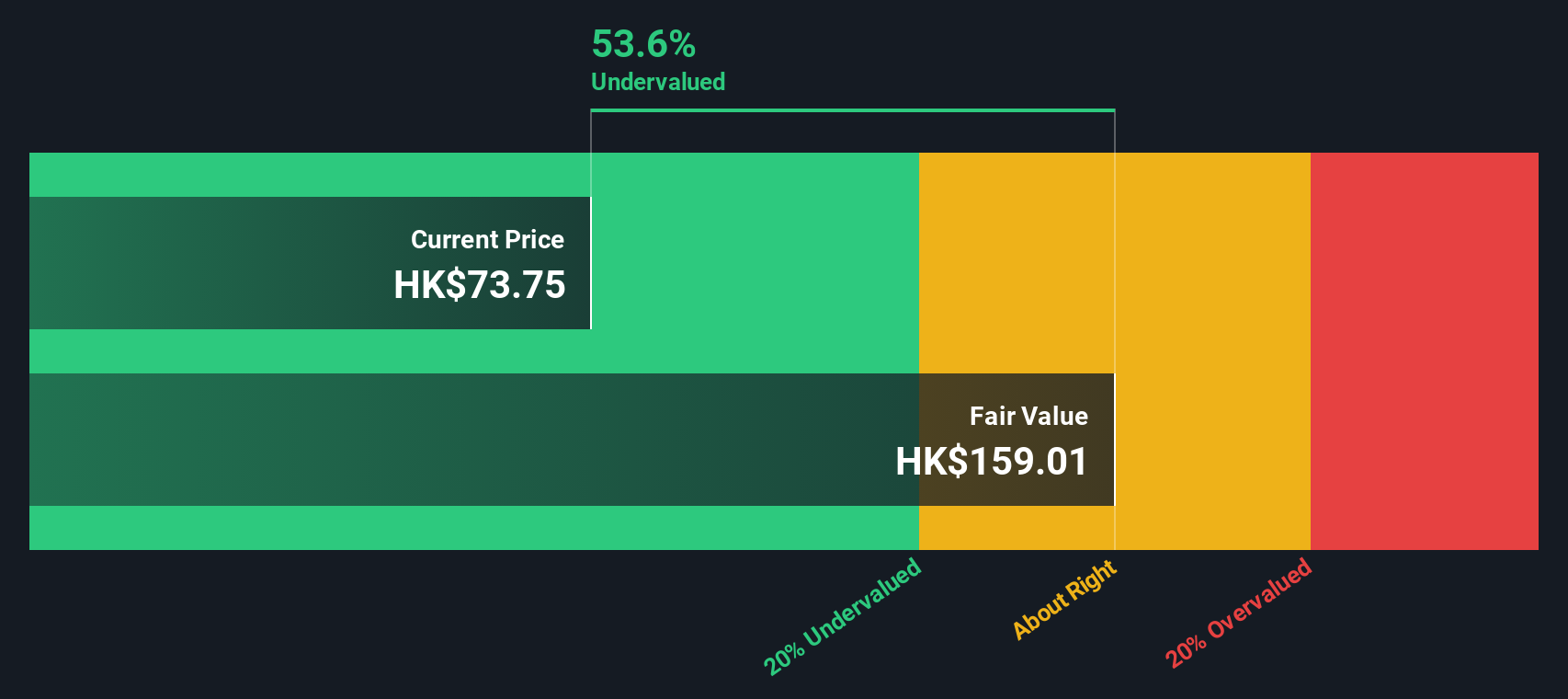

Looking at Dekon Food and Agriculture Group through our DCF model offers a different perspective. The SWS DCF model estimates the company’s fair value at HK$159.11 per share, which is significantly above the current price. This signals even deeper undervaluation than the P/E ratio reveals. Could the market be overlooking something, or does risk still loom?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dekon Food and Agriculture Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 897 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dekon Food and Agriculture Group Narrative

If you would rather reach your own conclusions or want to dig into different angles, you can easily shape your own take using our interactive tools: Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Dekon Food and Agriculture Group.

Looking for More Smart Investment Ideas?

Expand your investing horizons and get ahead of the curve by checking out powerful stock ideas curated by Simply Wall St. These handpicked opportunities can highlight sectors and trends you might miss elsewhere.

- Uncover generous payouts and boost your passive income by reviewing these 15 dividend stocks with yields > 3% with yields above 3%.

- Get a jump on groundbreaking trends by tracking these 27 AI penny stocks as they reshape industries through advancements in artificial intelligence.

- Target those hidden gems trading below their true worth by reviewing these 897 undervalued stocks based on cash flows based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2419

Dekon Food and Agriculture Group

Engages in the livestock and poultry breeding and farming businesses.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives