- Hong Kong

- /

- Oil and Gas

- /

- SEHK:956

China Suntien Green Energy (SEHK:956): Assessing Valuation After Earnings Show Profit Growth Despite Lower Revenue

Reviewed by Simply Wall St

China Suntien Green Energy (SEHK:956) reported earnings for the nine months ending September 30, 2025, showing a rise in net income and improved earnings per share, even as total revenue declined year over year.

See our latest analysis for China Suntien Green Energy.

China Suntien Green Energy’s latest results appear to have energized investor sentiment, with the share price rising 12.6% over the last month and up a striking 30.2% year-to-date. Even more impressive, the past year’s total shareholder return reached 43.3%, highlighting sustained performance momentum amid shifting market dynamics and recent earnings news.

If strong returns in the energy space have you looking for what else is available, consider using our energy-focused discovery tool: fast growing stocks with high insider ownership

But after such robust gains, investors may be wondering if China Suntien Green Energy is undervalued given its improving profits, or if the market has already factored in all future growth and optimism.

Price-to-Earnings of 10.6x: Is it justified?

China Suntien Green Energy is trading at a price-to-earnings (P/E) ratio of 10.6x, which suggests a discount compared to many industry peers and the broader market. The latest close was HK$4.74, with earnings outpacing the Hong Kong market’s growth.

The P/E ratio measures how much investors are willing to pay per dollar of company earnings. It is a key indicator for companies like China Suntien Green Energy, as it offers insight into how the market views its profitability and future prospects relative to competitors.

This valuation hints that the market might be underestimating China Suntien Green Energy’s ongoing earnings recovery and growth trajectory. Notably, the company’s P/E is below the peer average of 28.1x and the Hong Kong market average of 12.5x. In addition, it sits under the estimated fair P/E ratio of 12.1x. This level provides room for upside if earnings continue to climb, especially as performance remains robust.

Explore the SWS fair ratio for China Suntien Green Energy

Result: Price-to-Earnings of 10.6x (UNDERVALUED)

However, obstacles remain, such as volatile energy demand and policy shifts. These factors may challenge sustained profit growth in upcoming quarters.

Find out about the key risks to this China Suntien Green Energy narrative.

Another View: Discounted Cash Flow Paints a Cautious Picture

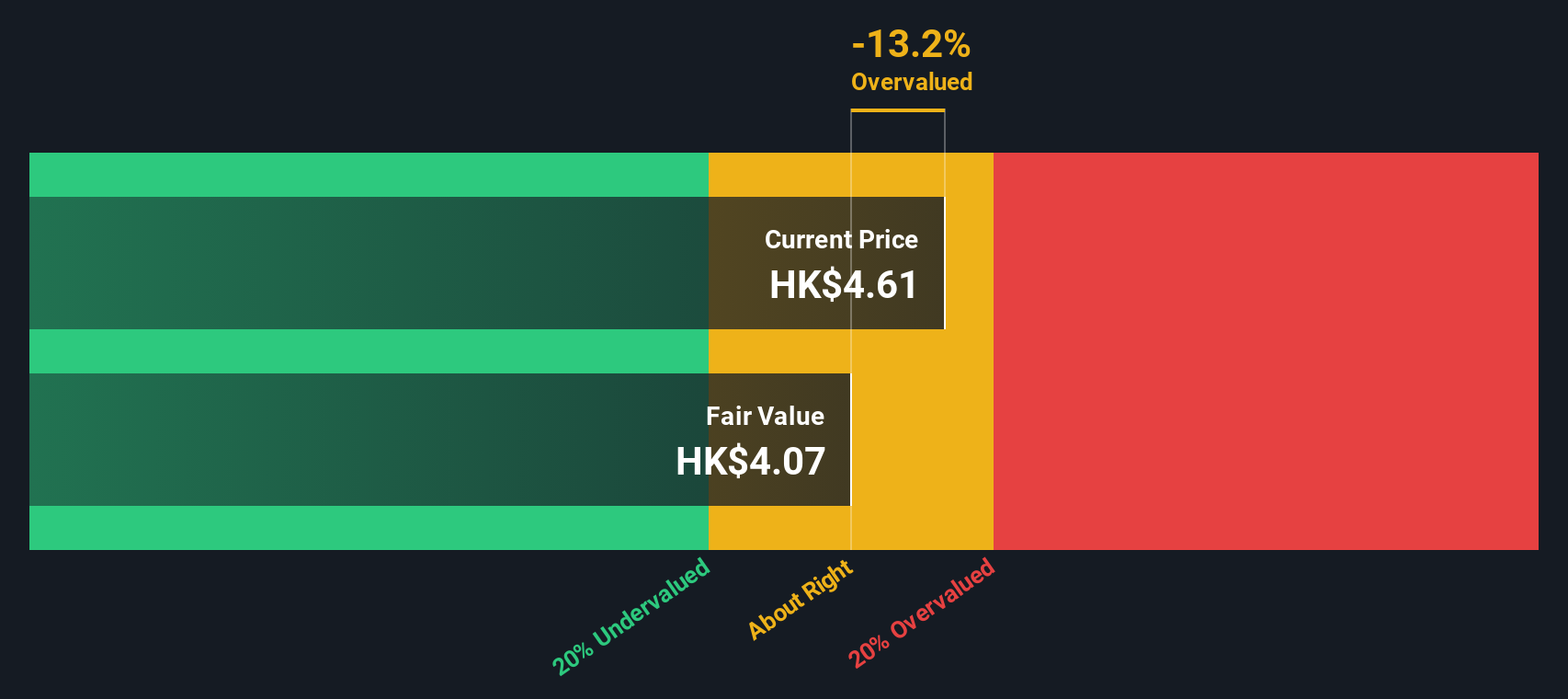

While the P/E ratio suggests China Suntien Green Energy may be undervalued, the SWS DCF model comes to a different conclusion. According to this approach, the current share price of HK$4.74 is above our fair value estimate of HK$4.07, indicating the stock is overvalued by this method.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out China Suntien Green Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 848 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own China Suntien Green Energy Narrative

If you would like to dig deeper into the details or weigh up your own conclusions, you can craft your own perspective in just a few minutes. Do it your way

A great starting point for your China Suntien Green Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Turn opportunity into action by checking out stocks that could supercharge your portfolio. Below are three unique ways to stay ahead of the crowd:

- Unlock the advantages of compounding returns when you target potential high-yield opportunities through these 17 dividend stocks with yields > 3% paying over 3%.

- Stay at the forefront of technology by backing innovators among these 25 AI penny stocks as they push boundaries in artificial intelligence.

- Access tomorrow’s disruptors early and tap into growth stories with these 3597 penny stocks with strong financials showing strength where it counts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:956

China Suntien Green Energy

Develops and utilizes clean energy in Mainland China.

Moderate growth potential second-rate dividend payer.

Market Insights

Community Narratives