- Taiwan

- /

- Hospitality

- /

- TWSE:2731

Top Asian Dividend Stocks To Consider In November 2025

Reviewed by Simply Wall St

As global markets face fluctuations with concerns over elevated valuations and economic uncertainties, Asian markets present a unique landscape for investors seeking stability through dividend stocks. In the current environment, characterized by easing U.S.-China trade tensions and cautious monetary policies in key regions like Japan and China, dividend-paying stocks can offer a reliable income stream while potentially providing a buffer against market volatility.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.43% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.77% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.95% | ★★★★★★ |

| NCD (TSE:4783) | 4.35% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.88% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.90% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.58% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.59% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.68% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.46% | ★★★★★★ |

Click here to see the full list of 1039 stocks from our Top Asian Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

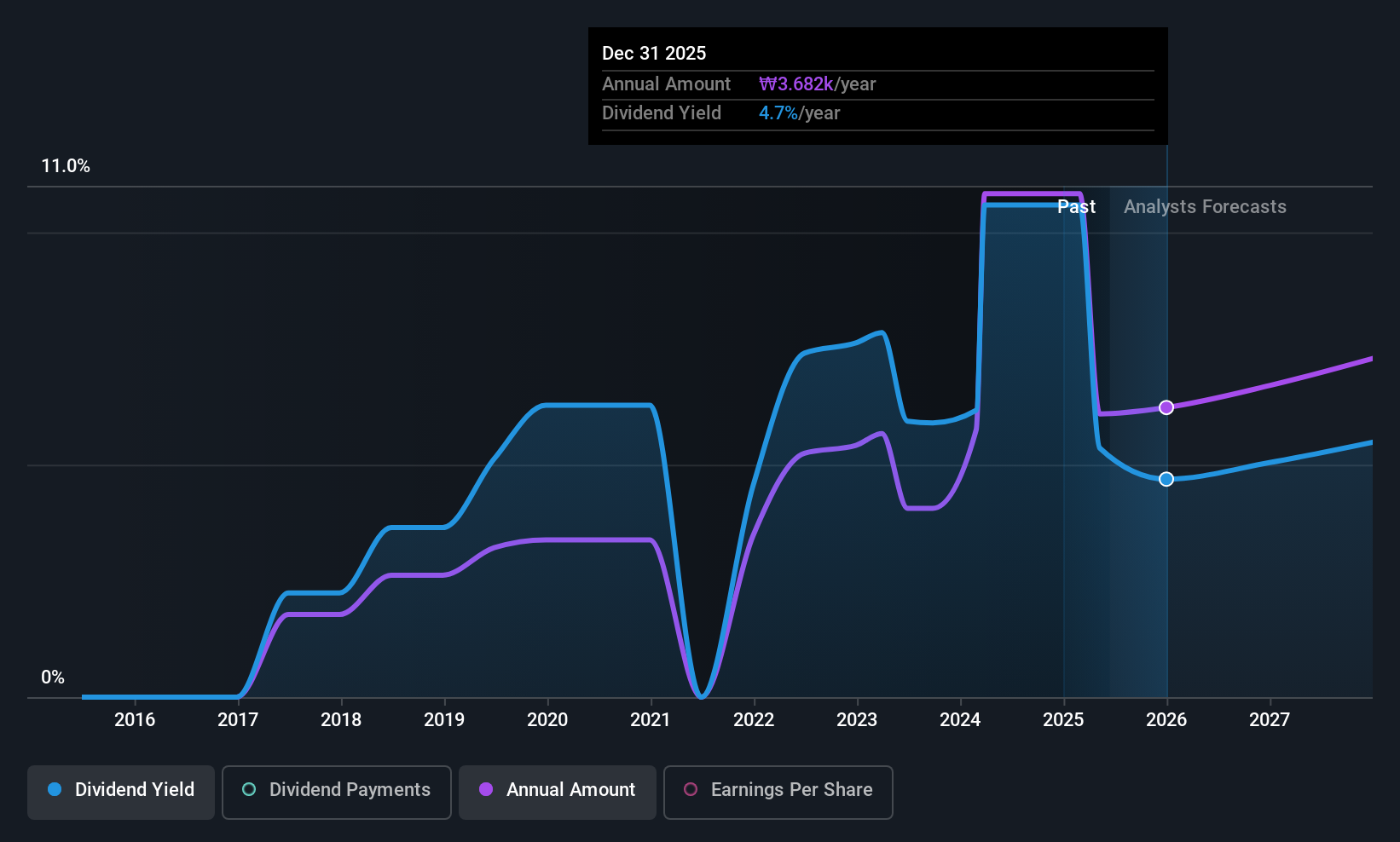

Hana Financial Group (KOSE:A086790)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hana Financial Group Inc. operates through its subsidiaries to provide financial services in South Korea, with a market cap of ₩24.62 trillion.

Operations: Hana Financial Group Inc. generates its revenue through various financial services offered by its subsidiaries in South Korea.

Dividend Yield: 3.9%

Hana Financial Group's dividend strategy is highlighted by a low payout ratio of 41.1%, indicating dividends are well covered by earnings and expected to improve to 26.3% over three years. However, its dividend history is less stable, with volatility over the past nine years despite recent growth in payments. The company recently announced a share buyback program, enhancing shareholder value alongside trading at an attractive valuation relative to peers and industry standards.

- Navigate through the intricacies of Hana Financial Group with our comprehensive dividend report here.

- Our valuation report here indicates Hana Financial Group may be undervalued.

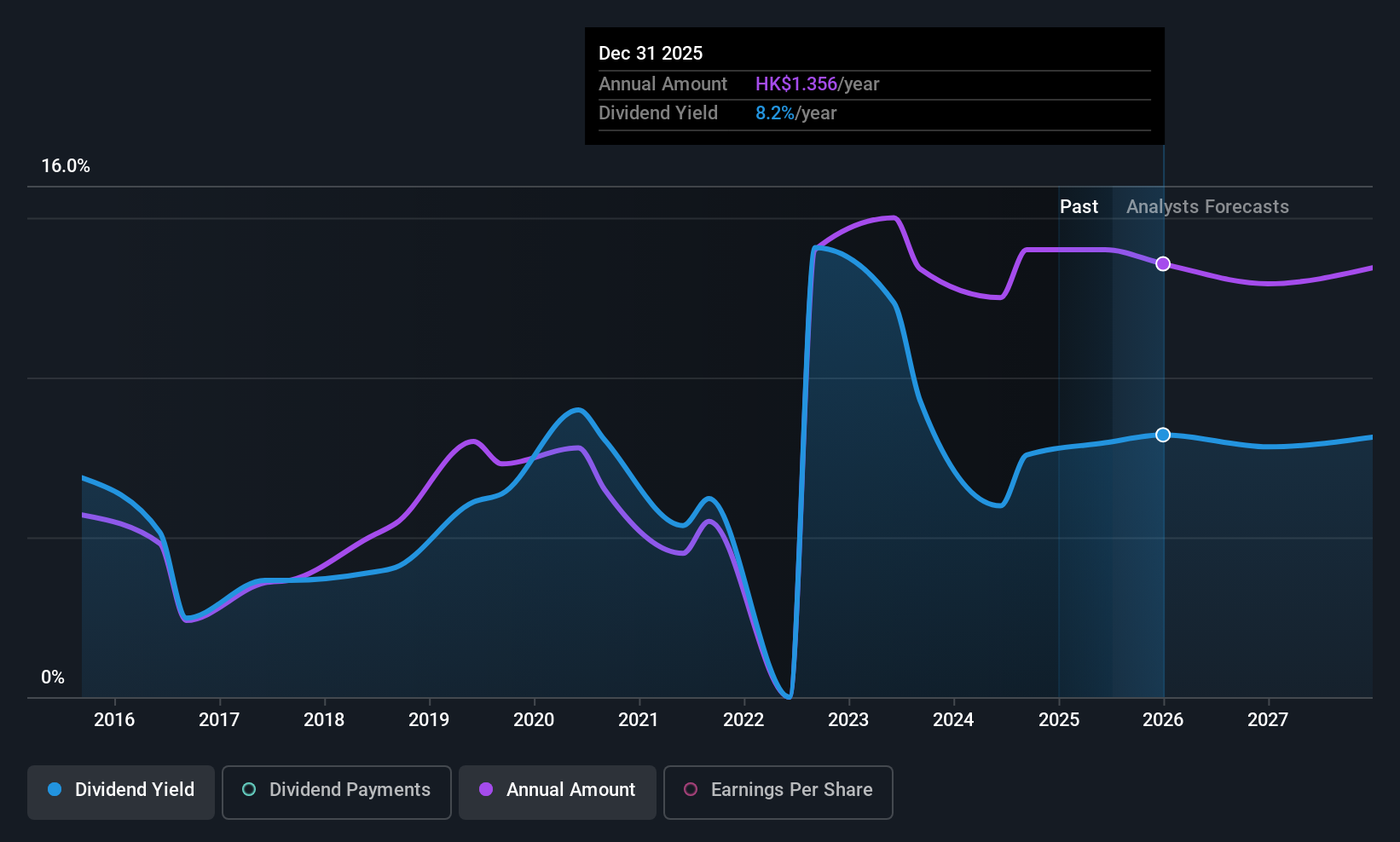

CNOOC (SEHK:883)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CNOOC Limited is an investment holding company involved in the exploration, development, production, and sale of crude oil and natural gas globally, with a market cap of HK$1.04 trillion.

Operations: CNOOC Limited generates revenue through its global operations in exploring, developing, producing, and selling crude oil and natural gas.

Dividend Yield: 6.6%

CNOOC's dividend strategy is supported by a reasonable payout ratio of 50.8%, indicating dividends are covered by earnings, though the company's dividend history has been volatile over the past decade. Recent earnings reports show a decline in net income to CNY 101.97 billion for the first nine months of 2025, compared to CNY 116.66 billion a year ago, which may impact future payouts. Despite this, CNOOC trades at good value relative to peers and industry standards.

- Delve into the full analysis dividend report here for a deeper understanding of CNOOC.

- Upon reviewing our latest valuation report, CNOOC's share price might be too pessimistic.

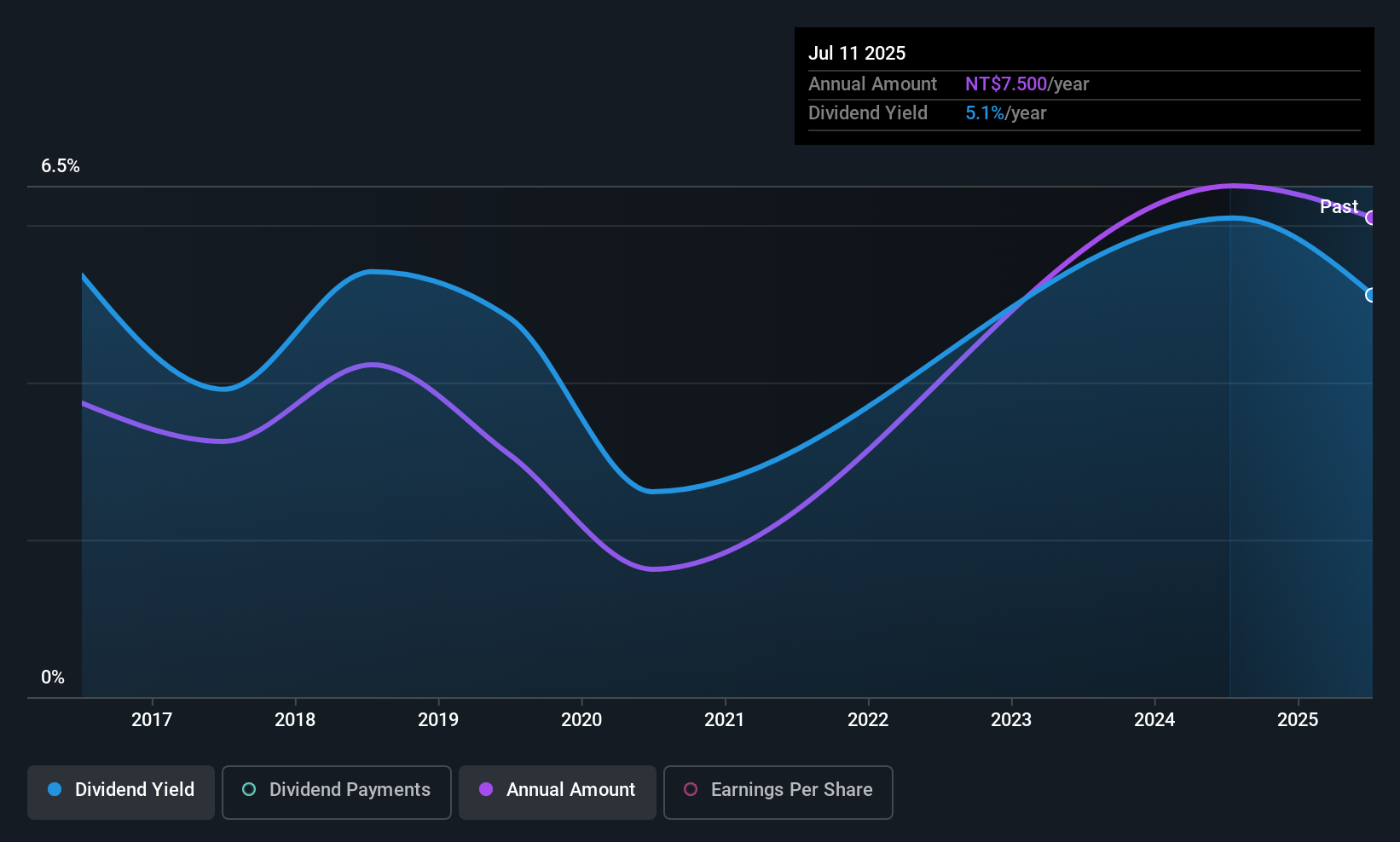

Lion Travel Service (TWSE:2731)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lion Travel Service Co., Ltd. offers travel services both in Taiwan and internationally, with a market capitalization of NT$15.76 billion.

Operations: Lion Travel Service Co., Ltd.'s revenue primarily comes from its Tour Department, which generated NT$30.44 billion.

Dividend Yield: 4.4%

Lion Travel Service's dividends have grown over the past decade, though they remain volatile with a history of unreliability. The payout ratio is reasonable at 64.2%, indicating dividends are covered by earnings, and a low cash payout ratio of 32.8% suggests strong cash flow support. However, its dividend yield of 4.44% is below top-tier levels in Taiwan's market. Recent earnings show improved net income for Q2 2025, with TWD 367.98 million compared to TWD 294.28 million last year, aiding dividend sustainability despite lower profit margins this year at 3.7%.

- Take a closer look at Lion Travel Service's potential here in our dividend report.

- The analysis detailed in our Lion Travel Service valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Unlock more gems! Our Top Asian Dividend Stocks screener has unearthed 1036 more companies for you to explore.Click here to unveil our expertly curated list of 1039 Top Asian Dividend Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2731

Lion Travel Service

Provides travel services in Taiwan and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives