- Hong Kong

- /

- Oil and Gas

- /

- SEHK:883

Shandong Weigao Group Medical Polymer And 2 Other SEHK Dividend Stocks

Reviewed by Simply Wall St

As global markets react to anticipated interest rate cuts from the Federal Reserve, the Hong Kong market remains a focal point for investors seeking stability and growth. Amid this backdrop, dividend stocks like Shandong Weigao Group Medical Polymer offer compelling opportunities for income-focused investors. In today's market conditions, a good dividend stock typically combines consistent payout history with strong fundamentals, providing both income and potential capital appreciation.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| Chow Tai Fook Jewellery Group (SEHK:1929) | 8.31% | ★★★★★☆ |

| China Construction Bank (SEHK:939) | 7.51% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 5.40% | ★★★★★☆ |

| China Electronics Huada Technology (SEHK:85) | 9.81% | ★★★★★☆ |

| S.A.S. Dragon Holdings (SEHK:1184) | 8.75% | ★★★★★☆ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 7.94% | ★★★★★☆ |

| China Resources Land (SEHK:1109) | 7.17% | ★★★★★☆ |

| Zhongsheng Group Holdings (SEHK:881) | 9.07% | ★★★★★☆ |

| PC Partner Group (SEHK:1263) | 8.81% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 7.10% | ★★★★★☆ |

Click here to see the full list of 83 stocks from our Top SEHK Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Shandong Weigao Group Medical Polymer (SEHK:1066)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shandong Weigao Group Medical Polymer Company Limited is involved in the research and development, production, wholesale, and sale of medical devices in China with a market cap of HK$18.74 billion.

Operations: Shandong Weigao Group Medical Polymer Company Limited generates revenue from Orthopaedic Products (CN¥1.27 billion), Interventional Products (CN¥1.93 billion), Medical Device Products (CN¥7.01 billion), Blood Management Products (CN¥1.04 billion), and Pharma Packaging Products (CN¥2.02 billion).

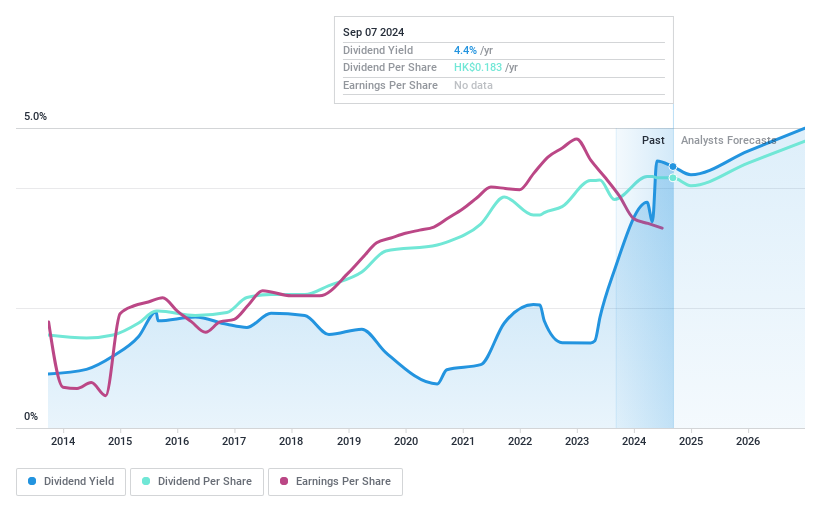

Dividend Yield: 4.4%

Shandong Weigao Group Medical Polymer has a mixed dividend history, with payments being volatile over the past decade. However, recent increases in dividends and a low payout ratio of 37.8% suggest improved stability and coverage by earnings and cash flows. The company's dividend yield is relatively low at 4.38%, but it trades at a significant discount to its estimated fair value. Recent board changes may also impact future performance and governance positively.

- Unlock comprehensive insights into our analysis of Shandong Weigao Group Medical Polymer stock in this dividend report.

- In light of our recent valuation report, it seems possible that Shandong Weigao Group Medical Polymer is trading behind its estimated value.

PetroChina (SEHK:857)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PetroChina Company Limited, with a market cap of HK$1.75 trillion, engages in various petroleum-related products, services, and activities both in Mainland China and internationally.

Operations: PetroChina Company Limited generates revenue from exploration and production (CN¥1.05 trillion), refining and chemicals (CN¥1.15 trillion), marketing (CN¥2.22 trillion), and natural gas and pipeline operations (CN¥0.65 trillion).

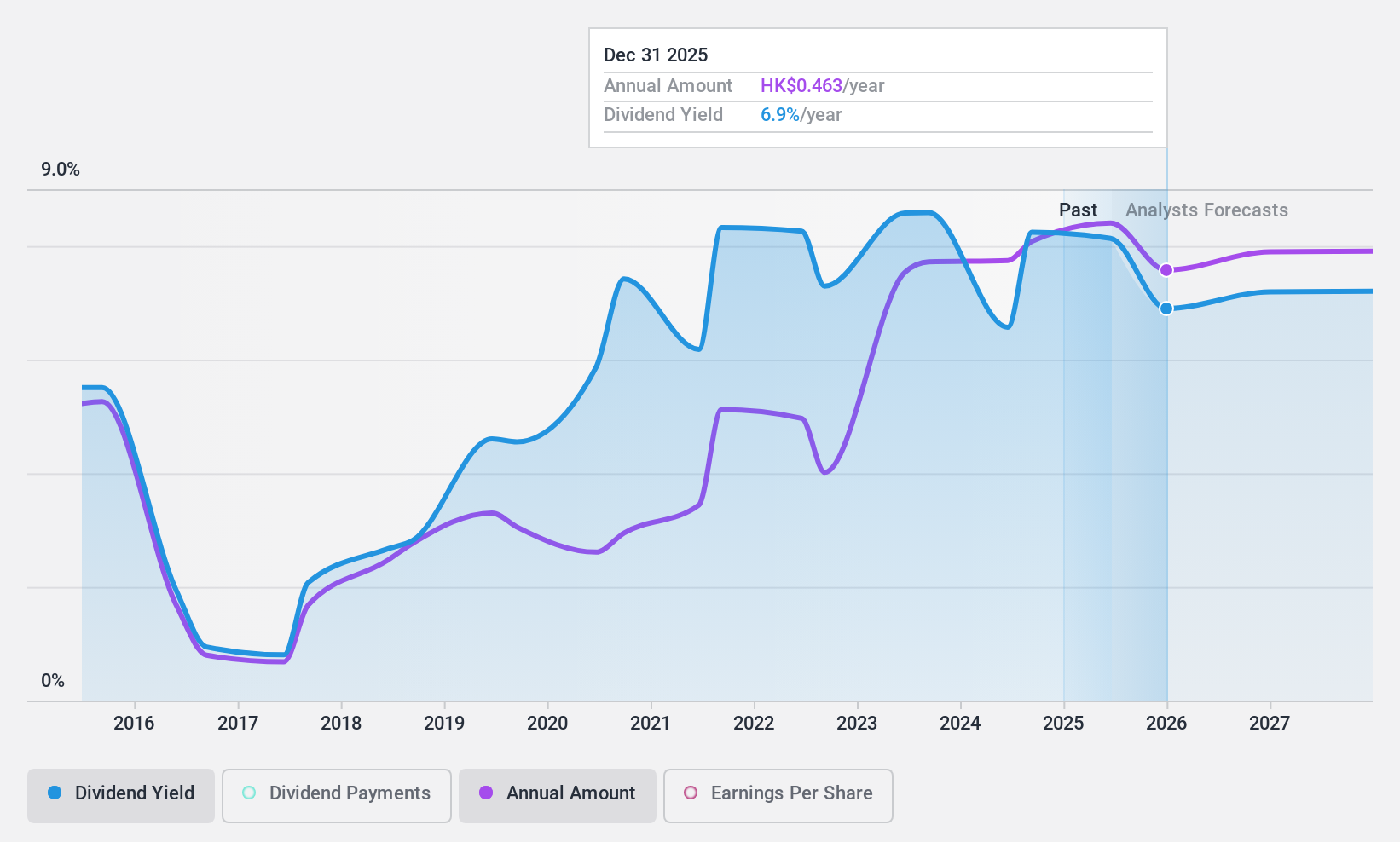

Dividend Yield: 6.7%

PetroChina's dividend payments have been volatile over the past decade, though recent increases indicate some improvement. The company's dividends are well covered by both earnings (payout ratio: 50.1%) and cash flows (cash payout ratio: 48.2%). Despite a lower dividend yield of 6.75% compared to top-tier payers, it remains attractive due to its significant undervaluation, trading at 50.9% below estimated fair value. Recent earnings growth and board changes could further influence its performance and governance positively.

- Navigate through the intricacies of PetroChina with our comprehensive dividend report here.

- The analysis detailed in our PetroChina valuation report hints at an deflated share price compared to its estimated value.

CNOOC (SEHK:883)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CNOOC Limited is an investment holding company involved in the exploration, development, production, and sale of crude oil and natural gas in China, Canada, and internationally with a market cap of HK$1.02 trillion.

Operations: CNOOC Limited generates revenue primarily from the exploration, development, production, and sale of crude oil and natural gas across China, Canada, and other international markets.

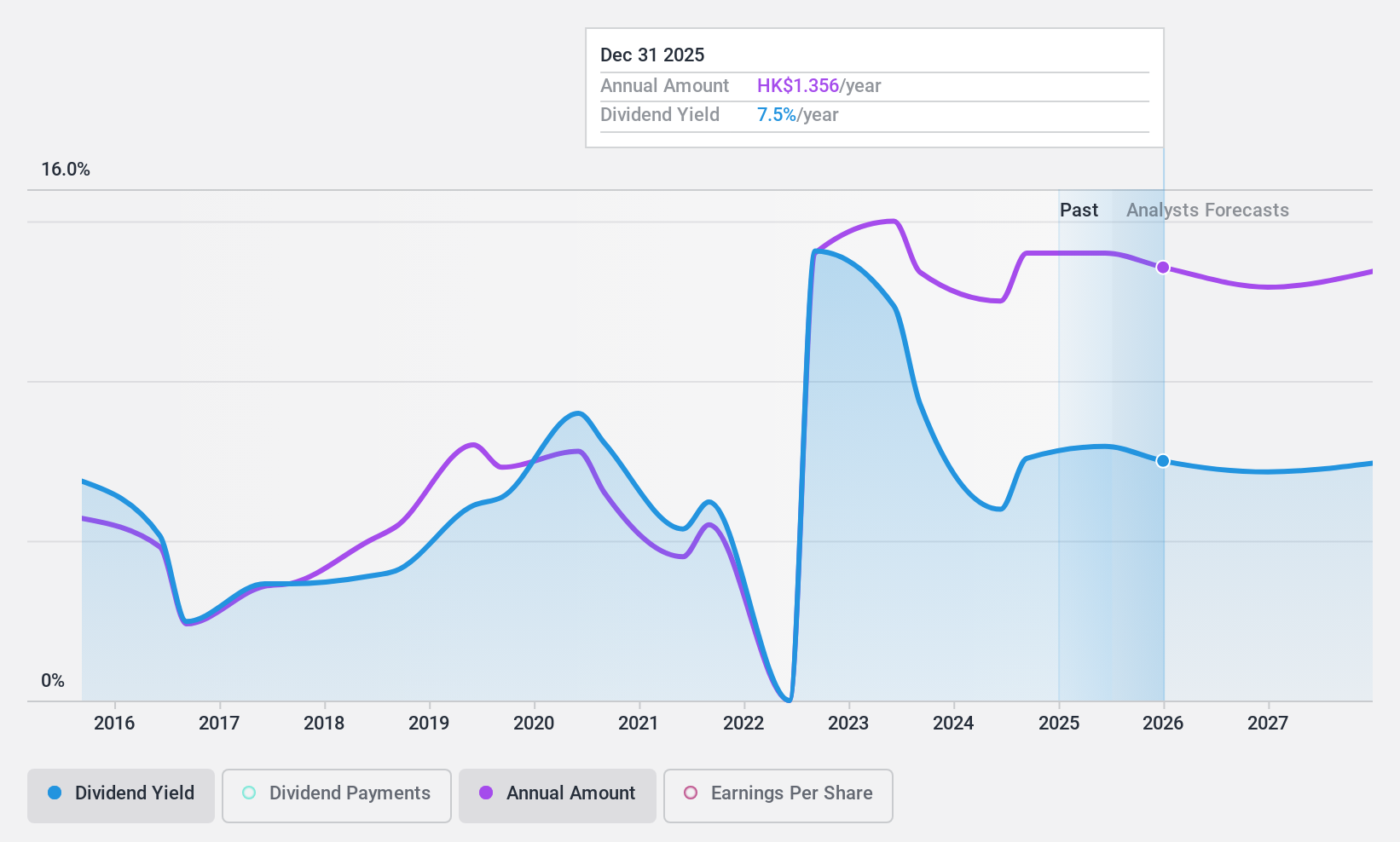

Dividend Yield: 5.8%

CNOOC's dividend payments have been volatile over the past decade, though they are well covered by earnings (payout ratio: 41.1%) and cash flows (cash payout ratio: 58.7%). The stock trades at a significant discount, approximately 29.6% below estimated fair value. Recent share repurchase plans could enhance net asset value per share and earnings per share. However, the dividend yield of 5.85% is lower than top-tier payers in Hong Kong's market.

- Take a closer look at CNOOC's potential here in our dividend report.

- Upon reviewing our latest valuation report, CNOOC's share price might be too pessimistic.

Summing It All Up

- Click through to start exploring the rest of the 80 Top SEHK Dividend Stocks now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:883

CNOOC

An investment holding company, engages in the exploration, development, production, and sale of crude oil and natural gas in the People’s Republic of China, Canada, and internationally.

Flawless balance sheet, undervalued and pays a dividend.