- Hong Kong

- /

- Oil and Gas

- /

- SEHK:883

CNOOC (SEHK:883): Revisiting Valuation as Investor Interest Rises Without Major News

Reviewed by Simply Wall St

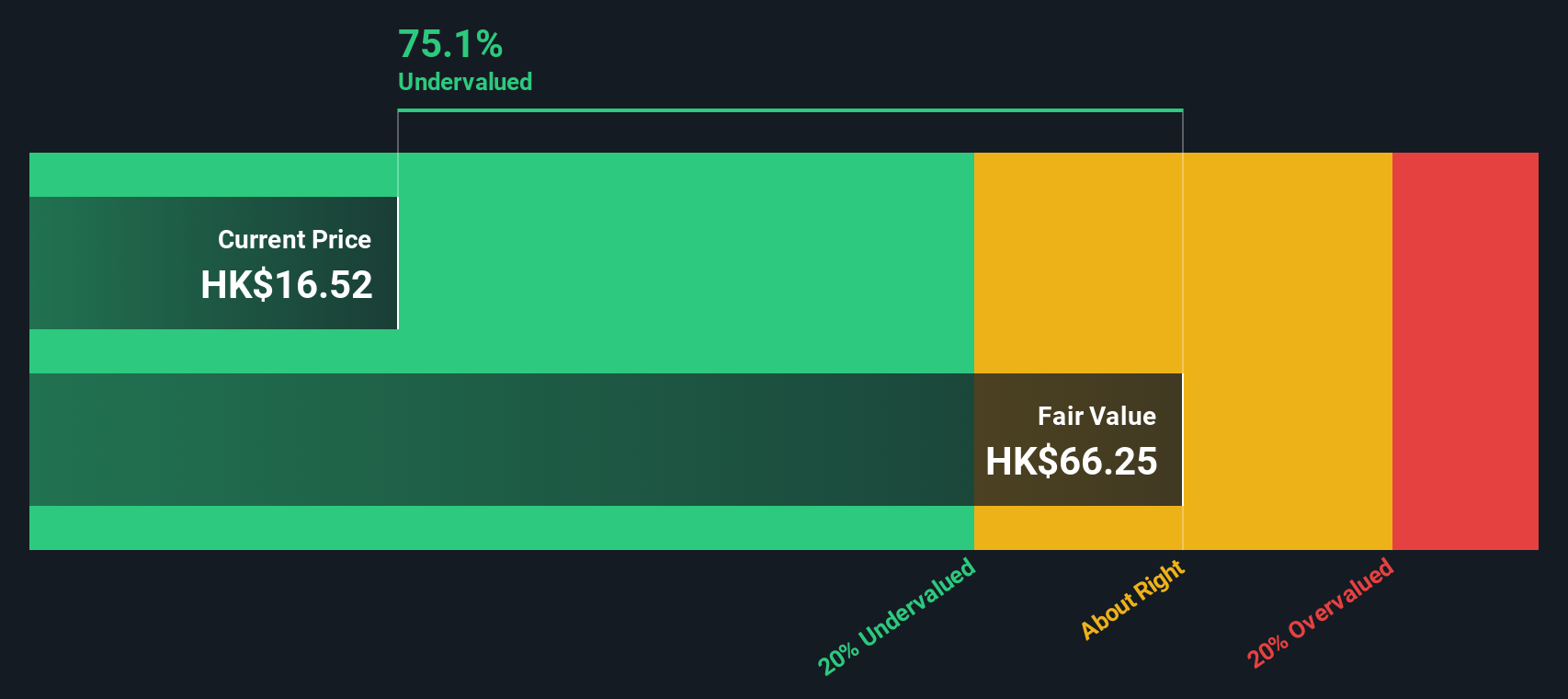

CNOOC (SEHK:883) has once again sparked investor conversations, even without a clear triggering event this week. Sometimes, a move in the stock can be enough to make investors take a closer look and wonder if there is an underlying signal at play. When there is no major news or headline, those watching the energy sector tend to focus back on the basics: how is the company actually performing, and is the market fairly valuing those fundamentals?

Looking at CNOOC’s journey over the last year, there has been consistent upward momentum. Shares have delivered a 13% return over the past year and more than doubled over the past 3 years, outpacing much of the energy sector. Despite the lack of any recent major announcements, the stock’s steady climb seems to reflect renewed confidence among investors, possibly hinting at optimism around the company’s long-term earnings outlook.

After this extended run, is CNOOC trading at an attractive entry point for new investors, or is the market already factoring in all the potential future growth?

Most Popular Narrative: 6.5% Undervalued

The most widely followed narrative considers CNOOC shares to be undervalued by 6.5%, with current analysis pointing to untapped potential in the company’s fundamentals and structural market drivers when compared to the present share price.

The company's unwavering focus on low-cost operations, evidenced by all-in costs dropping below USD 27/boe and consistent application of efficiency and lean management programs, enhances net margins and protects earnings through commodity price cycles.

Ready to find out what is powering this undervalued verdict? There is a core financial assumption behind CNOOC’s fair value, hinting at rising margins and an earnings leap backed by a surprisingly disciplined outlook. Wondering what future profit figures and analyst expectations are built into this valuation? Explore the data to see which forward-looking numbers could explain why this stock’s value might just catch the market by surprise.

Result: Fair Value of $21.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising global competition in natural gas and CNOOC’s heavy focus on traditional oil could challenge the upbeat outlook and dampen future earnings momentum.

Find out about the key risks to this CNOOC narrative.Another View: SWS DCF Model Offers a Different Perspective

While the most popular narrative sees value based on market expectations and earnings forecasts, our DCF model looks at CNOOC from a pure cash flow perspective and also suggests the stock is undervalued. However, does the future unfold as precisely as presented in cash flow models?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own CNOOC Narrative

If you see things differently or want to crunch the numbers on your own, you can craft your own CNOOC story in just minutes. Do it your way.

A great starting point for your CNOOC research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

You’re missing out if you stop here. Use the tools savvy investors trust to target stocks that fit your strategy and build real momentum in your portfolio.

- Tap into potential price dislocations by tracking undervalued gems with strong cash flow using our undervalued stocks based on cash flows.

- Get ahead of market shifts by finding healthcare innovators at the intersection of artificial intelligence and medical breakthroughs with our healthcare AI stocks.

- Set your sights on future disruptors in digital finance as you browse opportunities among cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About SEHK:883

CNOOC

An investment holding company, engages in the exploration, development, production, and sale of crude oil and natural gas in worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives