- Hong Kong

- /

- Oil and Gas

- /

- SEHK:857

PetroChina (SEHK:857) Margin Improvement Reinforces Community Debate Around Weak Growth Outlook

Reviewed by Simply Wall St

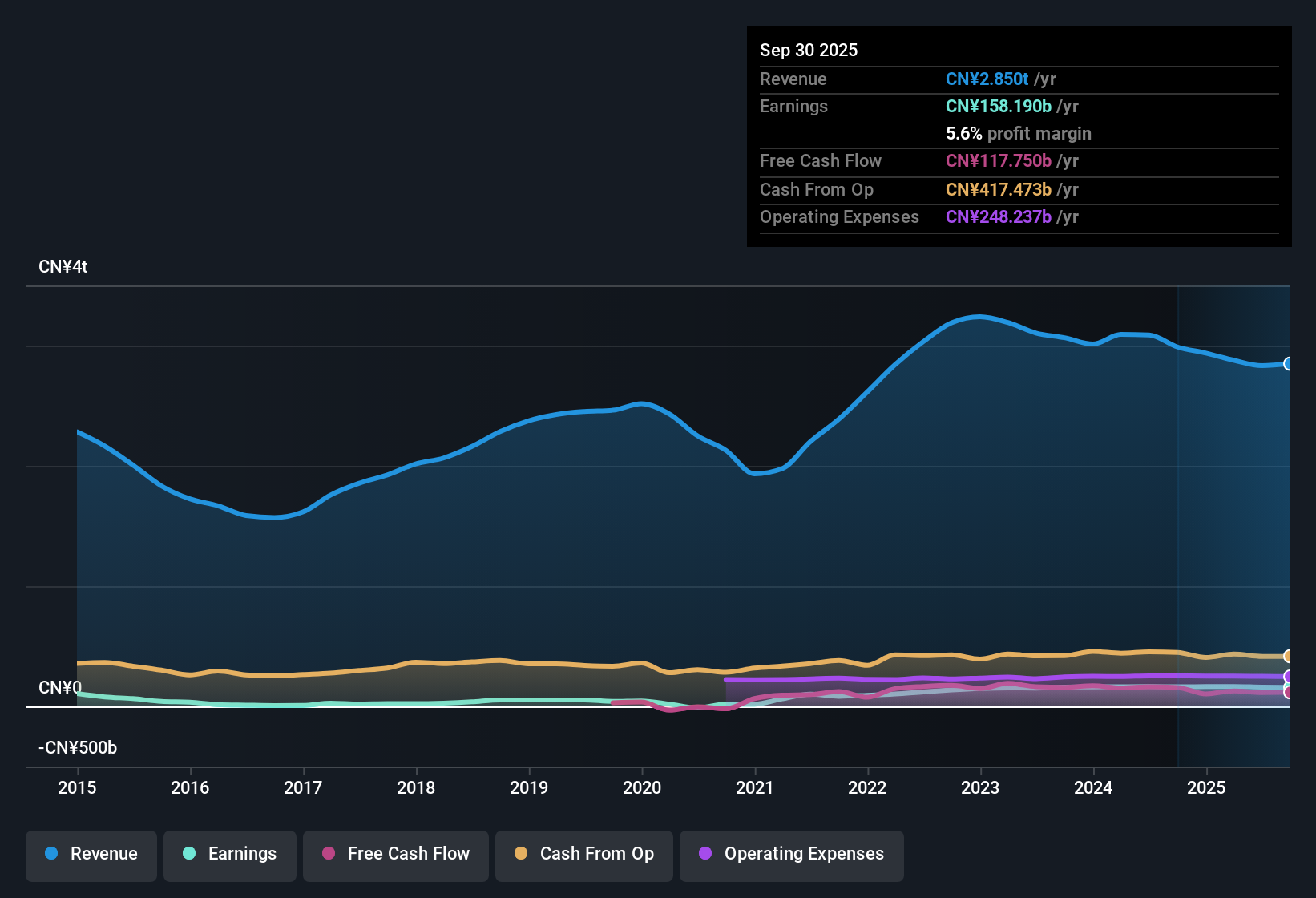

PetroChina (SEHK:857) reported net profit margins of 5.6%, slightly ahead of last year’s 5.4%. This came even as annual earnings for the most recent period declined, following a 21.2% compound growth rate over the past five years. The company’s shares are currently trading at HK$8.02, well below an estimated fair value of HK$34.57. Its price-to-earnings ratio of 8.5x compares favorably to both peer and industry averages. While the company has demonstrated high-quality past earnings, the forecast indicates moderate contractions in both earnings and revenue over the next three years, creating a conflicted outlook for investors to consider.

See our full analysis for PetroChina.Next, we will compare these headline results with prevailing market narratives to assess which stories are supported and which may be challenged.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Edge Up Despite Declining Top Line

- Net profit margins rose to 5.6%, slightly higher than last year’s 5.4%, even as annual earnings growth turned negative following a five-year run at 21.2% growth per year.

- Prevailing market view notes that margin strength may help offset the forecast for shrinking earnings and revenue over the next three years.

- Margins remaining stable, despite the expected 0.7% annual drop in earnings and 0.2% decrease in revenue, supports arguments that underlying profitability is more resilient than headline growth rates suggest.

- This creates a nuanced outlook. While contraction is expected, the company’s strategic position as a large, integrated energy player could help it defend cash flows even in a slower growth environment.

Valuation Remains Attractive Versus Sector

- PetroChina’s price-to-earnings ratio is only 8.5x, sitting well below the peer average of 10.2x and Hong Kong sector’s 9.1x, while its HK$8.02 share price trades at a steep discount to its DCF fair value of HK$34.57.

- In the prevailing market view, the low valuation is seen as a buffer against growth risks but could reflect investor hesitation over the lack of earnings momentum.

- The sharp gap between share price and DCF fair value invites speculation about mean reversion. Yet, the forecast for declining profits tempers the case for a sustained rally.

- Peers trading at premium multiples signal that the wider market may reward income stability even as top-line growth stalls.

Past Growth Outpaces Forward Outlook

- Over the past five years, earnings compound growth was a robust 21.2% per year, but coming years are projected to reverse course, with revenue and earnings both set to contract. Earnings are expected to decline by 0.7% and revenue by 0.2% annually.

- The prevailing market view highlights that while past performance has been impressive, forward-looking estimates suggest a critical inflection point for investors.

- This contrast between strong historical growth and weak projected figures underscores a key debate: whether PetroChina can pivot to new opportunities or must manage through a mature phase with muted upside.

- Market confidence may rest on management’s ability to sustain dividend payments amid a less favorable growth profile.

For a deeper dive into how these trends play out in community discussions and market perspectives, check out the full Consensus Narrative for PetroChina below. 📊 Read the full PetroChina Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on PetroChina's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While PetroChina’s history of robust growth is giving way to a forecast of contracting earnings and revenue in the years ahead, future upside is uncertain.

If you want to target steady long-term performers instead, focus your search on stable growth stocks screener (2094 results) to zero in on companies delivering consistent growth through various market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:857

PetroChina

Engages in a range of petroleum related products, services, and activities in Mainland China and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives