- Hong Kong

- /

- Oil and Gas

- /

- SEHK:857

PetroChina (SEHK:857): Evaluating Valuation After 17% Share Price Climb This Month

Reviewed by Simply Wall St

See our latest analysis for PetroChina.

PetroChina’s momentum has really picked up in 2024, with a 30-day share price return of 17.4% helping push its year-to-date gain to an impressive 49.8%. Looking longer term, the company’s total shareholder return stretches to nearly 71% over the past year and an astonishing 413% over five years. This signals both compounding growth and strong market conviction around its prospects.

If PetroChina’s rally got your attention, now is a smart moment to broaden your search and discover fast growing stocks with high insider ownership

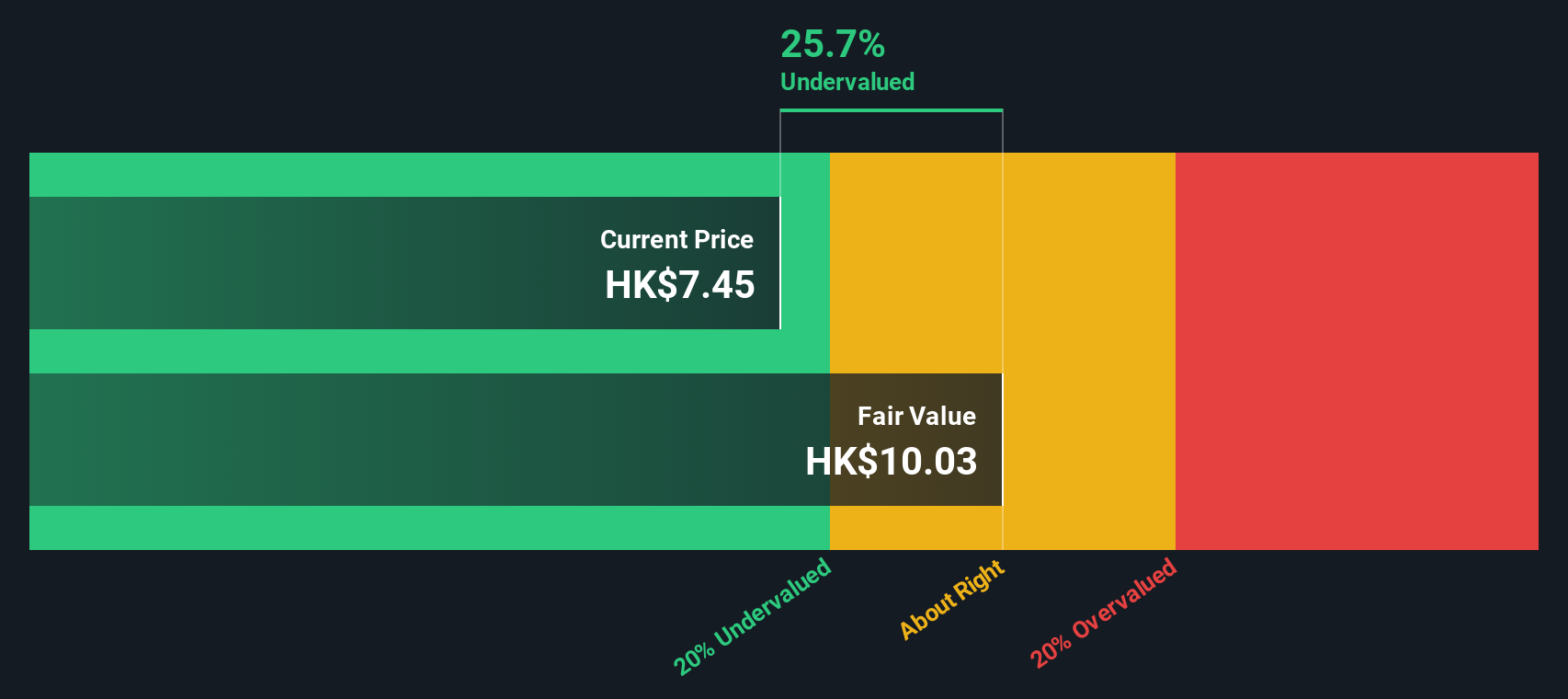

With such strong returns, the big question for investors is whether PetroChina remains undervalued or if recent gains mean the market has already priced in all of its future growth. Could this still be a buying opportunity?

Price-to-Earnings of 9.5x: Is it justified?

PetroChina is trading at a price-to-earnings (P/E) ratio of 9.5x, which suggests the stock may be undervalued relative to peers and industry benchmarks, especially given its robust share price performance.

The price-to-earnings ratio measures how much investors are willing to pay for one dollar of earnings. For a large, established energy company like PetroChina, this metric can reveal how the market views its future earnings potential in the context of sector trends and company performance.

At 9.5x, PetroChina’s P/E is not only below the Hong Kong Oil and Gas industry average of 9.9x but also beneath the peer group average of 10.8x. Compared to the estimated fair P/E ratio of 12.8x, the difference is striking. The current multiple leaves room for re-rating if market sentiment or earnings forecasts improve. This gap shows investors are pricing in some caution, but the valuation could shift if fundamentals trend positively toward the higher fair ratio.

Explore the SWS fair ratio for PetroChina

Result: Price-to-Earnings of 9.5x (UNDERVALUED)

However, revenue and net income have both slightly declined this year. This could signal underlying headwinds if these trends persist.

Find out about the key risks to this PetroChina narrative.

Another View: What Does the SWS DCF Model Suggest?

Of course, using a different lens can yield a different outcome. According to our DCF model, PetroChina’s share price (HK$9.03) is trading around 23% below its intrinsic value (HK$11.75). This approach looks beyond earnings multiples by focusing on cash flows and future growth. If the DCF signals undervaluation as well, is the upside case stronger than it seems?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out PetroChina for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 897 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own PetroChina Narrative

If you have a different perspective or want to dive deeper into the numbers yourself, it only takes a few minutes to construct your own view and see how it compares, so why not Do it your way

A great starting point for your PetroChina research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for one opportunity. Maximize your advantage by tapping into fresh possibilities across the market that others might be missing right now.

- Capture growth before the mainstream jumps in by checking out these 3579 penny stocks with strong financials with strong financials and untapped upward potential.

- Unlock reliable income and portfolio stability through these 15 dividend stocks with yields > 3% currently offering yields above 3%.

- Ride the future of healthcare technology by targeting these 30 healthcare AI stocks transforming diagnostics, patient care, and medical innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:857

PetroChina

Engages in a range of petroleum related products, services, and activities in Mainland China and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives