- Hong Kong

- /

- Oil and Gas

- /

- SEHK:689

Revenues Tell The Story For EPI (Holdings) Limited (HKG:689) As Its Stock Soars 28%

Those holding EPI (Holdings) Limited (HKG:689) shares would be relieved that the share price has rebounded 28% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 44% over that time.

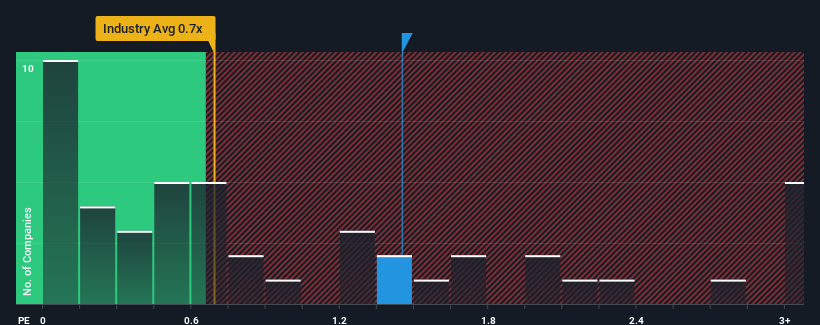

Following the firm bounce in price, given close to half the companies operating in Hong Kong's Oil and Gas industry have price-to-sales ratios (or "P/S") below 0.7x, you may consider EPI (Holdings) as a stock to potentially avoid with its 1.5x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for EPI (Holdings)

What Does EPI (Holdings)'s P/S Mean For Shareholders?

EPI (Holdings) certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for EPI (Holdings), take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is EPI (Holdings)'s Revenue Growth Trending?

In order to justify its P/S ratio, EPI (Holdings) would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 84% last year. The strong recent performance means it was also able to grow revenue by 96% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

This is in contrast to the rest of the industry, which is expected to grow by 1.8% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this in consideration, it's not hard to understand why EPI (Holdings)'s P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What Does EPI (Holdings)'s P/S Mean For Investors?

EPI (Holdings)'s P/S is on the rise since its shares have risen strongly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that EPI (Holdings) maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 3 warning signs for EPI (Holdings) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if EPI (Holdings) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:689

EPI (Holdings)

An investment holding company, primarily engages in the exploration and production of petroleum in Canada and Hong Kong.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives