Stock Analysis

- Hong Kong

- /

- Oil and Gas

- /

- SEHK:681

Discover December 2024's Top Penny Stocks

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by political developments and economic data, major stock indexes have shown mixed results. Amidst this backdrop, the concept of penny stocks remains intriguing for many investors. Although often seen as a relic from past market eras, penny stocks—typically smaller or newer companies—continue to offer potential growth opportunities when backed by strong financials. This article explores several noteworthy penny stocks that combine affordability with robust fundamentals, presenting an underappreciated chance for growth in today's market conditions.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.78 | A$143.12M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.43 | MYR1.2B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.885 | MYR293.77M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.155 | £811.93M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.92 | HK$43.17B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.555 | A$65.06M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £1.04 | £164.05M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$539.57M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.60 | £68.66M | ★★★★☆☆ |

Click here to see the full list of 5,705 stocks from our Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Chinese People Holdings (SEHK:681)

Simply Wall St Financial Health Rating: ★★★★★★

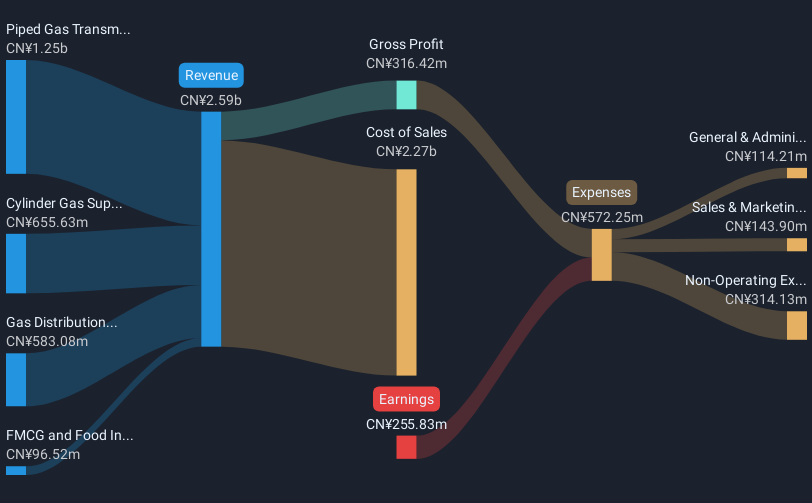

Overview: Chinese People Holdings Company Limited is an investment holding company involved in piped gas transmission and distribution, cylinder gas supply, gas distribution, and FMCG and food ingredients supply in China, with a market cap of HK$232.30 million.

Operations: The company's revenue is primarily derived from piped gas transmission and distribution (CN¥1.25 billion), cylinder gas supply (CN¥655.63 million), gas distribution (CN¥583.08 million), and FMCG and food ingredients supply (CN¥96.52 million).

Market Cap: HK$232.3M

Chinese People Holdings Company Limited, with a market cap of HK$232.30 million, primarily generates revenue from piped gas transmission and distribution (CN¥1.25 billion), cylinder gas supply (CN¥655.63 million), and gas distribution (CN¥583.08 million). Despite being unprofitable with a negative return on equity (-8.69%), the company has more cash than debt, and its operating cash flow covers debt well at 240.7%. Short-term assets exceed both short-term and long-term liabilities significantly, indicating financial stability in covering obligations despite increased losses over the past five years at 53% annually. The board's average tenure is experienced at 10.7 years, although management tenure data is insufficient for assessment.

- Get an in-depth perspective on Chinese People Holdings' performance by reading our balance sheet health report here.

- Examine Chinese People Holdings' past performance report to understand how it has performed in prior years.

Uni-Bio Science Group (SEHK:690)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Uni-Bio Science Group Limited is an investment holding company that focuses on the research, development, manufacturing, and sale of biological and chemical pharmaceutical products for treating human diseases in the People’s Republic of China, with a market cap of HK$394.10 million.

Operations: The company's revenue is derived from two main segments: Chemical Pharmaceutical Products, contributing HK$270.73 million, and Biological Pharmaceutical Products, generating HK$237.67 million.

Market Cap: HK$394.1M

Uni-Bio Science Group Limited, with a market cap of HK$394.10 million, demonstrates financial stability and growth potential in the biotech sector. The company has become profitable over the past five years, with earnings increasing by 62.6% annually and recent earnings growth of 56.2% surpassing industry averages. Its short-term assets exceed both long-term liabilities and short-term liabilities significantly, indicating strong financial health. Recent product approvals in medical aesthetics highlight its innovation and strategic expansion into dermatology solutions, positioning it to capitalize on growing market opportunities while maintaining a high return on equity at 31.6%.

- Click to explore a detailed breakdown of our findings in Uni-Bio Science Group's financial health report.

- Explore historical data to track Uni-Bio Science Group's performance over time in our past results report.

Country Group Development (SET:CGD)

Simply Wall St Financial Health Rating: ★★★★★☆

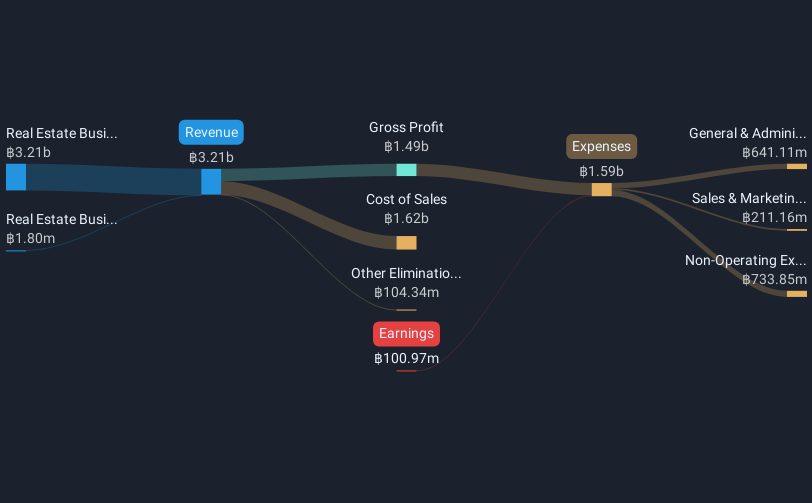

Overview: Country Group Development Public Company Limited operates in the real estate development sector both in Thailand and internationally, with a market capitalization of approximately THB2.73 billion.

Operations: The company generates revenue through its real estate business, with THB1.80 billion from investment property abroad and THB3.21 billion from domestic real estate development.

Market Cap: THB2.73B

Country Group Development, with a market cap of THB2.73 billion, operates in the real estate sector but is currently unprofitable. Its revenue has declined to THB651.83 million for the recent quarter from THB1,088.1 million a year ago, resulting in a net loss of THB27.51 million compared to previous net income. Despite this, the company maintains financial resilience with more cash than debt and sufficient cash runway for over three years due to positive free cash flow growth at 18% annually. The experienced board and management team contribute stability amid challenges in covering short-term liabilities with assets valued at THB6.7 billion against liabilities of THB9.6 billion.

- Dive into the specifics of Country Group Development here with our thorough balance sheet health report.

- Evaluate Country Group Development's historical performance by accessing our past performance report.

Summing It All Up

- Investigate our full lineup of 5,705 Penny Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:681

Chinese People Holdings

An investment holding company, engages in the piped gas transmission and distribution, cylinder gas supply, gas distribution, and FMCG and food ingredients supply businesses in the People’s Republic of China.