- Hong Kong

- /

- Oil and Gas

- /

- SEHK:65

Take Care Before Jumping Onto Grand Ocean Advanced Resources Company Limited (HKG:65) Even Though It's 31% Cheaper

Grand Ocean Advanced Resources Company Limited (HKG:65) shareholders won't be pleased to see that the share price has had a very rough month, dropping 31% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 44% in that time.

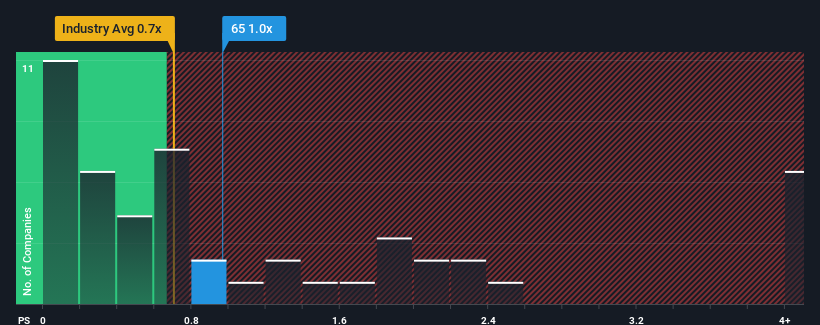

Even after such a large drop in price, there still wouldn't be many who think Grand Ocean Advanced Resources' price-to-sales (or "P/S") ratio of 1x is worth a mention when the median P/S in Hong Kong's Oil and Gas industry is similar at about 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Grand Ocean Advanced Resources

What Does Grand Ocean Advanced Resources' P/S Mean For Shareholders?

The revenue growth achieved at Grand Ocean Advanced Resources over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Although there are no analyst estimates available for Grand Ocean Advanced Resources, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Grand Ocean Advanced Resources' Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Grand Ocean Advanced Resources' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 16% gain to the company's top line. As a result, it also grew revenue by 26% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 0.5% shows it's noticeably more attractive.

With this information, we find it interesting that Grand Ocean Advanced Resources is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Key Takeaway

Grand Ocean Advanced Resources' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We didn't quite envision Grand Ocean Advanced Resources' P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Having said that, be aware Grand Ocean Advanced Resources is showing 2 warning signs in our investment analysis, you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:65

Grand Ocean Advanced Resources

An investment holding company, produces and sells coal and minerals in Hong Kong and the People’s Republic of China.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives