- Hong Kong

- /

- Oil and Gas

- /

- SEHK:65

Revenues Tell The Story For Grand Ocean Advanced Resources Company Limited (HKG:65) As Its Stock Soars 30%

Grand Ocean Advanced Resources Company Limited (HKG:65) shares have continued their recent momentum with a 30% gain in the last month alone. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 28% over that time.

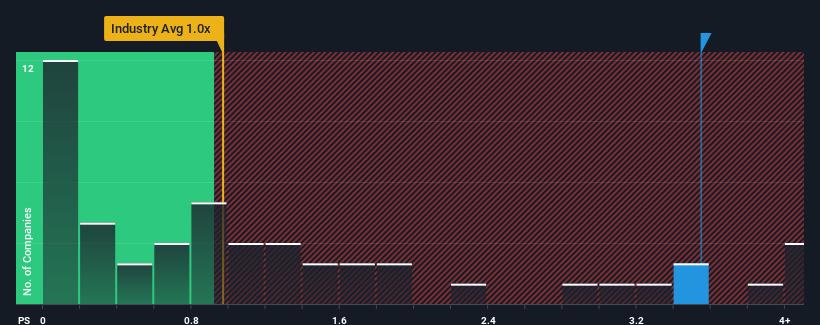

After such a large jump in price, when almost half of the companies in Hong Kong's Oil and Gas industry have price-to-sales ratios (or "P/S") below 1x, you may consider Grand Ocean Advanced Resources as a stock not worth researching with its 3.5x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Grand Ocean Advanced Resources

What Does Grand Ocean Advanced Resources' Recent Performance Look Like?

For instance, Grand Ocean Advanced Resources' receding revenue in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Grand Ocean Advanced Resources' earnings, revenue and cash flow.How Is Grand Ocean Advanced Resources' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Grand Ocean Advanced Resources' is when the company's growth is on track to outshine the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 23%. Still, the latest three year period has seen an excellent 37% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 0.3% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we can see why Grand Ocean Advanced Resources is trading at such a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Final Word

Shares in Grand Ocean Advanced Resources have seen a strong upwards swing lately, which has really helped boost its P/S figure. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Grand Ocean Advanced Resources maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Grand Ocean Advanced Resources (1 is concerning!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Grand Ocean Advanced Resources, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:65

Grand Ocean Advanced Resources

An investment holding company, produces and sells coal and minerals in Hong Kong and the People’s Republic of China.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives