- Hong Kong

- /

- Capital Markets

- /

- SEHK:806

Asian Penny Stocks To Watch In November 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by mixed performances and significant geopolitical developments, the Asian market is drawing attention with its unique set of opportunities and challenges. Amid this backdrop, penny stocks—often smaller or younger companies—continue to intrigue investors with their potential for value and growth. Despite the term's somewhat outdated nature, these stocks can still offer promising prospects when backed by strong financials, making them worth watching for those seeking under-the-radar investment opportunities in Asia.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.88 | HK$2.34B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.56 | HK$964.89M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.52 | HK$2.09B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.08 | SGD437.71M | ✅ 4 ⚠️ 2 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.72 | THB2.83B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.103 | SGD53.92M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.46 | SGD13.62B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$1.05 | HK$2.82B | ✅ 4 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.07 | NZ$152.31M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.46 | THB9.01B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 951 stocks from our Asian Penny Stocks screener.

Let's uncover some gems from our specialized screener.

United Energy Group (SEHK:467)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: United Energy Group Limited is an investment holding company involved in upstream oil, natural gas, clean energy, and energy trading operations across Pakistan, South Asia, the Middle East, and North Africa with a market cap of HK$13.18 billion.

Operations: The company's revenue is derived from its trading operations, which generated HK$7.99 billion, and its exploration and production activities, contributing HK$9.13 billion.

Market Cap: HK$13.18B

United Energy Group, with a market cap of HK$13.18 billion, has shown significant production growth, increasing its average daily gross production by 9.4% recently. Despite this operational success and becoming profitable in the past year, the company faces challenges such as a new management team with limited experience and short-term liabilities exceeding short-term assets by HK$1.4 billion. While trading significantly below estimated fair value and having reduced debt levels over time, its dividend yield of 17.65% is unsustainable given current earnings coverage constraints and recent insider selling may raise concerns for potential investors.

- Take a closer look at United Energy Group's potential here in our financial health report.

- Gain insights into United Energy Group's outlook and expected performance with our report on the company's earnings estimates.

Value Partners Group (SEHK:806)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Value Partners Group Limited is a publicly owned investment manager with a market cap of HK$4.80 billion.

Operations: The company generates revenue primarily from its Asset Management Business, amounting to HK$528.88 million.

Market Cap: HK$4.8B

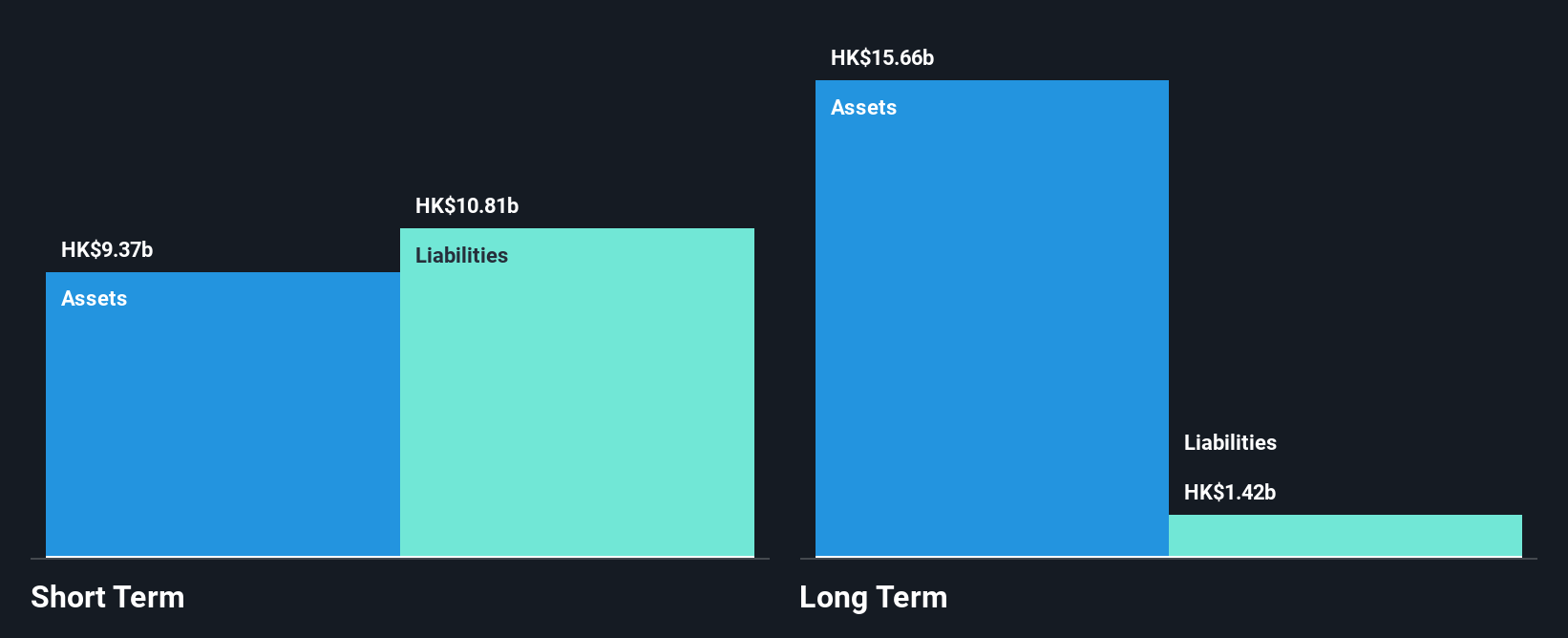

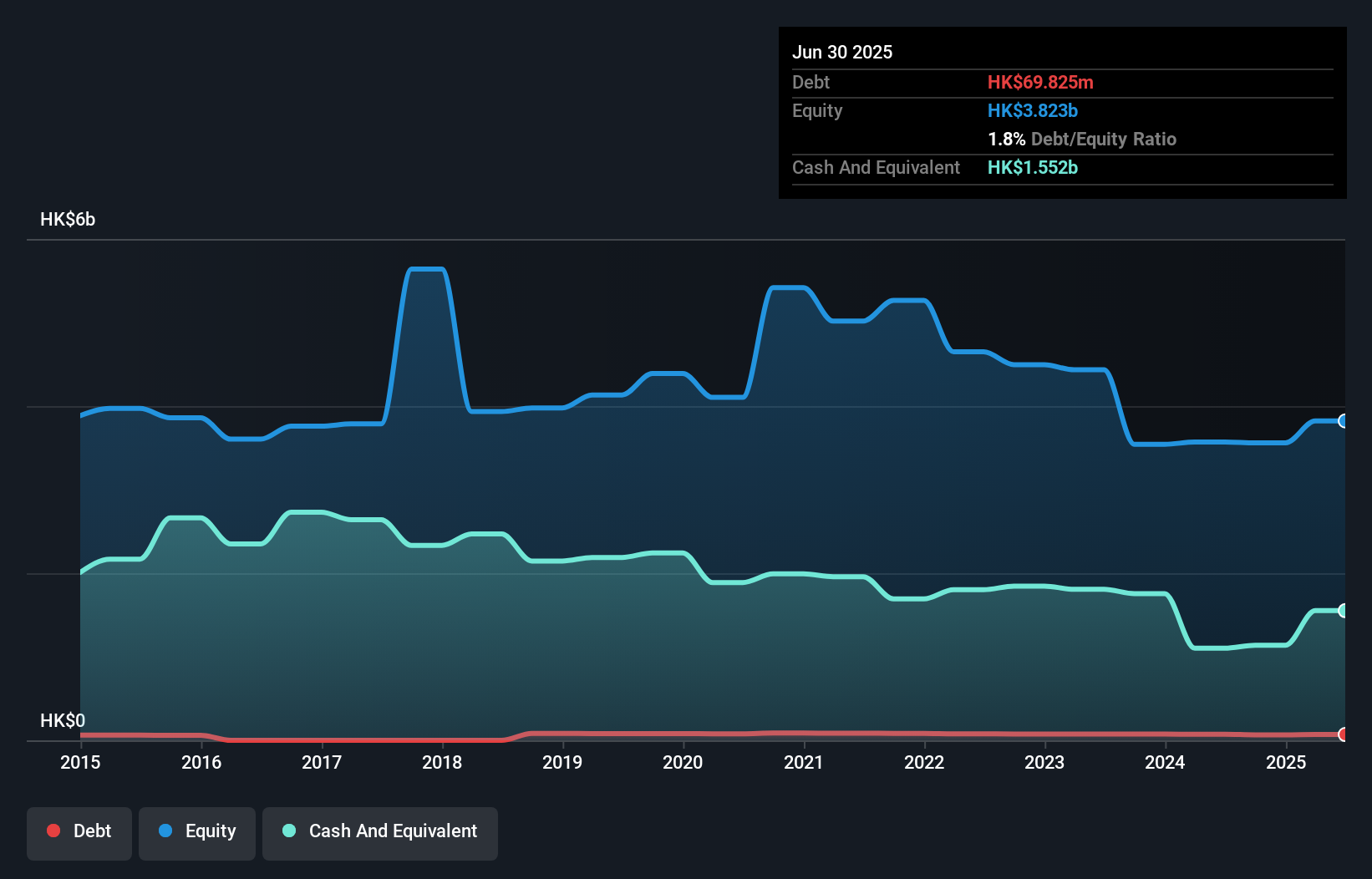

Value Partners Group, with a market cap of HK$4.80 billion, has demonstrated improved profitability, reporting net income of HK$251.57 million for the first half of 2025, largely influenced by a significant one-off gain. Despite this boost in earnings and stable weekly volatility at 8%, its return on equity remains low at 6.4%. The company's debt situation appears manageable with more cash than total debt, yet operating cash flow inadequately covers its debt obligations. Recent executive changes may introduce uncertainty as the board is relatively inexperienced with an average tenure of just 1.3 years.

- Navigate through the intricacies of Value Partners Group with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Value Partners Group's future.

ValueMax Group (SGX:T6I)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ValueMax Group Limited is an investment holding company operating in pawnbroking, moneylending, jewelry and watches retailing, and gold trading primarily in Singapore with a market cap of SGD913.28 million.

Operations: The company generates revenue from pawnbroking (SGD85.76 million), moneylending (SGD66.87 million), and retail and trading of jewellery and gold (SGD374.23 million).

Market Cap: SGD913.28M

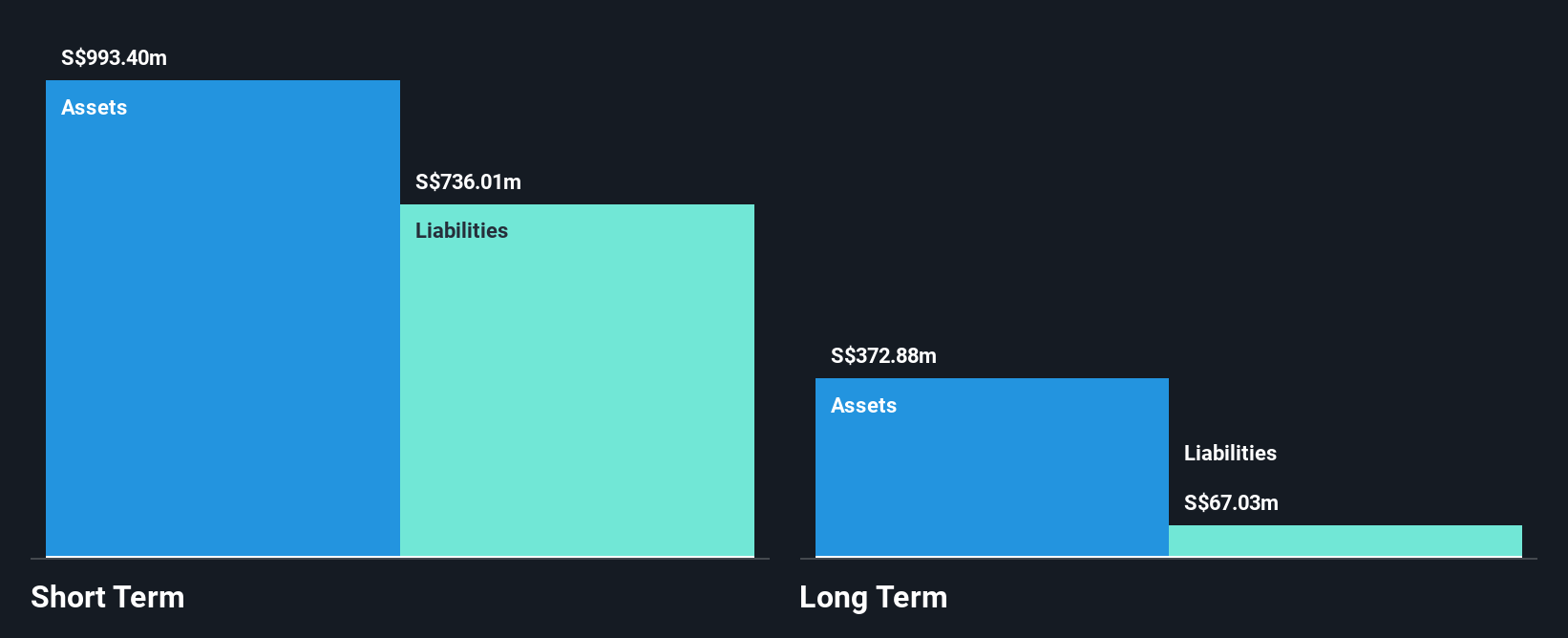

ValueMax Group, with a market cap of SGD913.28 million, has shown robust financial performance, reporting half-year sales of SGD268.34 million and net income of SGD48.03 million. The company maintains a strong position with short-term assets exceeding both its short and long-term liabilities, though its high net debt to equity ratio at 126.2% raises some concerns about leverage levels. Earnings growth outpaced the industry significantly at 51%, supported by experienced management and board teams. However, negative operating cash flow limits debt coverage capability and challenges dividend sustainability despite consistent profitability improvements over recent years.

- Click here to discover the nuances of ValueMax Group with our detailed analytical financial health report.

- Gain insights into ValueMax Group's historical outcomes by reviewing our past performance report.

Taking Advantage

- Discover the full array of 951 Asian Penny Stocks right here.

- Ready For A Different Approach? Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:806

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives