- Hong Kong

- /

- Oil and Gas

- /

- SEHK:386

A Fresh Look at Sinopec (SEHK:386) Valuation Following Mixed Q3 and Nine-Month Results

Reviewed by Simply Wall St

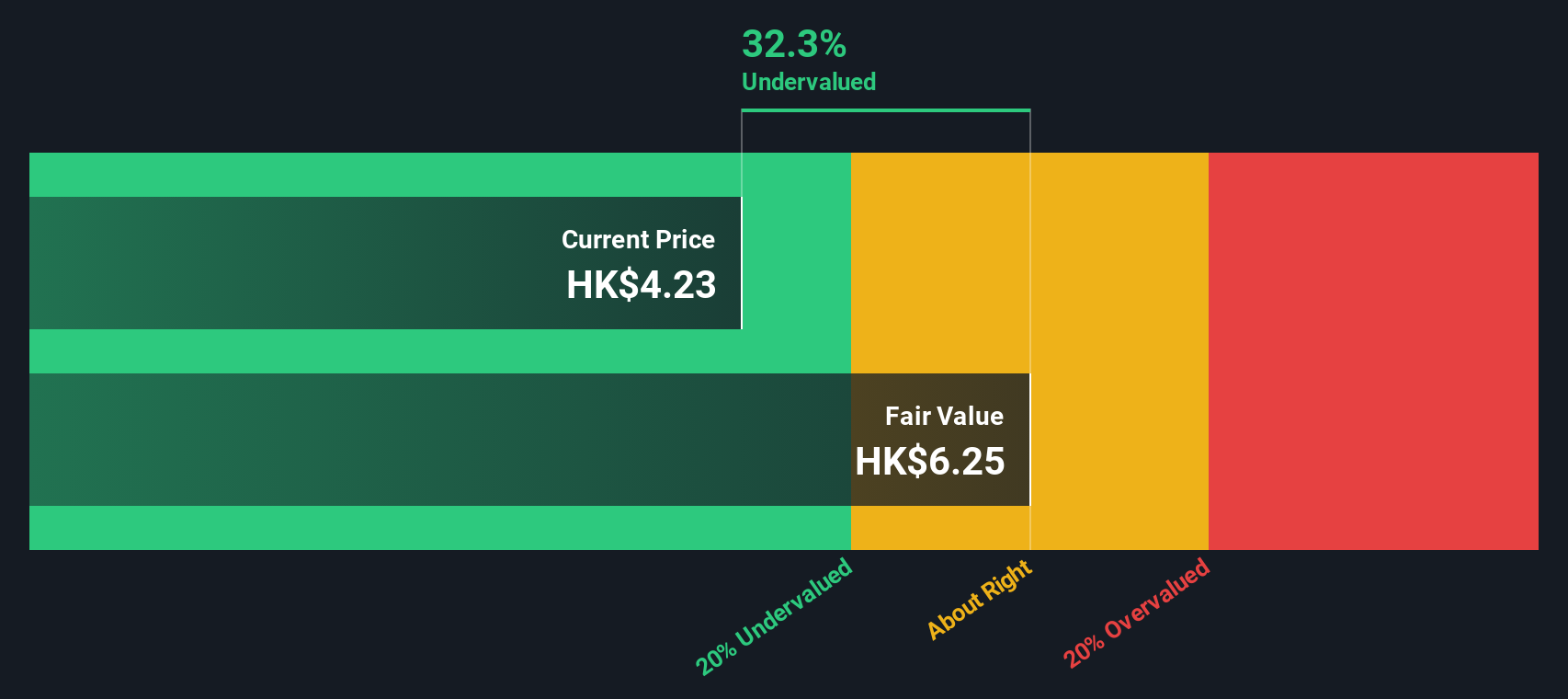

China Petroleum & Chemical (SEHK:386) just posted its third-quarter and nine-month financials, providing new insight into its 2025 performance. The results show a dip in sales and revenue, along with mixed net income trends.

See our latest analysis for China Petroleum & Chemical.

China Petroleum & Chemical’s latest financials just landed against a backdrop of modest share price momentum. After a sluggish few months, the stock pushed higher recently with a 4.38% one-month share price return and now sits at HK$4.29. While 2025 sales figures weighed on sentiment earlier this year, the stock’s 4.40% total shareholder return for the past year and near 90% five-year total return show long-term holders still have reason to feel encouraged.

If you’re curious what other sectors are showing serious growth potential, now’s the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With these mixed signals in the latest earnings, investors are left wondering: does China Petroleum & Chemical represent hidden value at current levels, or has the market already priced in its future growth prospects?

Price-to-Earnings of 13.3x: Is it justified?

China Petroleum & Chemical is trading at a price-to-earnings (P/E) ratio of 13.3x, notably higher than both local peers and the industry average. With shares closing at HK$4.29, this positions the company as relatively expensive compared to similar firms.

The P/E ratio measures what investors are willing to pay per dollar of company earnings. For oil and gas majors like China Petroleum & Chemical, this multiple can reveal whether the market is expecting outsized future profits or simply overvaluing the business.

This is especially relevant as the company’s P/E of 13.3x stands above both the peer average of 9.7x and the broader Hong Kong Oil and Gas industry figure of 10.1x. However, when compared to the estimated fair P/E ratio of 15.7x, the current multiple leaves some gap for further re-rating, potentially signaling room for optimism if future earnings materialize as forecast.

Explore the SWS fair ratio for China Petroleum & Chemical

Result: Price-to-Earnings of 13.3x (OVERVALUED)

However, ongoing revenue growth uncertainty and a recent dip in quarterly returns could make it challenging to support further upside at current valuation levels.

Find out about the key risks to this China Petroleum & Chemical narrative.

Another View: SWS DCF Model Sees Hidden Value

To contrast the market’s relatively high price-to-earnings multiple, our DCF model presents a very different outlook. It suggests China Petroleum & Chemical is actually trading at a 49.7% discount to its fair value, indicating shares may be undervalued. Can this modeled upside really materialize?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out China Petroleum & Chemical for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own China Petroleum & Chemical Narrative

If you’d rather dig into the details yourself or think there’s a different story behind the numbers, crafting your own view takes less than three minutes, so why not Do it your way

A great starting point for your China Petroleum & Chemical research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investing means always staying ahead of the curve. Here are proven ways to target opportunities that others might miss. Take action now or risk being left behind.

- Harvest higher yields by checking out these 16 dividend stocks with yields > 3% with reliable track records and above-average returns in a range of market cycles.

- Position yourself for the next technological leap by jumping into these 28 quantum computing stocks featuring pioneers at the frontier of quantum computing breakthroughs.

- Secure exposure to future medical trends when you screen for these 32 healthcare AI stocks that are transforming healthcare with artificial intelligence innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:386

China Petroleum & Chemical

An energy and chemical company, engages in the oil and gas and chemical operations in Mainland China.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives