Stock Analysis

- Hong Kong

- /

- Oil and Gas

- /

- SEHK:353

Energy International Investments Holdings (HKG:353) shareholders notch a 74% return over 1 year, yet earnings have been shrinking

While Energy International Investments Holdings Limited (HKG:353) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 21% in the last quarter. But that doesn't change the fact that the returns over the last year have been pleasing. In that time we've seen the stock easily surpass the market return, with a gain of 74%.

Since the stock has added HK$108m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

View our latest analysis for Energy International Investments Holdings

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year, Energy International Investments Holdings actually saw its earnings per share drop 62%.

Given the share price gain, we doubt the market is measuring progress with EPS. Therefore, it seems likely that investors are putting more weight on metrics other than EPS, at the moment.

Energy International Investments Holdings' revenue actually dropped 17% over last year. So the fundamental metrics don't provide an obvious explanation for the share price gain.

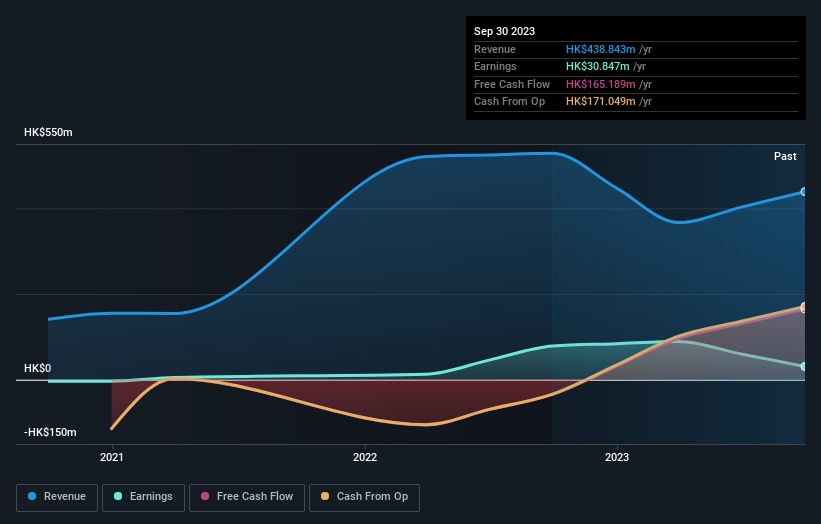

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Energy International Investments Holdings' financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that Energy International Investments Holdings shareholders have received a total shareholder return of 74% over the last year. Notably the five-year annualised TSR loss of 7% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Energy International Investments Holdings that you should be aware of before investing here.

But note: Energy International Investments Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Energy International Investments Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:353

Energy International Investments Holdings

An investment holding company, engages in the oil production, and oil and liquefied chemical terminal leasing businesses in the People’s Republic of China and Hong Kong.

Flawless balance sheet and fair value.