Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Yuan Heng Gas Holdings Limited (HKG:332) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Yuan Heng Gas Holdings

What Is Yuan Heng Gas Holdings's Debt?

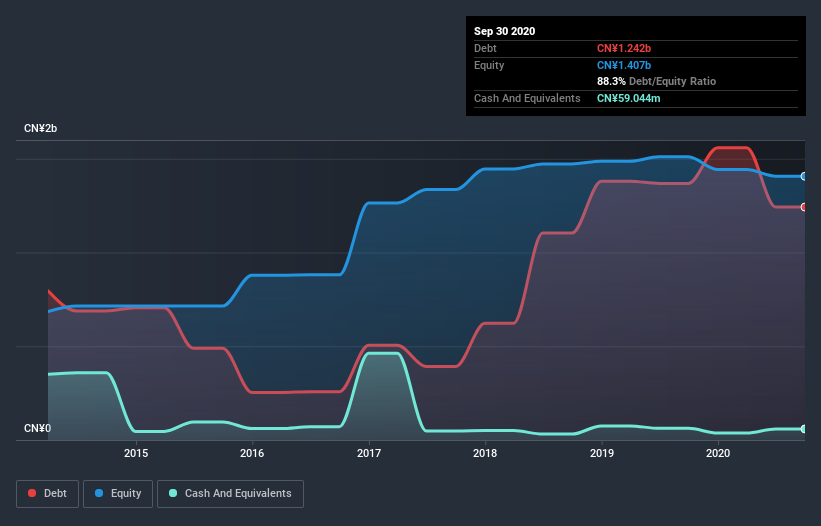

The image below, which you can click on for greater detail, shows that Yuan Heng Gas Holdings had debt of CN¥1.24b at the end of September 2020, a reduction from CN¥1.37b over a year. However, it does have CN¥59.0m in cash offsetting this, leading to net debt of about CN¥1.18b.

How Healthy Is Yuan Heng Gas Holdings' Balance Sheet?

We can see from the most recent balance sheet that Yuan Heng Gas Holdings had liabilities of CN¥2.01b falling due within a year, and liabilities of CN¥255.3m due beyond that. Offsetting these obligations, it had cash of CN¥59.0m as well as receivables valued at CN¥1.55b due within 12 months. So its liabilities total CN¥647.8m more than the combination of its cash and short-term receivables.

Yuan Heng Gas Holdings has a market capitalization of CN¥2.02b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Weak interest cover of 0.36 times and a disturbingly high net debt to EBITDA ratio of 13.3 hit our confidence in Yuan Heng Gas Holdings like a one-two punch to the gut. The debt burden here is substantial. Even worse, Yuan Heng Gas Holdings saw its EBIT tank 72% over the last 12 months. If earnings keep going like that over the long term, it has a snowball's chance in hell of paying off that debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Yuan Heng Gas Holdings's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Yuan Heng Gas Holdings burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

To be frank both Yuan Heng Gas Holdings's conversion of EBIT to free cash flow and its track record of (not) growing its EBIT make us rather uncomfortable with its debt levels. Having said that, its ability to handle its total liabilities isn't such a worry. After considering the datapoints discussed, we think Yuan Heng Gas Holdings has too much debt. While some investors love that sort of risky play, it's certainly not our cup of tea. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 3 warning signs for Yuan Heng Gas Holdings (2 are concerning!) that you should be aware of before investing here.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you decide to trade Yuan Heng Gas Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:332

Yuan Heng Gas Holdings

An investment holding company, engages in the trading of oil and gas products, and the provision of related consultancy services in the People’s Republic of China, Hong Kong, and Singapore.

Slight risk and slightly overvalued.

Market Insights

Community Narratives