- Hong Kong

- /

- Energy Services

- /

- SEHK:2883

How Strong Revenue and Profit Growth at China Oilfield Services (SEHK:2883) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

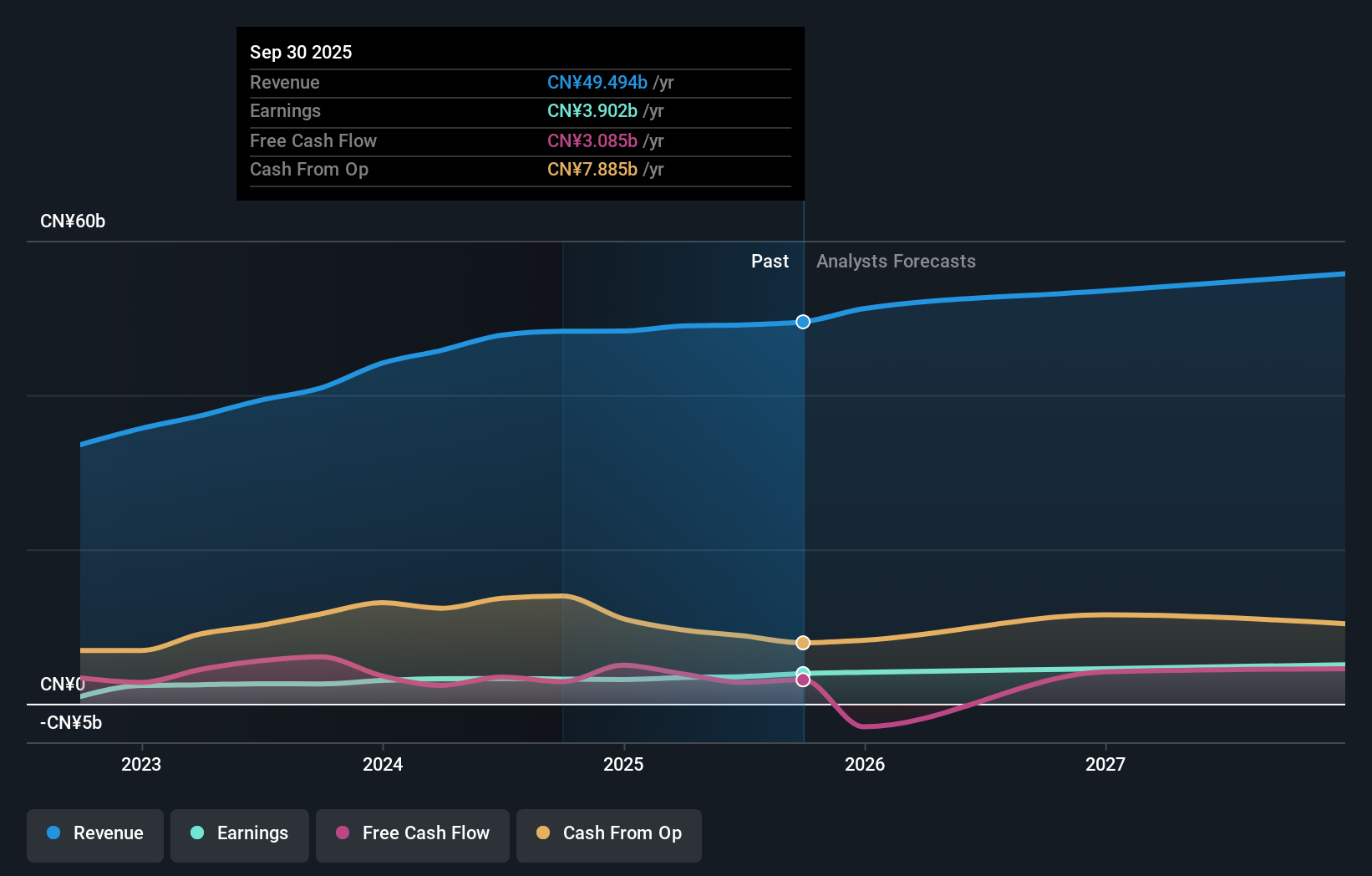

- China Oilfield Services Limited recently reported its earnings results for the nine months ended September 30, 2025, highlighting revenue of CNY34.85 billion and net income of CNY3.21 billion, both up from the same period last year.

- A rise in basic earnings per share from continuing operations, CNY0.67 versus CNY0.51 a year ago, signals improved profitability and enhanced operational efficiency.

- We'll examine how China Oilfield Services' improved revenue and profit performance could influence its longer-term investment outlook and risk profile.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

China Oilfield Services Investment Narrative Recap

To be a shareholder in China Oilfield Services, you typically want to believe in the company’s ability to convert robust offshore energy demand into consistent profit growth while managing the operational and financial risks that come with a concentrated client base and evolving global energy markets. The latest earnings report, showing rising revenue and net income, offers reassurance about operational execution but does not materially change the short-term catalyst of international contract wins or the key risk around customer concentration, particularly exposure to its largest domestic clients.

Among recent company announcements, the affirmation of a final dividend of RMB 0.2306 per share in May 2025 is closely tied to the company’s improved earnings. This underscores how increased profitability has supported shareholder returns, but the sustainability of these dividends remains closely linked to long-term contract stability, ongoing fleet renewal, and continued momentum in international markets.

But while many are focused on near-term profit gains, you should also be mindful of the volatility that comes with...

Read the full narrative on China Oilfield Services (it's free!)

China Oilfield Services is projected to reach CN¥57.5 billion in revenue and CN¥5.5 billion in earnings by 2028. This outlook assumes a 5.4% annual revenue growth and a CN¥2.0 billion increase in earnings from the current level of CN¥3.5 billion.

Uncover how China Oilfield Services' forecasts yield a HK$10.16 fair value, a 28% upside to its current price.

Exploring Other Perspectives

Fair value estimates from two Simply Wall St Community members range from HK$10.16 to HK$23.34, highlighting very different convictions about potential upside. Many are optimistic about contract-driven growth, but customer concentration risk remains an important consideration for China Oilfield Services’ outlook.

Explore 2 other fair value estimates on China Oilfield Services - why the stock might be worth just HK$10.16!

Build Your Own China Oilfield Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Oilfield Services research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free China Oilfield Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Oilfield Services' overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2883

China Oilfield Services

Provides integrated oilfield services in China, Indonesia, Mexico, Norway, the Middle East, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives