The harsh reality for Hilong Holding Limited (HKG:1623) shareholders is that its auditors, PricewaterhouseCoopers LLP, expressed doubts about its ability to continue as a going concern, in its reported results to December 2020. Thus we can say that, based on the results to that date, the company should raise capital or otherwise raise cash, without much delay.

Given its situation, it may not be in a good position to raise capital on favorable terms. So current risks on the balance sheet could have a big impact on how shareholders fare from here. The biggest concern we would have is the company's debt, since its lenders might force the company into administration if it cannot repay them.

View our latest analysis for Hilong Holding

What Is Hilong Holding's Debt?

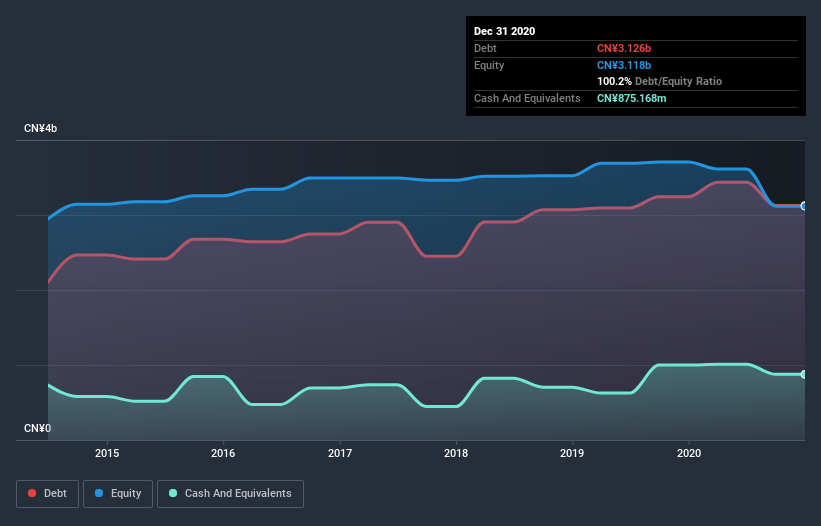

The chart below, which you can click on for greater detail, shows that Hilong Holding had CN¥3.13b in debt in December 2020; about the same as the year before. However, it also had CN¥875.2m in cash, and so its net debt is CN¥2.25b.

How Strong Is Hilong Holding's Balance Sheet?

According to the last reported balance sheet, Hilong Holding had liabilities of CN¥4.12b due within 12 months, and liabilities of CN¥127.6m due beyond 12 months. Offsetting these obligations, it had cash of CN¥875.2m as well as receivables valued at CN¥1.78b due within 12 months. So its liabilities total CN¥1.60b more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the CN¥391.0m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. At the end of the day, Hilong Holding would probably need a major re-capitalization if its creditors were to demand repayment.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While we wouldn't worry about Hilong Holding's net debt to EBITDA ratio of 4.4, we think its super-low interest cover of 0.66 times is a sign of high leverage. It seems that the business incurs large depreciation and amortisation charges, so maybe its debt load is heavier than it would first appear, since EBITDA is arguably a generous measure of earnings. So shareholders should probably be aware that interest expenses appear to have really impacted the business lately. Even worse, Hilong Holding saw its EBIT tank 67% over the last 12 months. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Hilong Holding can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. In the last three years, Hilong Holding created free cash flow amounting to 6.8% of its EBIT, an uninspiring performance. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

On the face of it, Hilong Holding's EBIT growth rate left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. And even its net debt to EBITDA fails to inspire much confidence. We think the chances that Hilong Holding has too much debt a very significant. To us, that makes the stock rather risky, like walking through a dog park with your eyes closed. But some investors may feel differently. While some investors may specialize in these sort of situations, it's simply too risky and complicated for us to want to invest in a company after an auditor has expressed doubts about its ability to continue as a going concern. Our preference is to invest in companies that always make sure the auditor has confidence that the company will continue as a going concern. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 3 warning signs for Hilong Holding (1 doesn't sit too well with us) you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

When trading Hilong Holding or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hilong Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1623

Hilong Holding

An investment holding company, operates as an oil field equipment and services provider in the People’s Republic of China, Hong Kong, Russia, Central Asia and Europe, the Middle East, North and South America, South Asia, Southeast Asia, and Africa.

Good value with adequate balance sheet.

Market Insights

Community Narratives