- Hong Kong

- /

- Infrastructure

- /

- SEHK:152

3 Top Undervalued Small Caps With Insider Buying

Reviewed by Simply Wall St

Global markets have faced significant volatility recently, with key indices like the Russell 2000 experiencing sharp pullbacks amid mixed economic data and investor sentiment. The cooling U.S. labor market and unexpected manufacturing contraction have particularly impacted small-cap stocks, creating potential opportunities for discerning investors. In this environment, identifying undervalued small caps with insider buying can be a strategic move. Such stocks often present attractive entry points due to their lower valuations and the confidence shown by insiders who are increasing their holdings.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| PCB Bancorp | 10.4x | 2.6x | 46.09% | ★★★★★☆ |

| Titan Machinery | 3.7x | 0.1x | 36.45% | ★★★★★☆ |

| Norcros | 7.4x | 0.5x | 4.23% | ★★★★☆☆ |

| Trican Well Service | 8.2x | 1.0x | 5.63% | ★★★★☆☆ |

| Citizens & Northern | 11.9x | 2.7x | 47.61% | ★★★★☆☆ |

| Russel Metals | 10.9x | 0.5x | 47.98% | ★★★★☆☆ |

| Westshore Terminals Investment | 14.2x | 3.8x | 26.01% | ★★★☆☆☆ |

| NSI | NA | 4.5x | 46.25% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Lindblad Expeditions Holdings | NA | 0.7x | -107.22% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

GHCL (NSEI:GHCL)

Simply Wall St Value Rating: ★★★★★☆

Overview: GHCL is a diversified company primarily engaged in the production of inorganic chemicals, with a market cap of ₹41.32 billion.

Operations: The company generates revenue primarily from its Inorganic Chemicals segment, with a recent reported revenue of ₹32.58 billion. The cost of goods sold (COGS) for the same period was ₹18.92 billion, resulting in a gross profit margin of 41.93%. Operating expenses were ₹7.07 billion, and net income was ₹5.18 billion, yielding a net income margin of 15.90%.

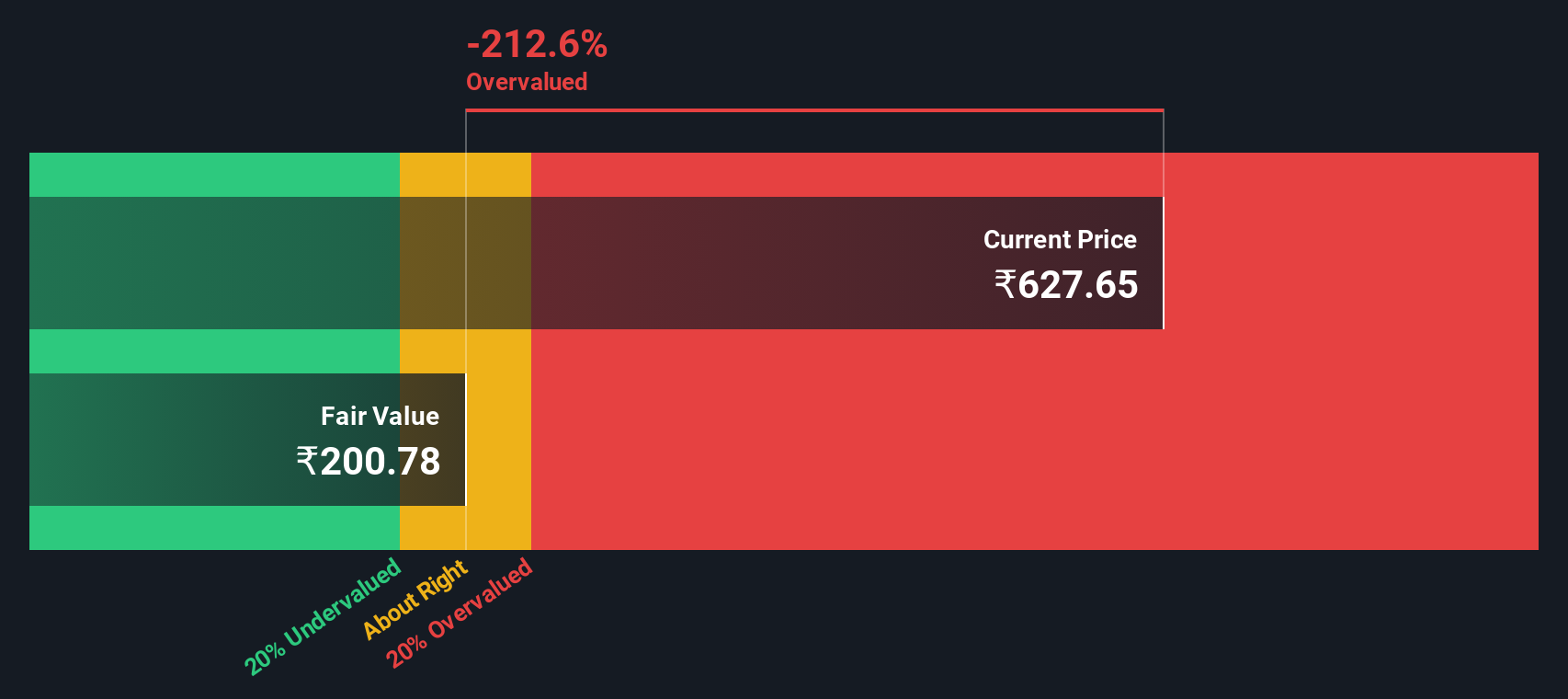

PE: 11.4x

GHCL, a smaller company in its sector, has seen a significant drop in profit margins from 27.7% last year to 15.9% this year. Despite the decline in revenue and net income for Q1 2024 compared to the previous year, earnings are forecasted to grow by 19.21% annually. Notably, insider confidence is evident with Anurag Dalmia purchasing shares worth ₹2.55 million on July 10, increasing their stake by nearly 0.71%. The company relies entirely on external borrowing for funding, adding some risk but also potential upside if managed well.

- Click here to discover the nuances of GHCL with our detailed analytical valuation report.

Gain insights into GHCL's past trends and performance with our Past report.

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Kinetic Development Group is a company engaged in property development, primarily focusing on residential and commercial projects, with a market cap of approximately CN¥4.29 billion.

Operations: Kinetic Development Group's revenue primarily comes from its core business operations, with notable increases over the periods observed. The company has experienced fluctuations in gross profit margin, reaching a peak of 69.80% as of June 30, 2022. Operating expenses and non-operating expenses are significant cost components impacting net income margins.

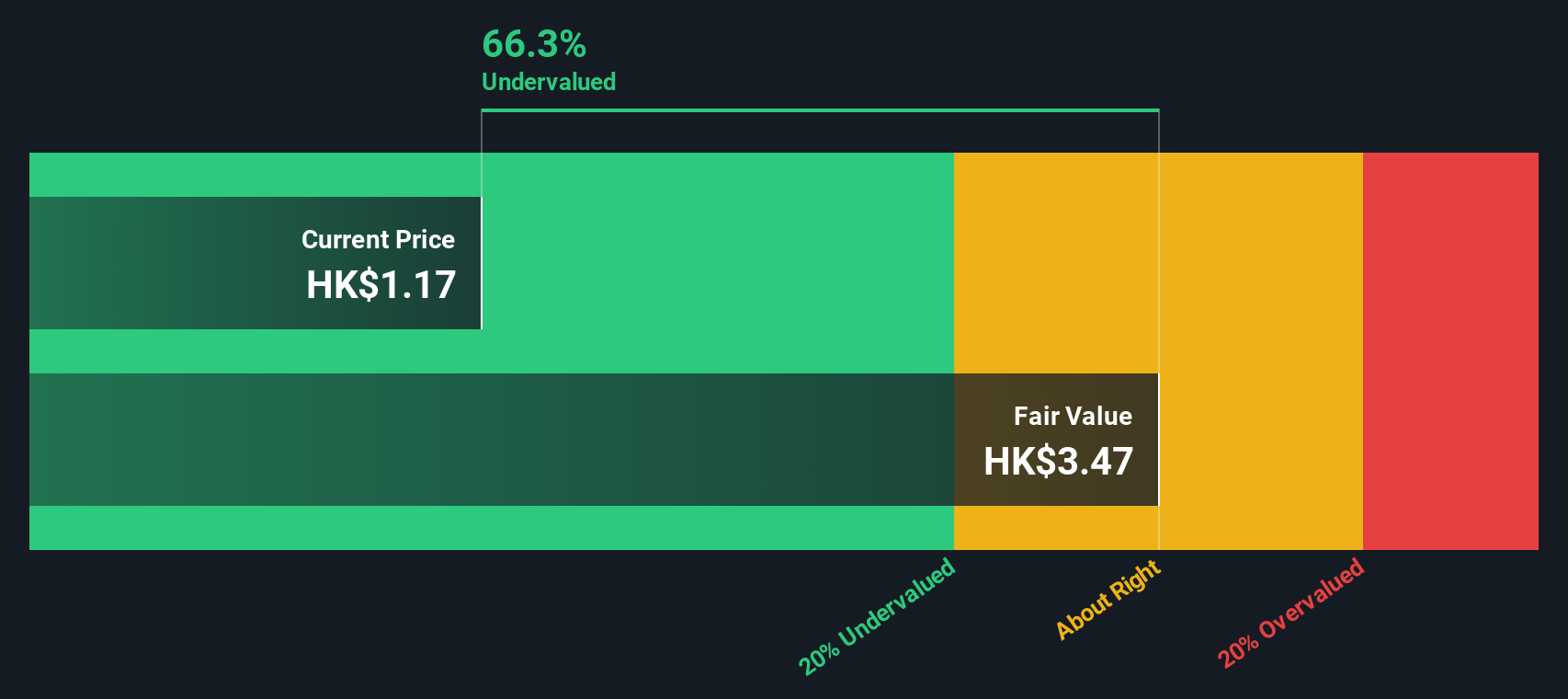

PE: 4.2x

Kinetic Development Group, a small cap stock, recently declared a final dividend of HK$0.05 per share for 2023 at its annual general meeting on May 7, 2024. Despite having no customer deposits and relying entirely on external borrowing for funding, the company shows insider confidence with recent share purchases by executives over the past six months. Amendments to their memorandum and articles of association were also approved during the same meeting, indicating potential strategic shifts ahead.

Shenzhen International Holdings (SEHK:152)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shenzhen International Holdings primarily operates in logistics services, including logistic parks, port and related services, and toll roads with a market cap of HK$24.51 billion.

Operations: Shenzhen International Holdings generates revenue primarily from Toll Roads and General-Environmental Protection Business, Logistics Park Transformation and Upgrading Services, Port and Related Services, Logistic Parks, and Logistic Services. The company's gross profit margin has shown variability over the periods, reaching 36.76% in the most recent quarter.

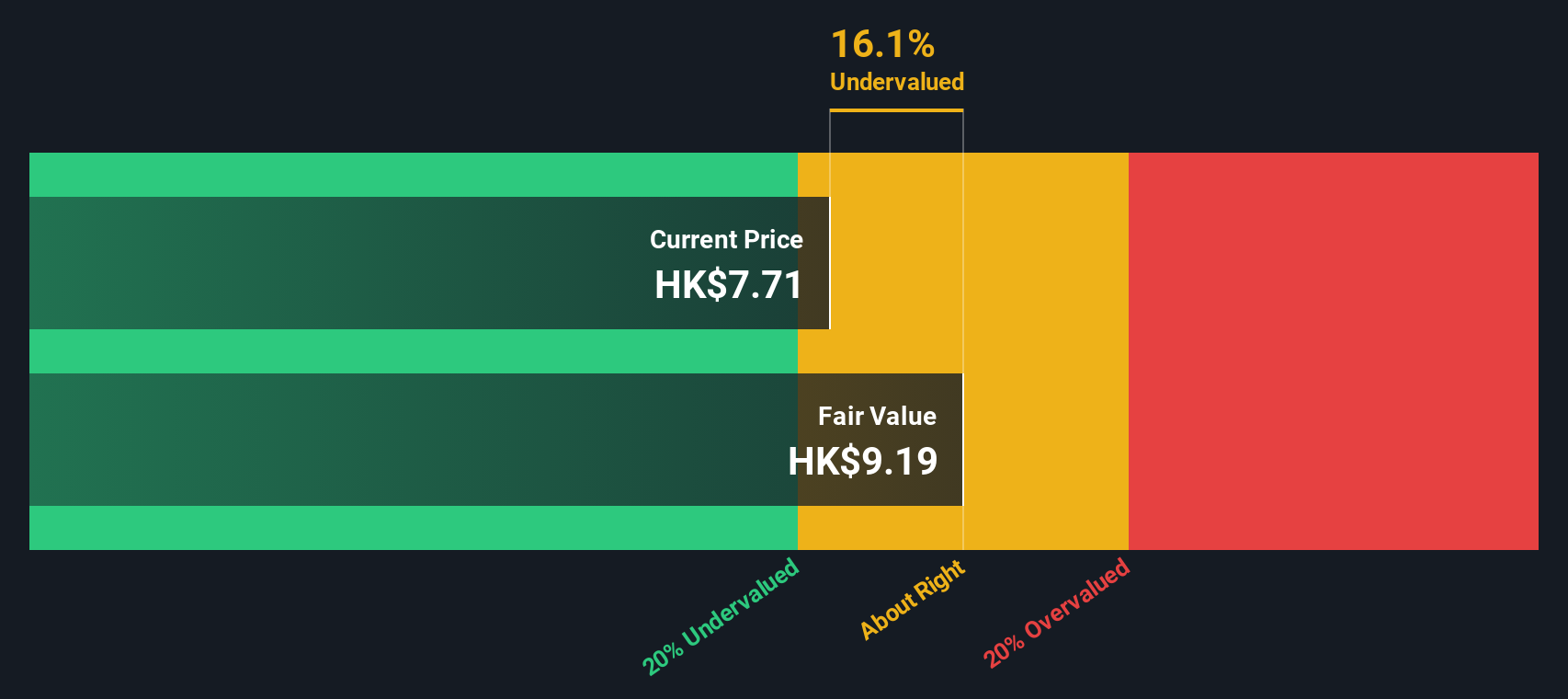

PE: 8.3x

Shenzhen International Holdings is drawing attention with its recent earnings guidance for the six months ending June 2024, projecting a profit of HK$550 million to HK$650 million, up from HK$92.05 million last year. This surge is largely due to gains from transferring logistics hubs to REITs and optimizing currency structures. CEO Zhengyu Liu's purchase of 693,000 shares worth approximately HK$3.97 million in May 2024 signifies insider confidence. Additionally, the company announced a final dividend of HK$0.40 per share for FY2023 and significant investments in infrastructure projects like the Shenyang-Haikou National Expressway expansion project worth RMB9.23 billion.

Next Steps

- Click here to access our complete index of 213 Undervalued Small Caps With Insider Buying.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:152

Shenzhen International Holdings

An investment holding company, invests in, constructs, and operates logistics infrastructure facilities primarily in the People’s Republic of China.

Good value with proven track record.