- Hong Kong

- /

- Oil and Gas

- /

- SEHK:1229

Nan Nan Resources Enterprise Full Year 2024 Earnings: EPS: HK$0.051 (vs HK$0.076 loss in FY 2023)

Nan Nan Resources Enterprise (HKG:1229) Full Year 2024 Results

Key Financial Results

- Revenue: HK$116.1m (down 52% from FY 2023).

- Net income: HK$39.1m (up from HK$58.3m loss in FY 2023).

- Profit margin: 34% (up from net loss in FY 2023).

- EPS: HK$0.051 (up from HK$0.076 loss in FY 2023).

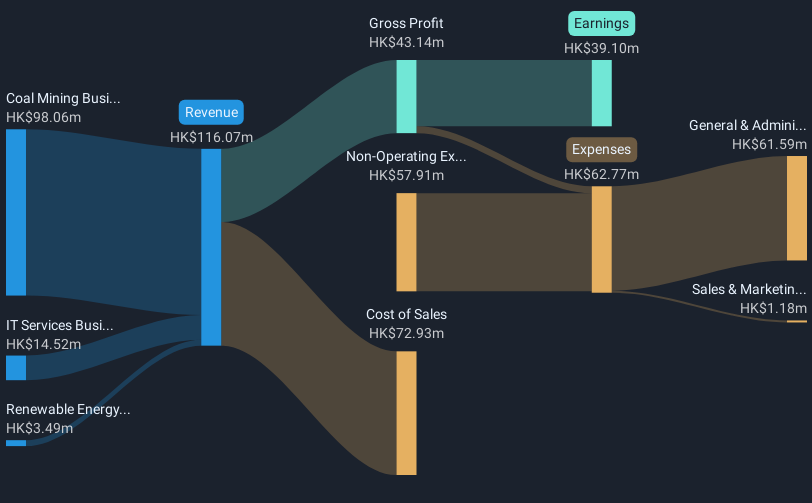

All figures shown in the chart above are for the trailing 12 month (TTM) period

The primary driver behind last 12 months revenue was the Coal Mining Business segment contributing a total revenue of HK$98.1m (84% of total revenue). Notably, cost of sales worth HK$72.9m amounted to 63% of total revenue thereby underscoring the impact on earnings. The largest operating expense was General & Administrative costs, amounting to HK$61.6m (99% of total expenses). Over the last 12 months, the company's earnings were enhanced by non-operating gains of HK$57.9m. Explore how 1229's revenue and expenses shape its earnings.

Nan Nan Resources Enterprise shares are down 1.3% from a week ago.

Risk Analysis

We don't want to rain on the parade too much, but we did also find 3 warning signs for Nan Nan Resources Enterprise (1 is concerning!) that you need to be mindful of.

Valuation is complex, but we're here to simplify it.

Discover if Nan Nan Resources Enterprise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1229

Nan Nan Resources Enterprise

An investment holding company, mines and sells coal in the Mainland China, Hong Kong, Singapore, the United Kingdom, and Malaysia.

Mediocre balance sheet low.