- Hong Kong

- /

- Oil and Gas

- /

- SEHK:1171

Yankuang Energy Group (SEHK:1171) Margin Drop Contradicts Resilience Narratives Despite Deep Valuation Discount

Reviewed by Simply Wall St

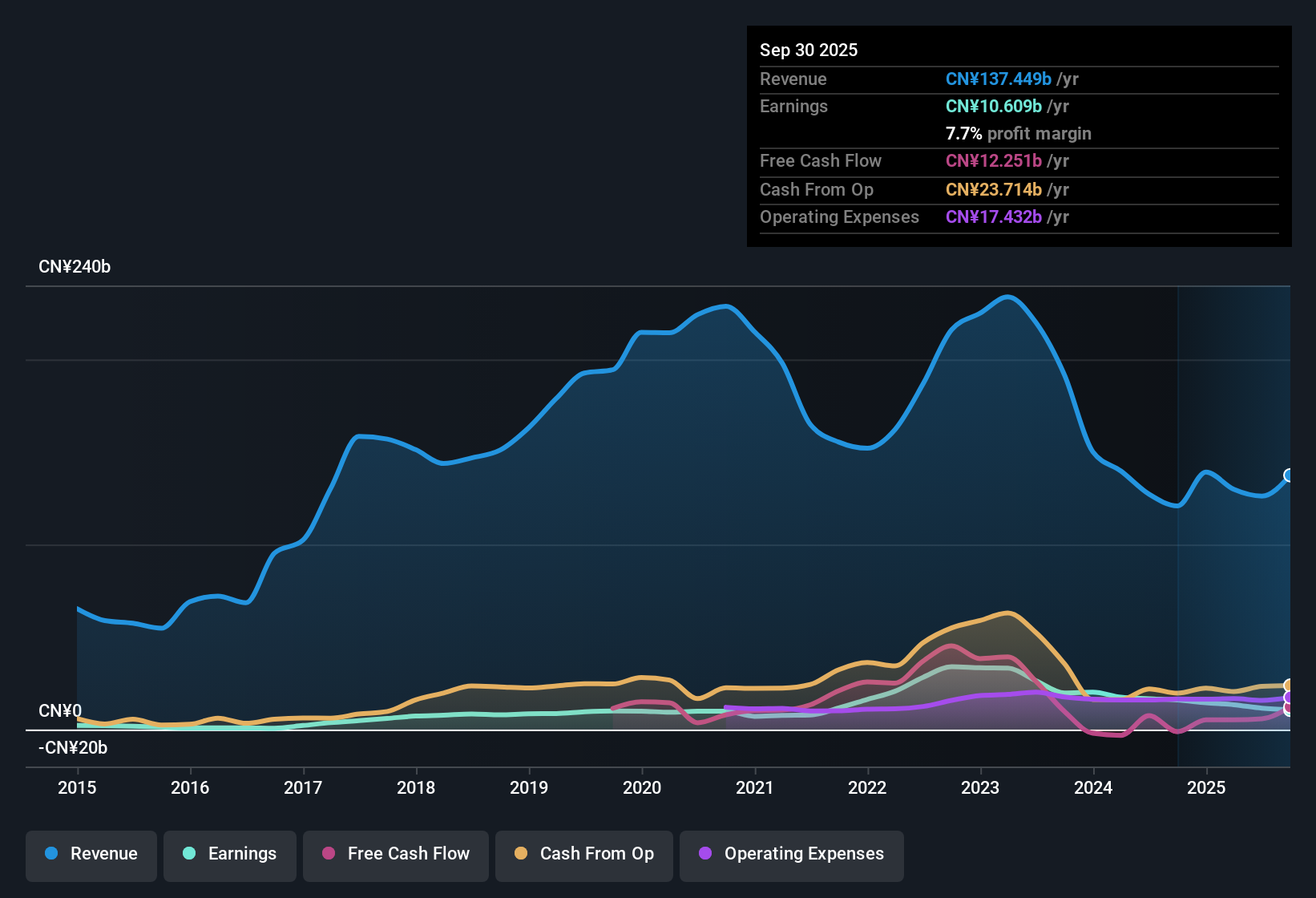

Yankuang Energy Group (SEHK:1171) reported a net profit margin of 7.7%, down from 13.2% last year. Over the past five years, annual earnings grew at a modest 2.7%, but the company saw negative earnings growth in the most recent period. While earnings are forecast to grow by 3.8% per year over the next three years, revenue is expected to decline by 0.8% per year. This leaves the projected growth rate notably slower than the Hong Kong market average of 12.4% per year. Investors should also note that the stock trades at a price-to-earnings ratio of 9.1x, well below the peer average of 30.2x, and is currently priced under the estimated fair value of HK$30.92 per share, balancing modest earnings prospects with a comparatively low valuation.

See our full analysis for Yankuang Energy Group.The next section puts these earnings results side by side with the hottest narratives in the market, clarifying where the numbers support or contradict investor expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Slide Below Sector Trend

- Net profit margin dropped sharply to 7.7%, well under last year’s 13.2%. Industry peers are also navigating volatility but with less pronounced margin compression.

- Some commentary highlights steady operational performance, but the prevailing market view faces direct pressure:

- The margin squeeze undercuts ideas of resilient profitability, especially as annual earnings grew only 2.7% on average over five years but turned negative this year.

- With revenue expected to fall 0.8% per year, there is little momentum to offset thinner margins. This suggests investors looking for stable bottom-line results may be unsettled by this trend.

Forecasted Growth Trails Hong Kong Market

- Annual earnings growth is projected at just 3.8% per year for the next three years, falling well behind the broader Hong Kong market’s 12.4% annual pace.

- Despite moderate optimism about forward growth, the prevailing view is cautious:

- This growth lag makes bullish narratives about sector rebounds hard to support when compared directly to the local market outlook.

- The combination of negative earnings in the most recent year and flat revenue expectations makes it unlikely for the company to capture outperformance unless unexpected catalysts emerge.

Current Price Well Below DCF Fair Value

- The latest share price of HK$10.67 is trading at a steep discount to the DCF fair value of HK$30.92 per share. It is also below the peer average valuation, as indicated by a P/E ratio of just 9.1x compared to 30.2x for the group.

- This significant gap leaves investors weighing risk versus opportunity in the prevailing market view:

- Compared to its sector, the company’s shares appear deeply undervalued by fundamental measures. This supports a view that long-term buyers could benefit if profitability stabilizes.

- However, ongoing concerns about margin pressure and revenue softness serve as a counterweight, as low valuations can persist if fundamentals do not improve.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Yankuang Energy Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Yankuang Energy Group’s slowing earnings, thinner margins, and weaker revenue outlook signal challenges in delivering the consistent growth many investors seek.

If stable results matter to you, check out stable growth stocks screener (2101 results) to discover companies shown to sustain reliable, steady earnings and revenue even when the market turns volatile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1171

Yankuang Energy Group

Engages in the mining, preparation, and sale of coal in China, Australia, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives