- Hong Kong

- /

- Oil and Gas

- /

- SEHK:1171

Earnings Working Against Yankuang Energy Group Company Limited's (HKG:1171) Share Price

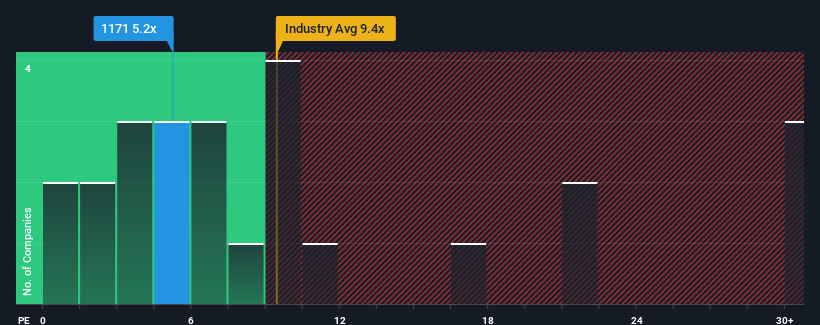

Yankuang Energy Group Company Limited's (HKG:1171) price-to-earnings (or "P/E") ratio of 5.2x might make it look like a buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 10x and even P/E's above 19x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

While the market has experienced earnings growth lately, Yankuang Energy Group's earnings have gone into reverse gear, which is not great. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Yankuang Energy Group

How Is Yankuang Energy Group's Growth Trending?

Yankuang Energy Group's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 58%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 30% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to slump, contracting by 20% during the coming year according to the four analysts following the company. Meanwhile, the broader market is forecast to expand by 23%, which paints a poor picture.

With this information, we are not surprised that Yankuang Energy Group is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Yankuang Energy Group's P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Yankuang Energy Group's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Yankuang Energy Group (at least 2 which are potentially serious), and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Yankuang Energy Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1171

Yankuang Energy Group

Engages in the mining, preparation, and sale of coal in China, Australia, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives