- Hong Kong

- /

- Oil and Gas

- /

- SEHK:1138

Does COSCO SHIPPING Energy Transportation (HKG:1138) Have A Healthy Balance Sheet?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that COSCO SHIPPING Energy Transportation Co., Ltd. (HKG:1138) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for COSCO SHIPPING Energy Transportation

What Is COSCO SHIPPING Energy Transportation's Debt?

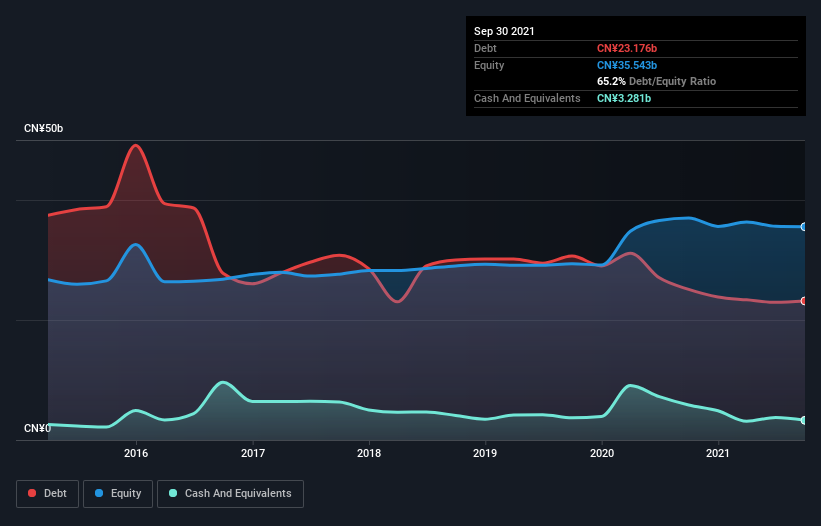

As you can see below, COSCO SHIPPING Energy Transportation had CN¥23.2b of debt at September 2021, down from CN¥25.1b a year prior. However, it also had CN¥3.28b in cash, and so its net debt is CN¥19.9b.

How Strong Is COSCO SHIPPING Energy Transportation's Balance Sheet?

The latest balance sheet data shows that COSCO SHIPPING Energy Transportation had liabilities of CN¥9.25b due within a year, and liabilities of CN¥20.1b falling due after that. Offsetting this, it had CN¥3.28b in cash and CN¥1.93b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥24.2b.

Given this deficit is actually higher than the company's market capitalization of CN¥20.2b, we think shareholders really should watch COSCO SHIPPING Energy Transportation's debt levels, like a parent watching their child ride a bike for the first time. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

As it happens COSCO SHIPPING Energy Transportation has a fairly concerning net debt to EBITDA ratio of 6.1 but very strong interest coverage of 1k. This means that unless the company has access to very cheap debt, that interest expense will likely grow in the future. Importantly, COSCO SHIPPING Energy Transportation's EBIT fell a jaw-dropping 82% in the last twelve months. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if COSCO SHIPPING Energy Transportation can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, COSCO SHIPPING Energy Transportation recorded free cash flow worth a fulsome 93% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Our View

On the face of it, COSCO SHIPPING Energy Transportation's net debt to EBITDA left us tentative about the stock, and its EBIT growth rate was no more enticing than the one empty restaurant on the busiest night of the year. But on the bright side, its interest cover is a good sign, and makes us more optimistic. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making COSCO SHIPPING Energy Transportation stock a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 3 warning signs we've spotted with COSCO SHIPPING Energy Transportation (including 1 which doesn't sit too well with us) .

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1138

COSCO SHIPPING Energy Transportation

An investment holding company, engages in the shipment of oil, liquefied natural gas (LNG), and chemicals along the coast of the People’s Republic of China and internationally.

Undervalued with adequate balance sheet.