- Hong Kong

- /

- Oil and Gas

- /

- SEHK:1138

COSCO SHIPPING Energy Transportation (HKG:1138) Seems To Use Debt Quite Sensibly

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, COSCO SHIPPING Energy Transportation Co., Ltd. (HKG:1138) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for COSCO SHIPPING Energy Transportation

What Is COSCO SHIPPING Energy Transportation's Debt?

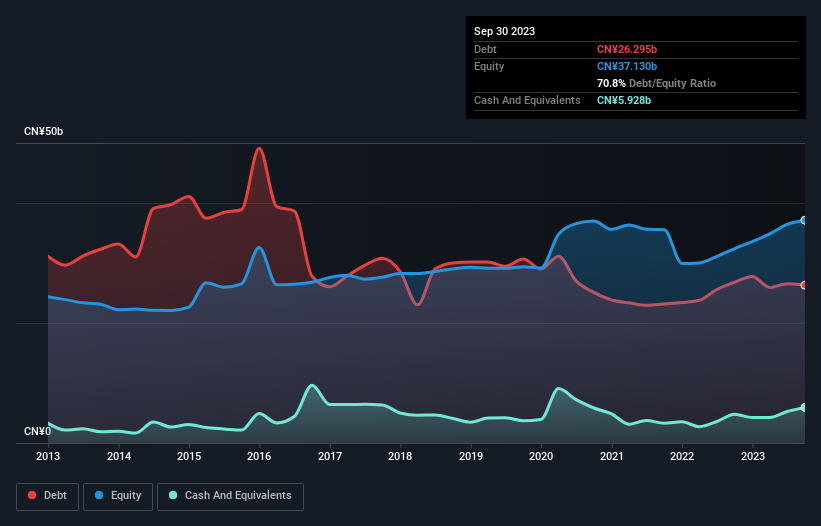

As you can see below, COSCO SHIPPING Energy Transportation had CN¥26.3b of debt, at September 2023, which is about the same as the year before. You can click the chart for greater detail. However, it also had CN¥5.93b in cash, and so its net debt is CN¥20.4b.

How Healthy Is COSCO SHIPPING Energy Transportation's Balance Sheet?

According to the last reported balance sheet, COSCO SHIPPING Energy Transportation had liabilities of CN¥7.55b due within 12 months, and liabilities of CN¥27.7b due beyond 12 months. Offsetting this, it had CN¥5.93b in cash and CN¥2.49b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥26.8b.

While this might seem like a lot, it is not so bad since COSCO SHIPPING Energy Transportation has a market capitalization of CN¥58.0b, and so it could probably strengthen its balance sheet by raising capital if it needed to. However, it is still worthwhile taking a close look at its ability to pay off debt.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

We'd say that COSCO SHIPPING Energy Transportation's moderate net debt to EBITDA ratio ( being 2.3), indicates prudence when it comes to debt. And its strong interest cover of 57.2 times, makes us even more comfortable. Notably, COSCO SHIPPING Energy Transportation's EBIT launched higher than Elon Musk, gaining a whopping 1,757% on last year. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine COSCO SHIPPING Energy Transportation's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, COSCO SHIPPING Energy Transportation produced sturdy free cash flow equating to 63% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

COSCO SHIPPING Energy Transportation's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. But, on a more sombre note, we are a little concerned by its level of total liabilities. When we consider the range of factors above, it looks like COSCO SHIPPING Energy Transportation is pretty sensible with its use of debt. That means they are taking on a bit more risk, in the hope of boosting shareholder returns. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Be aware that COSCO SHIPPING Energy Transportation is showing 1 warning sign in our investment analysis , you should know about...

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1138

COSCO SHIPPING Energy Transportation

An investment holding company, engages in the shipment of oil, liquefied natural gas (LNG), and chemicals along the coast of the People’s Republic of China and internationally.

Undervalued with adequate balance sheet.