- Hong Kong

- /

- Oil and Gas

- /

- SEHK:1138

Assessing COSCO SHIPPING Energy Transportation (SEHK:1138) Valuation Following Earnings Decline for Nine Months Ending September 2025

Reviewed by Simply Wall St

COSCO SHIPPING Energy Transportation (SEHK:1138) just released its earnings covering the nine months ended September 2025, showing both revenue and net income dipping from last year. Investors are gauging how this performance shift affects the company’s outlook.

See our latest analysis for COSCO SHIPPING Energy Transportation.

Despite the recent earnings dip, COSCO SHIPPING Energy Transportation’s momentum has been striking, with a 20% share price return over the past month and a remarkable 75.95% gain year-to-date. Its one-year total shareholder return stands at 58%, which reinforces that investors are still optimistic for the long term even as near-term results fluctuate.

If this kind of market momentum has you rethinking your next move, now could be the perfect time to explore fast growing stocks with high insider ownership

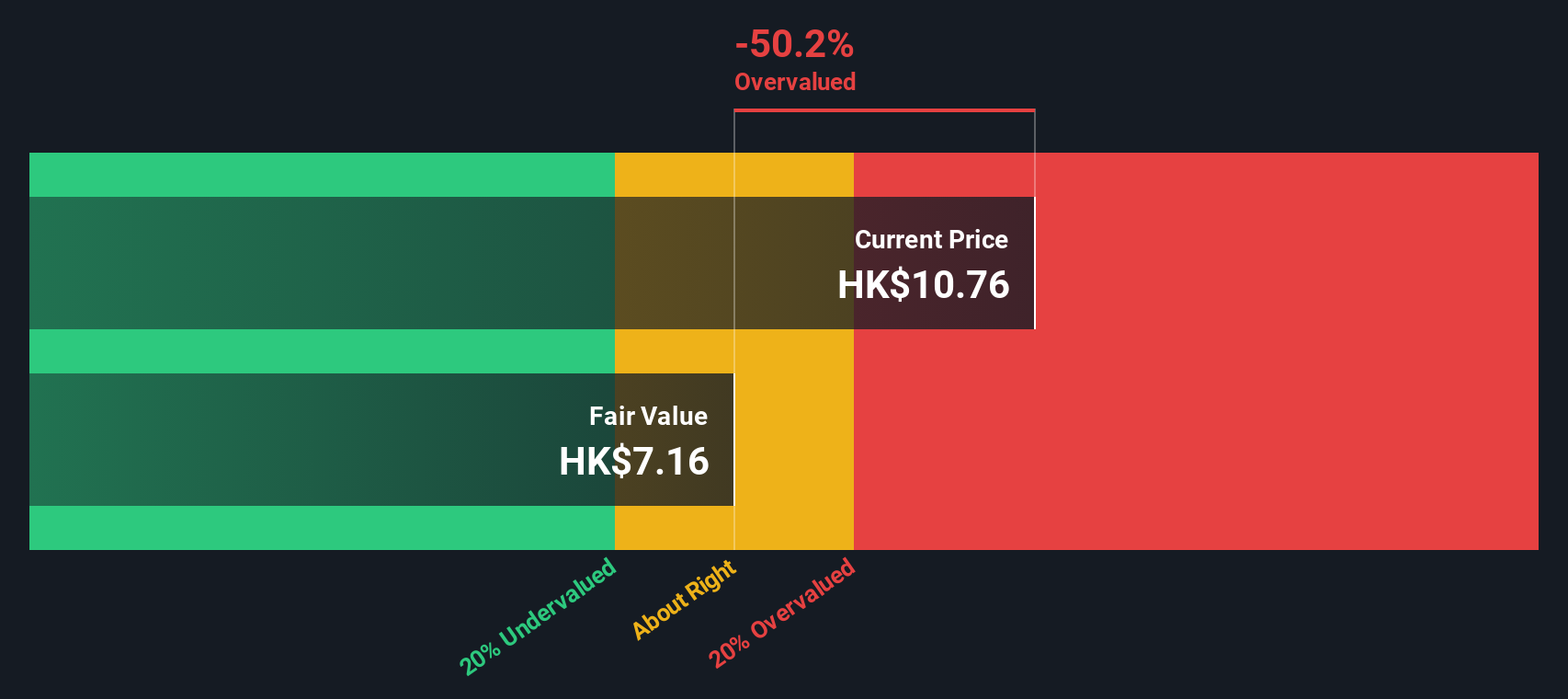

With shares recently rallying despite softer earnings, the big question is whether COSCO SHIPPING Energy Transportation is currently trading below its true value, or if the market is already anticipating further growth ahead.

Price-to-Earnings of 16.1x: Is it justified?

COSCO SHIPPING Energy Transportation currently trades at a Price-to-Earnings ratio of 16.1x, putting it at a premium to both sector norms and its own estimated fair value. Compared to peers, the stock appears overvalued by this metric, despite recent market optimism.

The price-to-earnings ratio measures how much investors are willing to pay for each dollar of earnings. It is a widely followed indicator for evaluating listed shipping companies. A higher P/E can suggest market confidence in future growth, but can also flag overexuberance if not supported by fundamentals.

In this case, the 16.1x Price-to-Earnings is not only higher than the fair value benchmark of 12.5x but also far exceeds the oil and gas industry average of 9.8x and the peer group’s average of 9.5x. This signals that the market is pricing in significantly higher growth or profitability, which may not be fully justified based on current financials and growth projections. The fair ratio points to a more moderate valuation level that the market might eventually gravitate towards.

Explore the SWS fair ratio for COSCO SHIPPING Energy Transportation

Result: Price-to-Earnings of 16.1x (OVERVALUED)

However, slowing revenue growth or unexpected market downturns could quickly undermine the current optimism around COSCO SHIPPING Energy Transportation’s valuation.

Find out about the key risks to this COSCO SHIPPING Energy Transportation narrative.

Another View: SWS DCF Model Says Shares Are Undervalued

While the price-to-earnings approach sees COSCO SHIPPING Energy Transportation as overvalued, our DCF model offers a different perspective. According to this analysis, the stock is currently trading 28.8% below its estimated fair value. This raises the question: is the market overlooking the company’s true long-term potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out COSCO SHIPPING Energy Transportation for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 860 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own COSCO SHIPPING Energy Transportation Narrative

If you have a different perspective or want to dig deeper into the numbers, you can quickly craft your own story based on the available data. Do it your way.

A great starting point for your COSCO SHIPPING Energy Transportation research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investing means staying ahead of the crowd and finding new opportunities before everyone else catches on. Use the Simply Wall Street Screener to spot trends and discover stocks most investors are missing out on right now.

- Unlock income potential by focusing on these 17 dividend stocks with yields > 3%, which offers robust yields and consistent payouts for your portfolio.

- Accelerate your strategy by reviewing these 860 undervalued stocks based on cash flows, featuring companies trading below their true worth and positioned for future growth.

- Step into tomorrow’s tech revolution with these 28 quantum computing stocks, where you’ll find innovators advancing the frontier of quantum computing solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1138

COSCO SHIPPING Energy Transportation

An investment holding company, engages in the transportation of oil and liquefied natural gas (LNG) in People’s Republic of China and internationally.

Proven track record with moderate growth potential.

Market Insights

Community Narratives