- Hong Kong

- /

- Capital Markets

- /

- SEHK:863

Can OSL Group’s (SEHK:863) Global Licensing Push Redefine Its Competitive Position in Digital Finance?

Reviewed by Sasha Jovanovic

- OSL Group made headlines at the recent Finternet 2025 – Asia Digital Finance Summit in Hong Kong, where its leadership team detailed the company’s expanding role in global digital finance and payments infrastructure, including the launch of a licensed payments business in Europe and pursuit of multiple licenses worldwide.

- A key insight from the event is OSL Group’s aim to create a global compliance network that effectively bridges digital assets with the real economy, positioning the company as an infrastructure provider across several major markets.

- Next, we’ll examine how OSL Group’s European licensed payments launch could influence its investment narrative and global expansion outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is OSL Group's Investment Narrative?

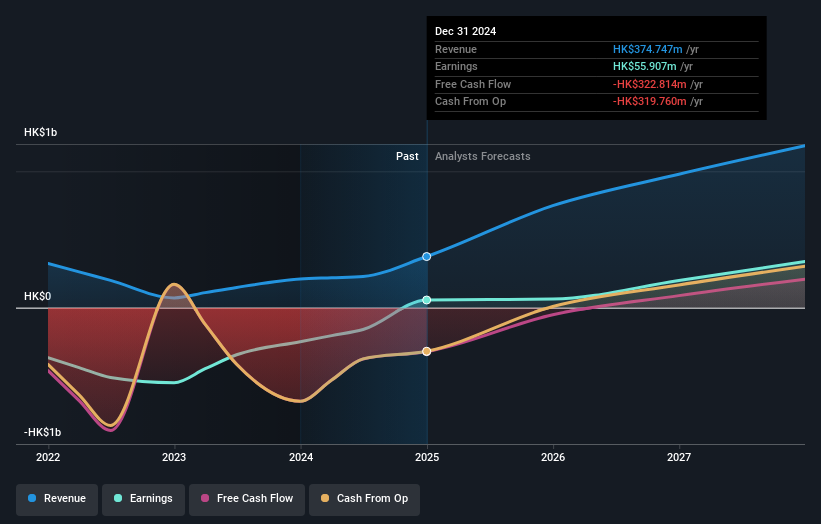

For anyone considering OSL Group, the core belief hinges on its ability to become a leading infrastructure provider linking digital assets to the real world, an ambition underscored by the company's rapid expansion into licensed payments in Europe and its push for over 50 licenses globally. This recent announcement adds substance to the company’s bold vision, strengthening one of its key short-term catalysts: gaining regulatory approval and ramping up international operations. However, with new markets come more regulatory scrutiny and execution risks, particularly given OSL Group’s ongoing net losses in the latest half-year results and high board turnover. On the other hand, successful progress in licensing and compliance could accelerate growth and help validate the company’s premium valuation. The latest price movement doesn’t yet indicate a material shift but keeps risk around leadership stability and cash requirements firmly in focus.

But it’s the pace of board changes and execution risk that investors should definitely keep in mind.

Exploring Other Perspectives

Explore another fair value estimate on OSL Group - why the stock might be worth as much as 30% more than the current price!

Build Your Own OSL Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OSL Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free OSL Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OSL Group's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:863

OSL Group

An investment holding company, engages in digital assets and blockchain platform business in Hong Kong, Australia, Japan, Singapore, and Mainland China.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives