- Hong Kong

- /

- Capital Markets

- /

- SEHK:8017

If You Like EPS Growth Then Check Out TradeGo FinTech (HKG:8017) Before It's Too Late

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in TradeGo FinTech (HKG:8017). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for TradeGo FinTech

How Fast Is TradeGo FinTech Growing Its Earnings Per Share?

In the last three years TradeGo FinTech's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Like a falcon taking flight, TradeGo FinTech's EPS soared from HK$0.027 to HK$0.043, over the last year. That's a commendable gain of 58%.

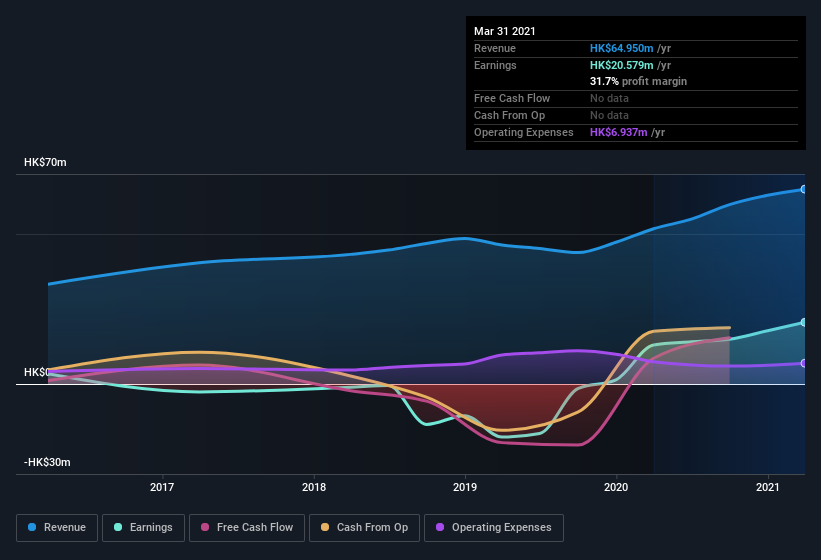

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). TradeGo FinTech shareholders can take confidence from the fact that EBIT margins are up from 20% to 31%, and revenue is growing. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

TradeGo FinTech isn't a huge company, given its market capitalization of HK$384m. That makes it extra important to check on its balance sheet strength.

Are TradeGo FinTech Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that TradeGo FinTech insiders have a significant amount of capital invested in the stock. To be specific, they have HK$99m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 26% of the company; visible skin in the game.

It means a lot to see insiders invested in the business, but I find myself wondering if remuneration policies are shareholder friendly. Well, based on the CEO pay, I'd say they are indeed. I discovered that the median total compensation for the CEOs of companies like TradeGo FinTech with market caps under HK$1.6b is about HK$1.8m.

The CEO of TradeGo FinTech only received HK$766k in total compensation for the year ending . That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is TradeGo FinTech Worth Keeping An Eye On?

Given my belief that share price follows earnings per share you can easily imagine how I feel about TradeGo FinTech's strong EPS growth. If you need more convincing beyond that EPS growth rate, don't forget about the reasonable remuneration and the high insider ownership. Each to their own, but I think all this makes TradeGo FinTech look rather interesting indeed. You still need to take note of risks, for example - TradeGo FinTech has 3 warning signs we think you should be aware of.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if TradeGo FinTech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8017

TradeGo FinTech

An investment holding company, provides integrated securities trading platform services to brokerage firms and their clients in Hong Kong and the People’s Republic of China.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives