- Hong Kong

- /

- Capital Markets

- /

- SEHK:3908

How Strong Earnings Growth and Governance Changes At China International Capital (SEHK:3908) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- China International Capital Corporation Limited recently announced that its shareholders approved an interim cash dividend and elected Ms. Tian Ting as employee director at the October 31, 2025 extraordinary general meeting, while also amending its Articles of Association.

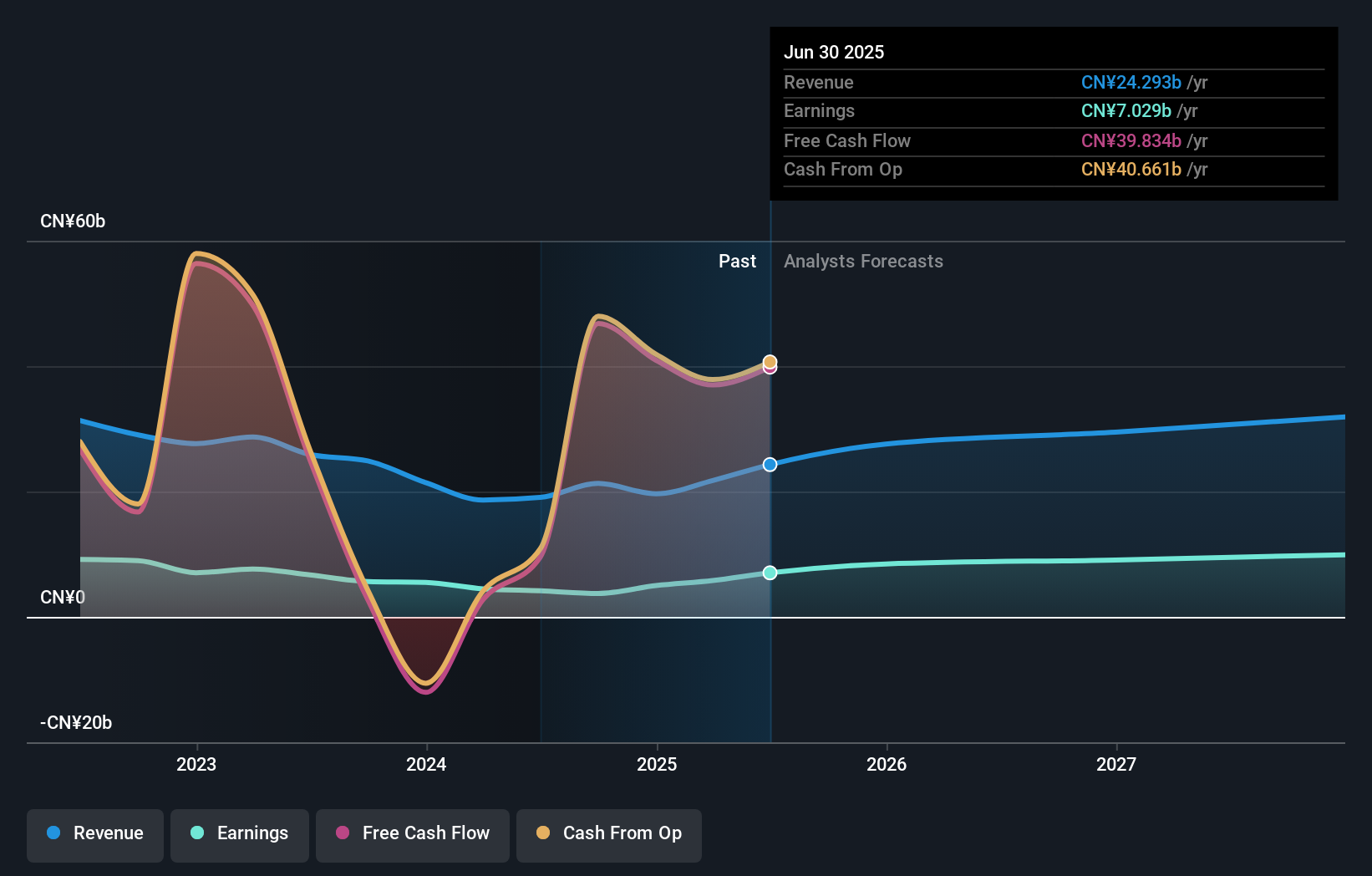

- The company also reported very large year-over-year increases in revenue and net income for the first nine months of 2025, reflecting improved operational performance.

- We'll examine how this substantial earnings growth during 2025 could shape China International Capital Corporation's investment narrative moving forward.

Find companies with promising cash flow potential yet trading below their fair value.

What Is China International Capital's Investment Narrative?

For shareholders of China International Capital Corporation (CICC), the big picture centers on the appeal of high-quality earnings, a track record of significant profit acceleration, and a board that is becoming more seasoned, even amid ongoing turnover. The recent announcement of a substantial interim dividend and stronger year-over-year earnings growth emphasizes operational momentum and can underpin short-term confidence, particularly as CICC continues to trade at a discount to consensus price targets and peers on traditional valuation metrics. With Ms. Tian Ting and Mr. Wang Shuguang joining the board and key committees, governance stability could improve slightly, but the board’s relatively short tenure and high turnover still weigh on long-term risk. These news events likely support, rather than alter, the main catalysts and risks already in focus: the sustainability of recent profit gains and how quickly the new leadership can prove its effectiveness. If you already believed in the company’s operational leverage and were watching for near-term catalysts, the latest announcements strengthen that narrative but do not fundamentally change the risk profile.

However, board inexperience remains something investors should keep on their radar.

Exploring Other Perspectives

Explore 2 other fair value estimates on China International Capital - why the stock might be worth 11% less than the current price!

Build Your Own China International Capital Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China International Capital research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free China International Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China International Capital's overall financial health at a glance.

No Opportunity In China International Capital?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3908

China International Capital

Provides financial services in Mainland China and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives